Investors face a fast-changing and challenging environment, but alternatives can help them mitigate risks and capitalize on new opportunities.

The global economy is in transition from a period of decade-high inflation to disinflation, from tight to normalized monetary policy, and from recession concerns to growing expectations for modest growth.

This has been a challenging backdrop for investors, with traditional asset classes of stocks and bonds rising and falling together. A conventional balanced portfolio of stocks and bonds has failed to provide the diversification needed during the rapid rise of inflation and interest rates.

Instead, investors must seek out investments that can maintain their purchasing power, provide less interest-rate sensitive sources of income and offer exposure to new areas of growth.

While we believe traditional asset classes will continue to be the foundation of investment portfolios, the expanded opportunity set of strategies alternatives can provide is too great to ignore.

At BNY Wealth, we have looked across the landscape of alternatives and identified four strategies that investors should consider to generate new sources of income, hedge inflation, dampen volatility and maximize growth opportunities.

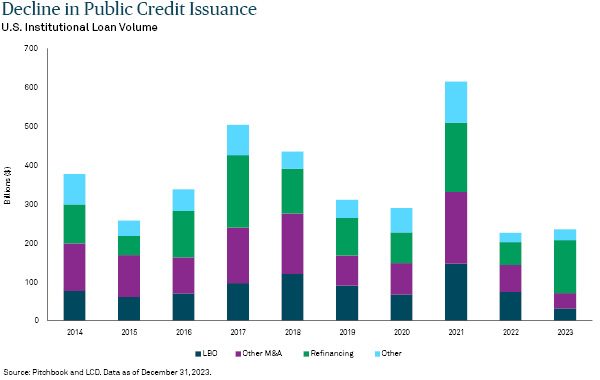

Private Credit: A New Source of Income

Many financial institutions have pared back on lending while tightening credit standards, creating an opportunity for private lenders to provide loans to mid-size and smaller companies in need of capital.

Private credit can generate consistent income and attractive risk-adjusted returns as compared to traditional fixed income. Unlike investment grade and high yield bonds, private debt tends to be floating rate, making it attractive in an elevated rate environment. The negotiated nature of private loans results in stronger lender protections, which historically have led to higher recovery rates on defaulted debt as compared to high yield corporate debt.

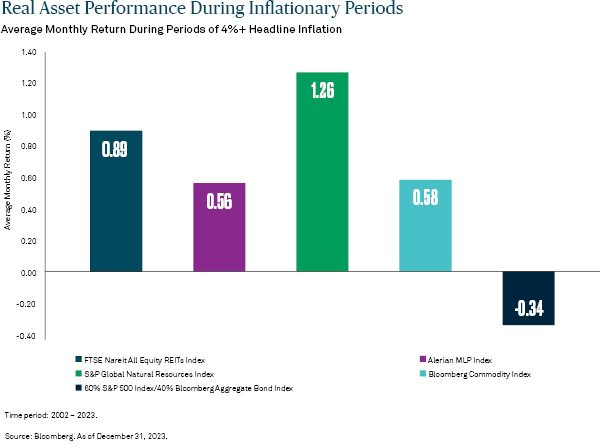

Real Assets: Inflation Protection

Although the pace of inflation has moderated over the past year, disinflation has slowed due to stickier price components such as housing. This suggests that the last mile of achieving price stability is proving to be the hardest.

Investments in real assets, such as real estate and infrastructure, have substantially outperformed 60/40 portfolios in past periods of higher inflation. For example, long-term leases for industrial assets include annual adjustments generally linked to inflation. Multi-family leases are short-term with rents that reset often and keep pace with inflation. Investments in traditional infrastructure (such as toll roads and utilities) and non-traditional infrastructure (such as cell towers and renewable energy) often have built-in inflation hedges, providing explicit protection.

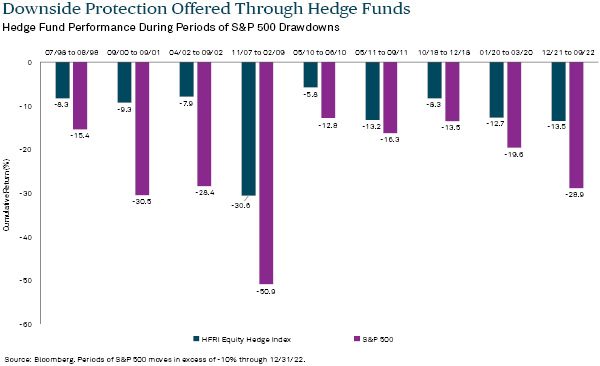

Hedge Funds: Dampening Volatility

The volatility of many asset classes has risen as investors digest the impact of persistent inflation, higher for longer interest rates, an uncertain path of monetary policy, and increased geopolitical tensions.

These dynamics have been challenging for diversification, with stocks and bonds moving in tandem during both the 2023 bull market and the 2022 bear market. As a result, investors need non-correlated assets that can reduce volatility and limit losses during market downturns.

Allocating to hedge funds with complementary strategies can help mitigate portfolio volatility. Market neutral, long/short equity and relative value hedge funds have historically delivered consistent returns, with significantly lower volatility and lower correlation to the public markets over market cycles, as a result of their neutral portfolio positioning.

Strategies such as global macro – which may utilize long or short positions in equities, fixed income, currencies and commodities to express views on macroeconomic and geopolitical trends – allow investors to take advantage of increased volatility and market dislocations.

Private Equity: Investing in Innovation

Opportunities for growth are harder to find because the bulk of growth and innovation is happening during the private stages of companies’ lives. With the number of private-backed companies now five times the number of publicly traded companies, investors need to invest in private equity to capture long-term growth opportunities.

One such area of innovation is artificial intelligence (AI). This technology will ultimately impact every industry, creating a huge potential for growth, as well as existential threats for those who fail to keep up with developments. AI should also help to drive further innovation in other areas that already present exciting opportunities, from health care to the energy transition.

Private equity (PE) investing is increasingly crucial for access to innovators at an early stage and at lower valuations. Investors should look to funds that offer venture capital (VC) and growth equity (GE) opportunities in businesses that are innovators or early adopters in emerging technologies. Current VC and GE vintages are well positioned to support and profit from future winners in fields from artificial intelligence, healthcare and e-commerce.

Learn More

Today’s investment challenges present an opportune time to explore alternatives. We think they can help diversify your portfolio, offer new income sources beyond traditional fixed income or dividend income, and uncover new sources of return.

For more information on how alternatives can enhance portfolios in this challenging market environment, BNY Investments launched Alternative Investments 2024: Eight Themes Steadying the Path of the 60/40 Portfolio. In this report our experts offer insights into eight cyclical and secular themes shaping the investment landscape. Over time, we believe incorporating alternatives can help you better meet your goals with less volatility.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation.

The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA.

In the U.K. a number of the services associated with BNY Wealth’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818.

Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd.

This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors.

This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such.

BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners.

BNY Wealth conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. BNY, BNY Mellon and Bank of New York Mellon are corporate names of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

©2024 The Bank of New York Mellon. All rights reserved. WI-544976-2024-05-10