States are well-positioned to weather lower commercial real estate valuations and a potentially weaker economy in the year ahead.

July 19, 2023

Investors are understandably focused on the potential for credit rating downgrades in the municipal bond market. The consensus is still for a weaker economy in the next 12 months, and cities are facing lower revenue now that office occupancy rates have plummeted in a post-Covid, hybrid working world. Headlines about struggling downtowns and budget deficit issues in some localities also haven’t helped.

Yet most states are in their best fiscal shape in decades. Moreover, the ways cities and states structure their budgets and diversify their revenue sources can help them withstand an economic downturn, exogenous events like bad weather, or a slump in property taxes.

“We may see some credit rating downgrades in light of declining property taxes or if the economy falls into a mild recession,” says John Flahive, head of fixed income investments at BNY Mellon Wealth Management. “But we don’t think short-term changes in ratings alone reflect the core fundamental strength and quality of municipal bonds over an entire economic cycle.”

Fiscally Stronger than Ever

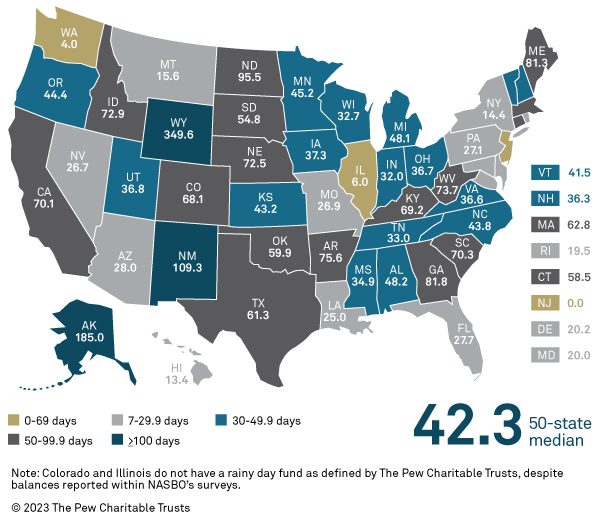

In recent years, abundant Covid-related federal aid and strong tax-revenue generation has boosted states’ rainy-day funds, which will help them balance operations in the event of an economic slowdown or a decline in property taxes.

Last year, 49 states reported revenue collections exceeding budgetary forecasts by about 20%. And recent data suggest revenues will continue to grow in 2023,1 with 33 states reporting greater-than-expected collections.

Exhibit 1: Rainy Day Fund Strength by State

Number of days each state could run on savings alone, FY 2022

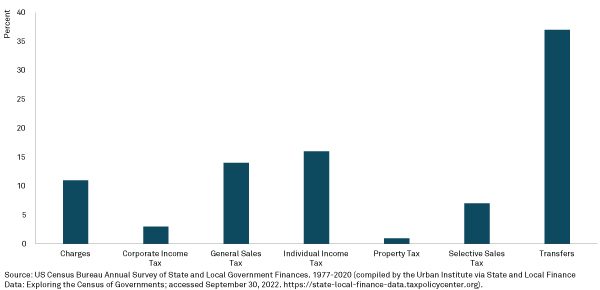

Diversification and Structural Protection

A city or state’s ability to weather recessions or a singular tax-revenue decline has much to do with its revenue diversification. As a matter of prudent fiscal practice, they typically look for new ways to diversify revenue to avoid raising existing taxes, especially on corporations and individuals. Recent sources of state and city revenue diversification include legalizing cannabis and gambling, as well as taxing commodities extracted within a state.

As it happens, the cities with the greatest concentration of offices are also among those with the most diversified revenue streams. Take New York City, where office vacancies are reportedly near 23% this year.2 A stress test by NYC Comptroller Brad Lander found that if office values dropped 40% from 2023 to 2029, the city would have a yearly revenue shortfall of $300 million, starting in 2025 and rising to $1.1 billion by 2027. This equates to only 3% of the total property tax levy, or 1.4% of city tax revenues.

Additionally, falling property tax can often be mitigated by a structural delay between a municipality’s adjustment to their commercial real estate valuations and today’s decline in property market values. In NYC’s case, the recent decline in commercial property values won’t appear on the tax roll for another two years. This gives the city time to adjust spending and taxes to balance its budget.

Exhibit 2: Sources of State General Revenue

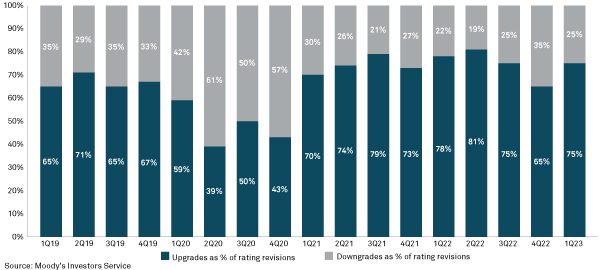

Strong Credit Quality

The municipal bond market is also highly rated, with about 75% of the $4 trillion market AA-rated or higher. However, there is an element of unpredictability in muni credit ratings. They can shift over the short-term and may not fully reflect a state’s ability to smooth out, delay or offset the impact of short-term revenue changes throughout an economic cycle.

Agencies have recently used the fiscal strength of municipal issuers as a catalyst for upgrades, and some entities have undergone rating changes several times over a short period. For example, the recent spate of upgrades came on the heels of rating downgrades due to financial concerns within the municipal sector.

Exhibit 3: Upgrades Continued to Outpace Downgrades in Q1 2023

Our credit analysts have created an internal rating system that reflects the core credit risk profile of a municipal bond issuer by accounting for its ability to navigate the ebb and flow of economic cycles. In doing so, we can better assess whether rating downgrades create potential buying opportunities.

“A potential decline in revenue and fund balances due to a recession or commercial real estate stress could trigger a reversal of the recent spate of credit rating upgrades,” says Flahive. “But having a deep bench of analysts and actively managing a muni portfolio gives us the ability to identify potential opportunities that could add value for our clients.”

Bottom Line

Municipal bonds are fundamentally different than other credit markets, given the unique flexibility of cities and states to mitigate tax revenue shortfalls. Given their improved fiscal strength and diversity of revenue streams, high-quality municipal bonds of intermediate duration continue to offer one of the best fixed income opportunities. This is especially the case for individuals in the highest tax brackets, who can achieve attractive after-tax returns on tax-exempt muni bonds.

Footnotes:

1. All years in this article are fiscal years.

2. Bloomberg. “NYC Revenue Won’t Tank…” Jun. 23, 2023

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation. The Bank of New York Mellon, DIFC Branch (the “Authorised Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorised Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorised by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA. In the U.K. a number of the services associated with BNY Mellon Wealth Management’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818. Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd. This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors. This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such. BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland. Trademarks and logos belong to their respective owners. BNY Mellon Wealth Management conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. ©2023 The Bank of New York Mellon Corporation. All rights reserved. WI-403172-2023-07-14