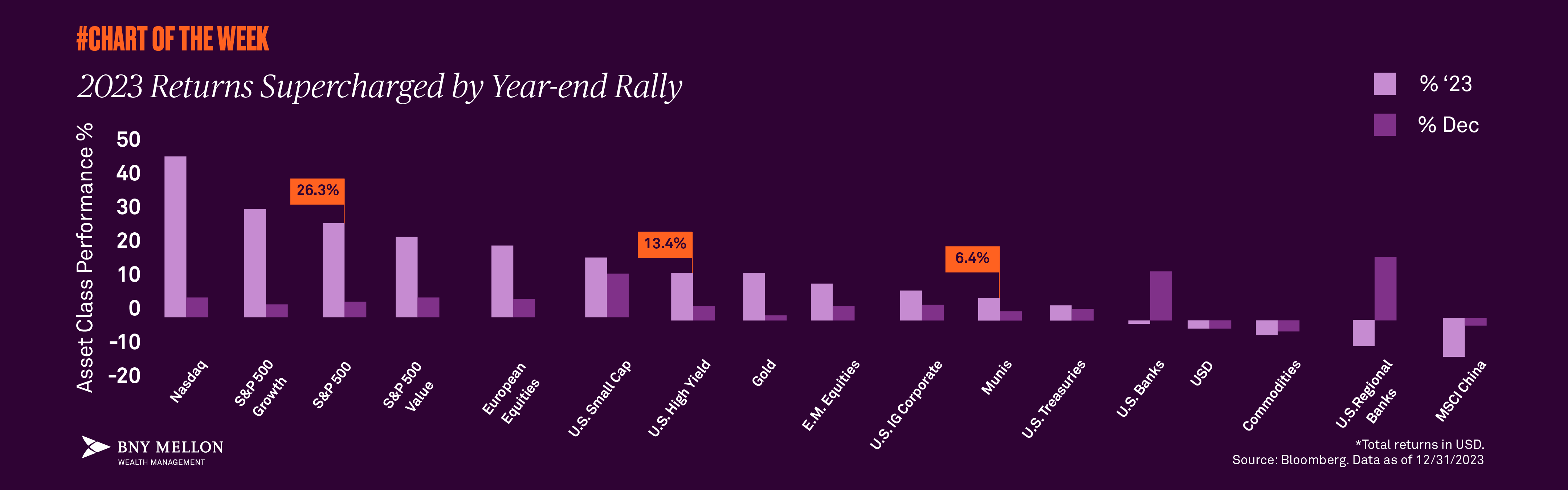

2023 Returns Supercharged by Year-end Rally

January 4, 2024

The year-end rally of 2023 was largely fueled by a more dovish Federal Reserve. After enduring elevated inflation and higher interest rates for much of the year, investor sentiment and most asset classes received a boost when the central bank indicated it would pivot to rate cuts in 2024 during its December policy meeting.

All asset classes gained in 2023, except the U.S. dollar, commodities, banks, and Chinese stocks. However, market participation broadened in December as investors priced in additional rate cuts for 2024, fueling underperforming sectors, such as banks, to outperform for the month.

U.S. stocks that underperformed in 2022, especially large cap growth and technology, led the way in 2023. On a total return basis, the Nasdaq gained 44.6% and growth stocks delivered 30.0%. The S&P 500 gained 26.3%.

Fixed income finished the year positive after two years of negative returns, with U.S. investment-grade corporate bonds gaining 8.5% and high-yield bonds returning 13.4%. Municipal bonds delivered over 6% while U.S. Treasuries generated over 4%.

While we don’t expect U.S. equities to repeat the enormous gains of 2023, history suggests that in years following returns of 20% or more in the S&P 500, the stock market ends higher 80% of the time. Although the strong end-of-year performance suggests the market is pricing in a soft landing, it may be overly optimistic on the timing and magnitude of rate cuts. Our outlook is for a healthy slowdown, lower inflation, modest rate cuts, and a pickup in earnings growth, which should lead to more normalized single-digit returns across most asset classes in 2024.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. ©2023 The Bank of New York Mellon Corporation. All rights reserved. WI-474938-2024-01-03