Investment Research

Access Insights Typically Reserved for Large Institutions

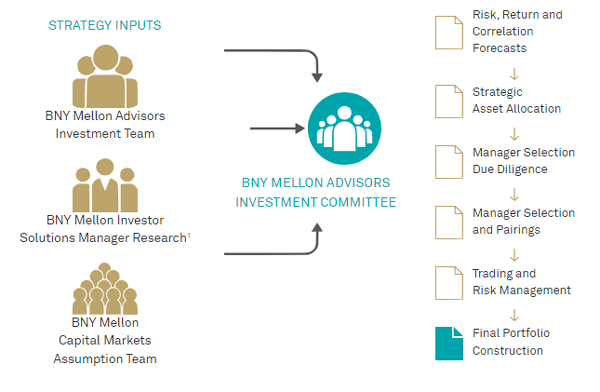

BNY Mellon Advisors, Inc. can provide institutional-quality research across markets, portfolio construction, manager due diligence and ongoing monitoring. BNY Mellon Advisors believes these insights are shaped by three core philosophical pillars:

Looking Behind the Numbers to Pursue Investment Value

Using a clearly defined and repeatable process, BNY Mellon Advisors evaluates multiple strategy inputs as they relate to economic outlook, capital markets expectations, asset allocation and portfolio construction. It then employs its experience, analytic technology and committee-based decision-making process to conduct manager due diligence and ongoing monitoring2 based on multiple factors, from organization and personnel to philosophy and process to implementation, and performance.

The team works hard to seek to stay ahead of the curve as market signals and the evolving financial landscape dictate change. They can help you in your efforts to do the same by three core philosophical pillars:

Evaluating the Investment World from Multiple Angles

Working with BNY Mellon Investor Solutions Manager Research

1 BNY Mellon Advisors receives certain research services from the BNY Mellon Investor Solutions Manager Research Group in manager research, due diligence and ongoing monitoring.

2 This service relates to the managers and investment vehicles under BNY Mellon Advisors’ research coverage process.

All third-party marks belong to their respective owners.

For professional use only. Not intended for use by the general public. Pershing does not provide investment advice. Investment advisory services, if offered, may be provided by BNY Mellon Advisors, Inc., an investment adviser registered in the United States under the Investment Advisers Act of 1940 or one or more affiliates of BNY Mellon. Technology services may be provided by Pershing X, Inc. Trademark(s) belong to their respective owners.

Important Disclosures [PDF] | Trade Away Transactions FAQ [PDF] | Trade Away Summary: Q1 2020 [PDF] | Q2 2020 [PDF] | Q3 2020 [PDF] | Q4 2020 [PDF] | Q1 2021 [PDF] | Q2 2021 [PDF] | Q3 2021 [PDF] | Q4 2021 [PDF] | Q1 2022 [PDF] |Q2 2022 [PDF] | Q3 2022 [PDF] | Q4 2022 [PDF] | Q1 2023 [PDF] | BNY Mellon Advisors’ Form ADV Part 2 Brochures | BNY Mellon Advisors’ Form CRS [PDF] | Affiliate Advised/Sub-Advised Fund and Model List [PDF]