Executive Summary

This article is excerpted from our full paper. Read it here.

While an investor may have created their wealth through a concentrated position in one or a few stocks, this can also lead to hidden risks within a portfolio. There are many ways investors accumulate an outsized amount of a single stock. Whether stock was received through an initial public offering, part of compensation through work, or an inheritance, too much wealth in one or a handful of stocks can prove costly if the stocks lose value over time.

Risks of Concentrated Stock Positions

1. Contrary to what investors assume, most individual stocks will underperform the broader market.

In fact, less than half of 1% of all U.S. stocks since 1926 have delivered 50% of gross wealth creation. This represents just 110 companies out of a total universe of 28,000 companies. Shareholder Wealth Creation* measures the dollar amount by which investors in aggregate were rewarded for participating in company stock appreciation. And, approximately 40%, or over 11,500 companies, create the remaining 50%. That means that nearly 60% of companies available to investors do not generate nearly any value and in many cases lose wealth over time.

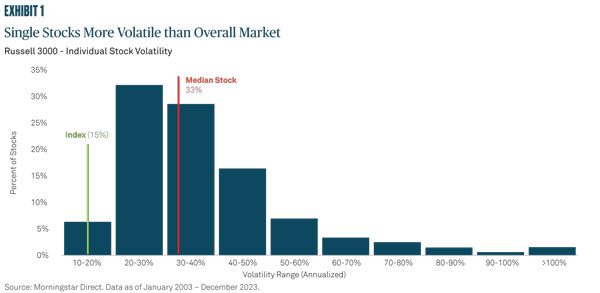

2. Individual stocks can vary in how much their value fluctuates up and down.

While some stocks are more volatile than others, on average, the median stock is more than twice as volatile as the index itself. For example, the Russell 3000 has historically fluctuated 15% from the mean in any given year, while the average single stock’s volatility is 34%. This suggests investors in a single stock should be prepared to weather a much bumpier ride.

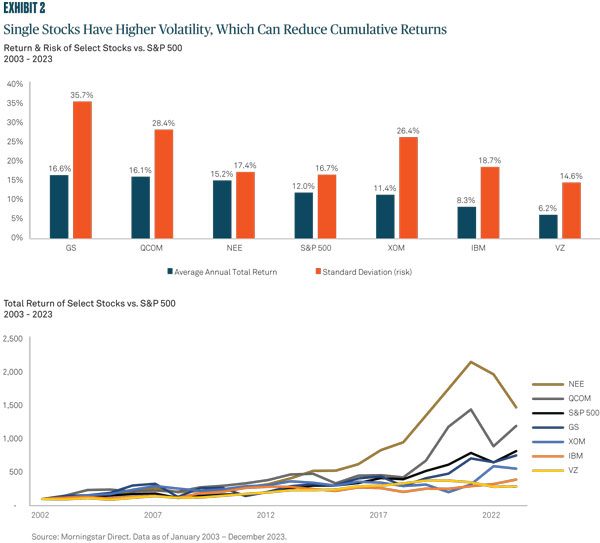

3. Concentration in a single stock can also create more uncertainty about reaching long-term goals because higher stock volatility negatively impacts long-term cumulative returns.

If we look at a few examples of bellwether stocks that delivered strong annual returns from 2003 through 2023, we can see large dispersions in their cumulative returns driven by this volatility. For example, Goldman Sachs (GS) and Qualcomm (QCOM) had similar average annual returns, as illustrated in the top chart of Exhibit 2, but since GS had much higher volatility, it resulted in a much lower cumulative return (bottom chart). An investment of $1 million in GS at the beginning of 2003 would have increased to over $7 million by the end of 2023, versus almost $11 million for QCOM. Further, while NextEra Energy (NEE) had a lower annual average return than GS over this same period, its total cumulative return of over $14 million was almost double Goldman’s due to its much lower volatility. The key message here is that a concentrated portfolio is likely to have high volatility, and high volatility reduces long-term cumulative returns.

The Risk/Reward Trade-off of a Concentrated Position

It’s crucial for investors to be aware of the risk/reward trade-off of holding a concentrated stock position. Although a single stock can provide strong annual returns, its higher volatility will reduce the long-term cumulative benefit of those returns. Further, a significant loss from a concentrated position can weigh on long-term investment goals. And as market forces change, so does leadership across companies and sectors. These changes make it more likely that a concentrated portfolio will miss out on new stock market leaders.

How to Diversify a Concentrated Portfolio

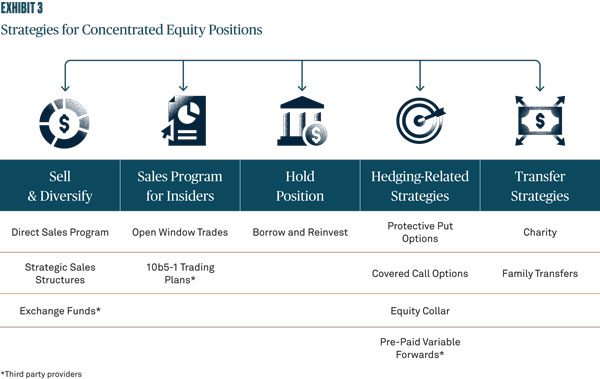

While many investors are reluctant to diversify away from stocks that have helped to build their wealth and may be concerned about the tax bill associated with diversification, selling the concentrated position is not the only option. BNY Wealth offers a full range of strategies that can help reduce risks associated with concentrated positions, including selling shares in a tax-efficient manner, and hedging and gifting shares (see Exhibit 3).

At BNY Wealth, we have a team of specialists that can analyze the specifics of each client’s situation and recommend a plan to de-risk the portfolio, manage taxes and help preserve wealth now and into the future.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Wealth’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Wealth conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

©2024 The Bank of New York Mellon Corporation. All rights reserved. WI-510297-2024-03-07