With the relationship between stocks and bonds changing, the assets we choose for our portfolios should change too.

Traditional portfolios consist of two staple assets — stocks and bonds. Investors hold a mix of the two, 60% stocks and 40% bonds — the 60/40 portfolio — to help balance each other out.

For most of the past three decades a 60/40 portfolio has provided “all-weather” protection through a variety of market conditions. Stocks and bonds have historically moved in opposite directions. Although stocks have tended to rise over the long term, in years when stocks have fallen, bonds have usually risen, helping to offset the occasional drawdown.

In recent years, rather than offsetting each other, stocks and bonds have started moving in the same direction. In 2022, stocks and bonds both suffered losses. In 2023, stocks and bonds both rose.

Investment theory suggests that a diversified mix of assets and strategies will improve risk and return outcomes. If bonds cannot always provide the diversification required, it is important to consider other asset classes and strategies to restore the all-weather protection, while enhancing growth and income. Meet alternatives.

What Are Alternatives?

Alternatives include a variety of investments that don’t fit into the traditional strategies of stocks and bonds. They range from strategies that are linked to public financial markets such as hedge funds to less liquid investments that are not traded publicly, including private equity, private credit, private real estate and infrastructure.

Some investors have historically been reluctant to invest in alternatives due to a misconception that they are reserved for large institutions with niche investment objectives. However, the asset class has become more accessible over the past decade, evidenced by a more than twofold increase in assets under management from 2010 to 2023, when it grew from $7 trillion to more than $16 trillion, according to data provider Preqin.

As versatile tools within portfolios, alternatives can be deployed to fulfill a range of objectives, from helping investors mitigate volatility to hedging against inflation, and can even be utilized to secure income or improve returns. In short, alternatives are simply too useful to ignore.

Hedge Funds — Dampen Volatility without Illiquidity

Another common misconception about alternatives is that they require long lock-up periods or are always illiquid, meaning that investors cannot quickly enter and exit them.

Hedge funds pool money from investors to invest in a wide range of assets and offer a variety of liquidity terms, including quarterly redemptions and even daily liquidity offered through open-end mutual funds.

Where they differ from public markets is in how they are structured. Contrary to just owning an asset (going long), hedge funds can employ opportunistic techniques, such as short selling (i.e., selling borrowed assets with the goal of profiting from an anticipated price decline), purchasing derivatives, following macro trends or taking advantage of market dislocations. This flexibility allows them to profit from both up and down moves in the market.

As a result, hedge funds can provide differentiated sources of return that are less correlated to traditional investments. It is for this reason that hedge funds can be an important component of building diversified, efficient investment portfolios.

For example, a long/short equity hedge fund can be used to benefit from both sides of the market by distinguishing between the winners and losers. This strategy can be used to dampen portfolio volatility, an especially pressing investment need in an era when the traditional 60/40 portfolio is no longer providing the diversification investors require.

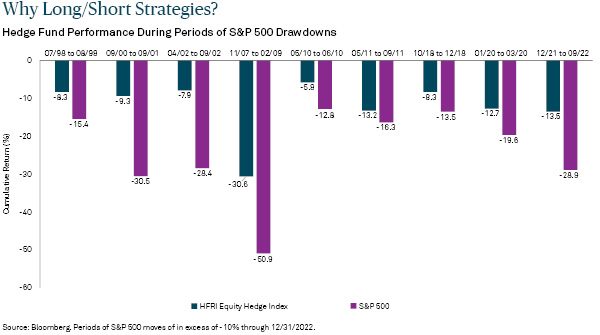

Since 1998 there have been 12 periods where the S&P 500 has experienced a correction of 10% or more. As illustrated below, long/short equity hedge strategies have helped to protect portfolios against equity market drawdowns. In 2022, for example, even though stocks suffered their worst year since the 2008 financial crisis, long/short equity hedge funds were able to buffer more than half of the downside and safeguard portfolios.

Private Markets — Expand the Opportunity Set

Beyond hedge funds, the world of private markets represents a growing opportunity. Private markets are investments made in assets not traded on a public exchange. This may include private equity (investments made in private companies), private credit (privately negotiated loans), parts of the real estate market, and infrastructure. These investments are less liquid than stocks and bonds and require a longer-term commitment, just like owning a home does.

Less liquid investments typically offer better risk-adjusted returns — this is known as an “illiquidity premium.” Some private investments, such as real estate and infrastructure, can also be used to help protect portfolios against inflation.

Fewer Traditional Lenders — More Private Lending

While traditional fixed income can provide stability and a predictable stream of income for portfolios, bonds are subject to interest rate risk. As we saw in 2022 during the Federal Reserve’s aggressive tightening cycle, bonds delivered negative returns as interest rates moved higher. Although we anticipate bonds will deliver potential capital appreciation as the Fed shifts to cutting rates, the higher-for-longer interest rate environment creates an opportunity to capture new sources of income.

Private credit — privately negotiated loans — has been around for over two decades. However, it is playing an increasingly prominent role in the lending market as new regulatory requirements have caused banks to pull back from large areas of lending, especially loans extended to smaller and mid-cap firms. That has created an opportunity for private lenders to step in, with assets under management in private debt recently surpassing $1.4 trillion.

The shortage of traditional lenders and an unpredictable interest rate environment is creating an attractive environment for adding private credit to portfolios.

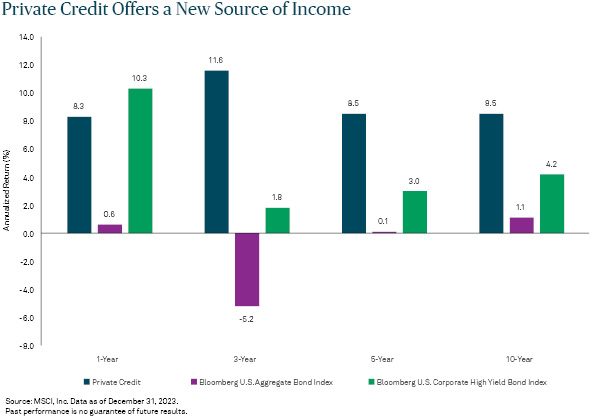

Over the past 10 years, private credit has delivered an annualized return of 8.5% compared to 1.1% for investment grade corporate debt and 4.2% for high yield corporate debt. These loans, often made to small- and mid-size companies, have floating rates that can adjust as interest rates rise thereby offering investors higher yields with lower volatility. Private credit has now been through several market rate cycles and been shown to have low defaults and high recovery rates.

Private credit offers higher yields than public markets, but with capital values that may be less sensitive to changes in interest-rate expectations.

Private Equity Taps into Wealth Creation

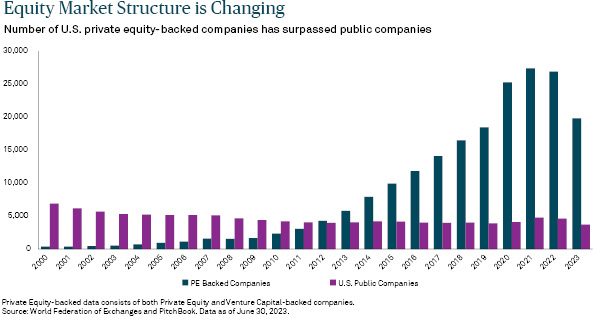

While many of the most highly regarded U.S. companies trade on public equity exchanges, the number of private companies — those that are not listed on public exchanges — has grown rapidly over the past few decades. The number of U.S. private equity-backed companies surpassed public companies in 2012 and the gap has only grown since then.

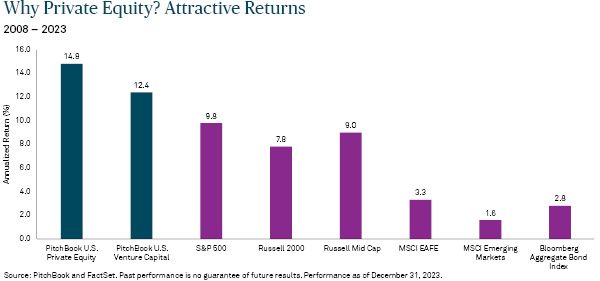

Companies are also staying private for longer, often realizing their healthiest growth before they reach the public market. In fact, the average length of time that a company stays private before an initial public offering nearly doubled from six years to 11 years since the 1990s. Thus, private equity managers seek to capitalize on a broad array of growth opportunities, such as artificial intelligence, energy transition and blockchain technology, in private companies during various stages of their life. By doing so, private equity can offer investors attractive returns not found in public markets over the long term.

We are Here to Help

Whether you are new to alternatives or have been utilizing these types of investments for some time, we can explore how these strategies can help enhance your portfolio. Depending on the importance of liquidity and what you want to accomplish with your wealth, we can work with you to determine the right combination of strategies to help diversify your portfolio, provide new sources of income, protect your capital or grow your wealth.

We have a dedicated team that identifies top performing managers in this space through rigorous due diligence processes, offering clients access to unique opportunities historically only available to institutional investors. Take the next steps to learn more about how this asset class can complement traditional investments.

This material is provided for illustrative/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Effort has been made to ensure that the material presented herein is accurate at the time of publication. However, this material is not intended to be a full and exhaustive explanation of the law in any area or of all of the tax, investment or financial options available. The information discussed herein may not be applicable to or appropriate for every investor and should be used only after consultation with professionals who have reviewed your specific situation.

The Bank of New York Mellon, DIFC Branch (the “Authorized Firm”) is communicating these materials on behalf of The Bank of New York Mellon. The Bank of New York Mellon is a wholly owned subsidiary of The Bank of New York Mellon Corporation. This material is intended for Professional Clients only and no other person should act upon it. The Authorized Firm is regulated by the Dubai Financial Services Authority and is located at Dubai International Financial Centre, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE.

The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the Federal Reserve and authorized by the Prudential Regulation Authority. The Bank of New York Mellon London Branch is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of our regulation by the Prudential Regulation Authority are available from us on request. The Bank of New York Mellon is incorporated with limited liability in the State of New York, USA. Head Office: 240 Greenwich Street, New York, NY, 10286, USA.

In the U.K. a number of the services associated with BNY Wealth’s Family Office Services– International are provided through The Bank of New York Mellon, London Branch, One Canada Square, London, E14 5AL. The London Branch is registered in England and Wales with FC No. 005522 and BR000818.

Investment management services are offered through BNY Mellon Investment Management EMEA Limited, BNY Mellon Centre, One Canada Square, London E14 5AL, which is registered in England No. 1118580 and is authorized and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd.

This document is issued in the U.K. by The Bank of New York Mellon. In the United States the information provided within this document is for use by professional investors.

This material is a financial promotion in the UK and EMEA. This material, and the statements contained herein, are not an offer or solicitation to buy or sell any products (including financial products) or services or to participate in any particular strategy mentioned and should not be construed as such.

BNY Mellon Fund Services (Ireland) Limited is regulated by the Central Bank of Ireland BNY Mellon Investment Servicing (International) Limited is regulated by the Central Bank of Ireland.

Trademarks and logos belong to their respective owners.

BNY Wealth conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation. BNY, BNY Mellon and Bank of New York Mellon are corporate names of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

©2024 The Bank of New York Mellon. All rights reserved. # WI-555520-2024-06-04