Securities Settlement Services Provided in 35 Countries

With access to markets around the world, drive sustainable growth when you work with BNY Broker-Dealer Services (BDS) for securities settlement and custody solutions. This includes direct access to primary TARGET2-Securities (T2S) European capital markets: Belgium, France Germany, Italy and the Netherlands. In addition, we provide market access to: Ireland, the U.K., the U.S. as well as Euroclear and Clearstream Central Securities Depositories (CSDs).

Capabilities

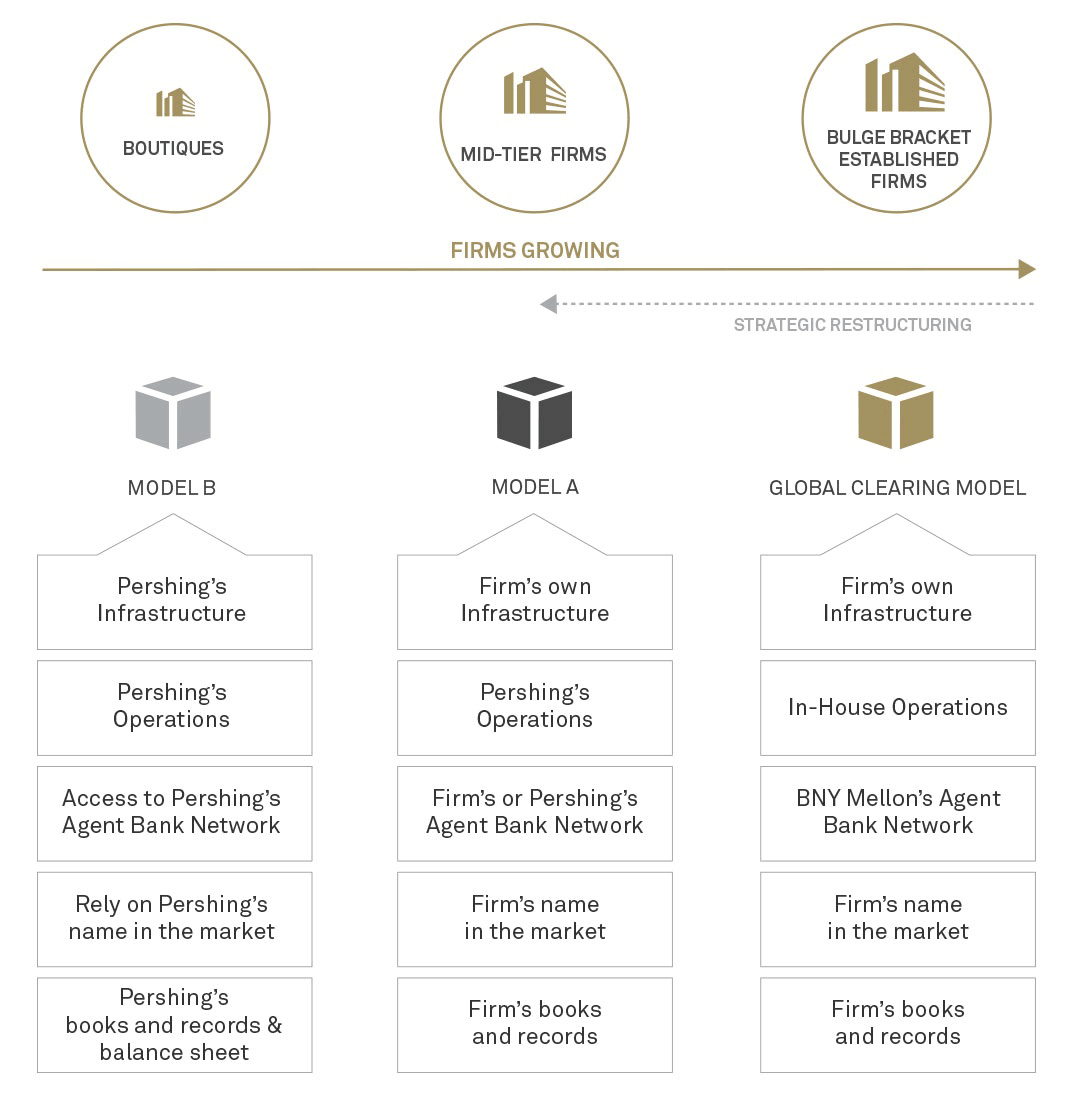

What Makes BNY Global Clearing Different?

Access to collateral across geographies

$262B*

Assets Under Custody (AUC)

$4.3T*

Average Quarterly Value of Securities Cleared

*USD. As of September 30, 2018.

Our Insights

Banks must strike a careful balance between helping to fuel economic activity with loans and keeping their balance sheets on solid ground.

Mutual funds, exchange-traded funds (ETFs), and separately managed accounts (SMAs) all saw net sales grow in Q1 2024.

BNY Growth Dynamics data shows flow trends to U.S. equity ETFs in the second half of 2023 began to shift, leading to the highest U.S. equity flows in Q4 2023 since the end of 2021.

Explore the dynamic world of open banking in the U.S. and discover how APIs and market-led initiatives are revolutionizing financial services.

Our Solutions

U.S. Triparty Repo Infrastructure Reform

As a leader in the U.S. Triparty Repo market, it is our goal to serve as a thought leader in providing insight and making changes that will help industry participants meet the U.S. Triparty Repo Infrastructure Reform objectives.

Clearance and Collateral Management

We help clients unlock value from their securities holdings by developing the innovative technologies, solutions and client services that make a difference in an evolving marketplace.