ALTS BRI DGE

MAKING ALTERNATIVE INVESTING

EASIER, AS ONLY BNY CAN

Introducing Alts BridgeSM. The integrated solution for finding, accessing and holding alternative assets.

Bridging global asset managers, advisors, investors and the alternatives market.

Combining the breadth and depth of BNY’s established expertise across investment management, advisory, distribution, securities services, wealth technology, and custody and clearing — you can rely on a simpler integrated solution.

A CURATED MARKETPLACE

A curated marketplace of highly sought after funds selected from our network of over 500 asset managers.

WILL WORK WHERE YOU ARE

Seamlessly integrated into existing desktops providing a unified, streamlined, experience with the tools advisors already use.

TO MAKE IT SIMPLE

Intelligent automation throughout the investment lifecycle and pre-populates up to 100% of required fund documents.

KEY FEATURES

Alts Bridge is an integrated solution that will make investing in the alternative investment industry simpler.

Advisor education & fund discovery

Advisors will be able to access a suite of alternative funds across asset classes and strategies, the tools to screen for specific products, and integrated fund discovery and data rooms to 'learn more' before investing.

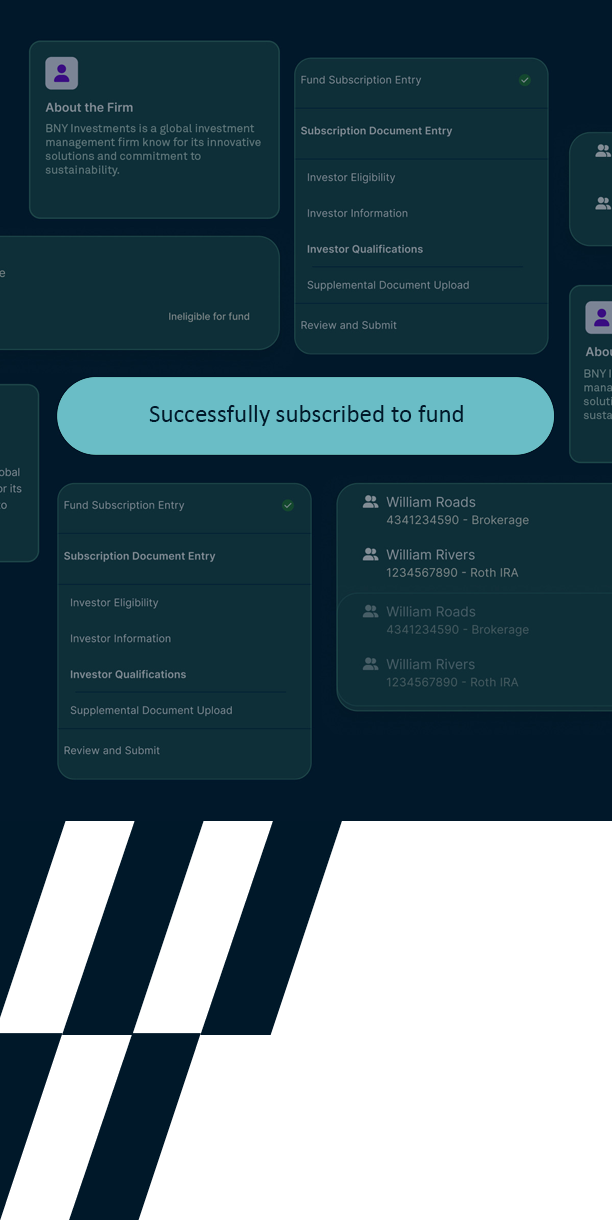

Automated document preparation

Pre-populated subscription documents, along with our real-time rules validation engine, are designed to help eliminate manual processes and reduce errors. This will expedite document completion and will shorten qualification time.

Simplified order entry and trade automation

A unified trade order screen across investment products and strategies will allow advisors to view order status, see and execute capital calls and distributions and manage investment lifecycle and workflows in one place.

Integrated account reporting

Advisors will be able to view their clients' alternative assets alongside their existing portfolios, provide them a comprehensive view of all investments and real-time updates they will be able to act on.

NEWS & INSIGHTS

Alts Bridge Feeder Funds were established to invest all of the capital contributed to the fund (net of fund fees and expenses) in a single underlying private investment vehicle (Underlying Fund). The manager of the Alts Bridge Feeder Fund operates the fund as a means for investors to access the performance of the Underlying Fund. However, investors will have no direct interest in the Underlying Fund, will have no voting rights in the Underlying Fund and will have no standing or recourse against the Underlying Fund, its underlying manager (“Underlying Fund Manager”) or their respective Affiliates. The interests in the Alts Bridge Feeder Funds have not been approved or disapproved by the U.S. Securities and Exchange Commission (the "SEC") or by the securities regulatory authority of any state or of any other jurisdiction. The Interests have not been registered under the Securities Act of 1933, as amended (the "Securities Act"), the securities laws of any other state or the securities laws of any other jurisdiction, nor is such registration contemplated. The funds will not be registered as an investment company under the Investment Company Act of 1940, as amended (the "1940 Act"). Consequently, limited partners of the funds are not afforded the protections of the 1940 Act. The funds are offered only to qualified investors who do not require immediate liquidity of the investment. An investment in the fund does not constitute a complete investment program. Investors must fully understand and be willing to assume the risks involved in the fund's investment program.

1784 Alternatives Management, LLC, a subsidiary of BNY, will act as manager of the Alts Bridge Feeder Fund. The Manager will administer the day-to-day operations of the Alts Bridge Feeder Fund and its investment in the Underlying Fund. However, no BNY Entity will act as the investment adviser to the Alts Bridge Feeder Fund. Various other subsidiaries of BNY will provide services to the Alts Bridge Feeder Fund. Pershing is the platform provider and provides custody services for the Alts Bridge Feeder Funds. BNY Mellon Advisors, Inc. will perform diligence on the Underlying Funds and Underlying Fund Managers. The Bank of New York Mellon will act as the administrator of the Alts Bridge Feeder Fund. BNY Mellon Securities Corporation, a registered broker-dealer, will act as distributor for the Alts Bridge Feeder Fund. Investors and their Financial Professional should closely review in their entirety the “Offering Materials” for an Alts Bridge Feeder Fund, which include (i) the Alts Bridge Platform Disclosure Document; (ii) the Alts Bridge Feeder Fund Supplement for the Alts Bridge Feeder Fund (including the Underlying PPM attached thereto); (iii) the limited liability company agreement of the Alts Bridge Feeder Fund; and (iv) the Alts Bridge Subscription Agreement. Information provided is for informational and educational purposes only and is not a recommendation to take any particular action, or any action at all, nor an offer or solicitation to buy or sell any securities or services presented. It is not investment advice. Investing involves risk, including the possible loss of principal invested. Technology Services Provided by Pershing X Inc.

BNY makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material. The information contained is for informational purposes only and is not a commitment to deliver any product or service. BNY makes no representations or warranties regarding the product, its features, or its availability, which are subject to change at any time. The platform is expected to be available to U.S. Registered Investment Advisors (RIAs) and Independent Broker-Dealers (IBDs) who are clients of BNY Pershing. For professional use only. Not intended for use by the general public. BNY will not be responsible for updating any information contained within this material and information contained herein is subject to change without notice. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Investment Products: Not FDIC Insured / No Bank Guarantee / May Lose Value