In 1784, Alexander Hamilton, a founding father of the United States, also founded BNY. Fast forward 240 years, and today BNY is an integral part of the world’s financial ecosystem, overseeing nearly $50 trillion in assets for clients across the globe.

A cornerstone of BNY’s work to this day is helping build and nurture resilient and inclusive economies, both abroad and closer to home, which includes helping community banks persevere and grow.

In many cities and towns across the U.S., community banks play a vital role in providing a wide range of services to consumers and local businesses, from everyday banking to lending to investing options. In fact, according to the latest figures from The American Bankers Association1, community banks hold almost one-fifth of total loans in the U.S. banking industry.

Community banks pride themselves on personalized service, and to keep pace with changing times, many have been upgrading their technological capabilities in recent years to offer online banking, automated loan decision-making and other cutting-edge services.

But community banks still face challenges that can impede their growth — and that of their communities.

At BNY, we’re proud of the trust our clients place in us, and are focused on listening to our clients and working together to help them achieve their objectives. This is why we collaborated with the Harris Poll to launch a first-of-its-kind BNY Voice of Community Banks Survey so we could learn more about these banks’ top challenges, needs and hopes for today and into the future — to help us better understand how best to support them.

TOP SURVEY TAKEAWAYS

We gleaned a lot from our survey of community banks, which was conducted in the spring of 2024 and captured feedback from key decision-makers ranging from CEOs and CFOs to those responsible for adopting and implementing new technologies.

Here are seven topline findings that we’ll explore in more depth in the chapters that follow:

1

How community banks see themselves

Nearly 50% of the banks that participated in our survey believe they’re seen as innovative within their communities, but nearly 25% also believe they’re perceived as constrained — showing there is an opportunity to better support community banks and the clients and communities they serve.

2

Wealth management and treasury services are top of mind

Among the community banks polled that are looking to expand their capabilities, there is considerable interest in exploring external opportunities that would enable them to offer wealth management and such treasury services as real-time payments to their clients, with 100% of the banks indicating a desire to provide wealth management services and just over 95% treasury services.

3

Growing customer demands are testing community banks

In our poll, 40% of banks said they face challenges to offer competitive loan rates, and over a third would like to better offer high-yield savings or advanced investment options to their customers. These gaps highlight opportunities for community banks to better meet customer demands through more sophisticated financial tools and digital finance solutions.

4

Community banks plan to prioritize tech to compete

Nearly 30% of community banks in the survey indicated that innovative technology services focused on efficiency and security — such as instant payments and automated loan processing — are critical to maintaining a competitive edge. To be able to deliver such services effectively, 20% of banks polled are eyeing collaborations with fintech companies over the next five years as a potential solution for such services

5

The race to embrace digital transformation

Over 90% of community banks surveyed said they are prepared to initiate digital transformations. However, while over 50% think their data analytics capabilities are advanced, less than 20% see themselves as experts in data analytics — underscoring the challenge many face to successfully launch a digital transformation program.

6

The impact of AI

Nearly 40% of community banks polled are incorporating artificial intelligence and machine learning into their strategic vision, with the goal of helping address everything from customer service to risk assessment.

7

Non-fintech partnerships are also enticing

Nearly 30% of the banks polled identified non-fintech partnerships — collaborations with businesses outside of the financial technology sector, such as education, retail and even traditional banking offerings — as an equally important opportunity over the next five years. This represents a strategic move to meet diverse customer needs more effectively.

Chapter 1: The Important Role Community Banks Play in the Financial Ecosystem

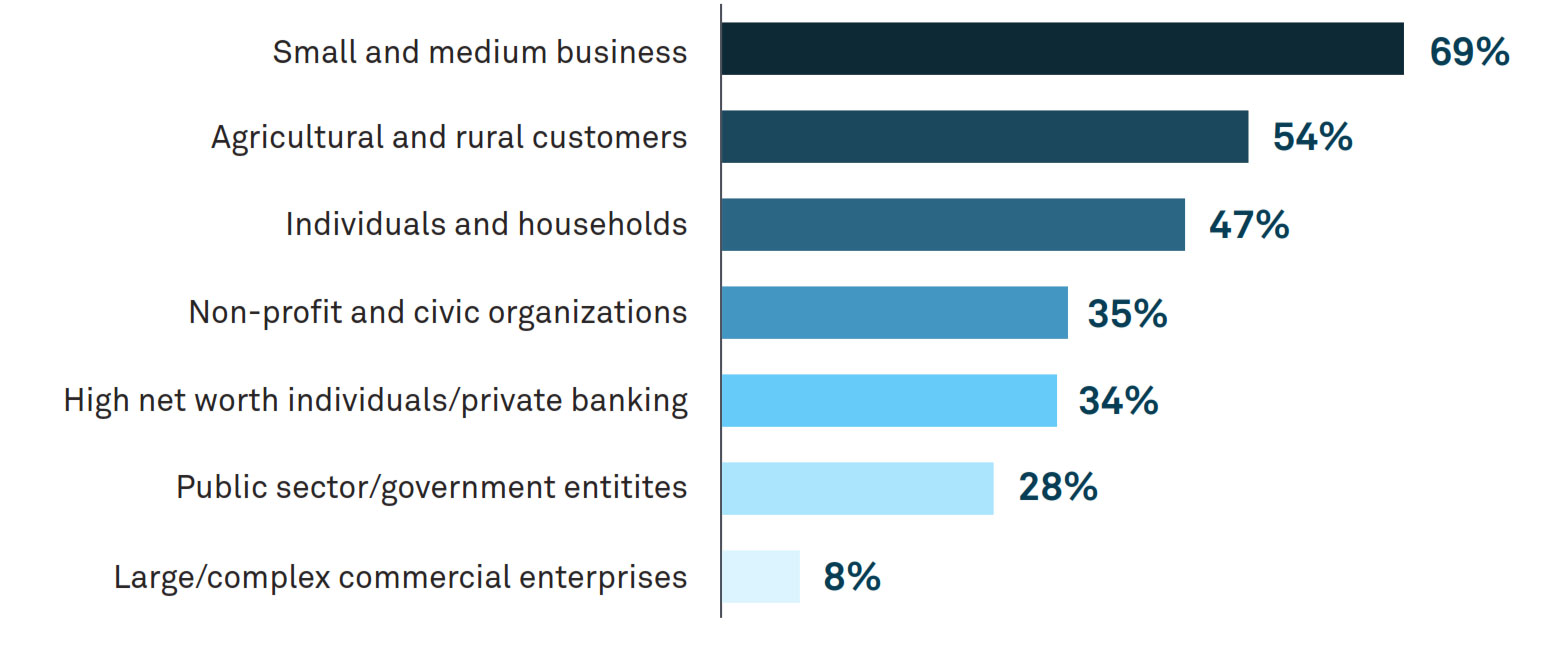

Approximately 4,593 banks make up the U.S. banking system — and 97% of them are community banks.2 They primarily provide services to small- and medium-sized businesses, agricultural customers and households within the community. Some community banks also service public sector and local government entities.

COMMUNITY BANKS' CUSTOMER BASE

To help further illustrate the vital role community banks play, they service 30% of commercial real estate loans, over 35% of small business loans and 70% of agricultural loans, according to a recent Federal Deposit Insurance Corporation (FDIC) study.3

Community banks have long prided themselves on their more personal approach to serving clients, and our study findings support this: almost half of the respondents polled believe they are recognized for their innovative approaches to helping clients within their communities.

That said, almost a quarter also believe they are seen as constrained when it comes to their ability to offer the best and most innovative services to their clients. This perception underscores an opportunity for community banks to explore how they might be able to overcome challenges through collaborations aimed at providing more sophisticated financial tools and digital finance solutions.

Choosing a provider that can cater to all our financial service needs can streamline operations and enhance efficiency.

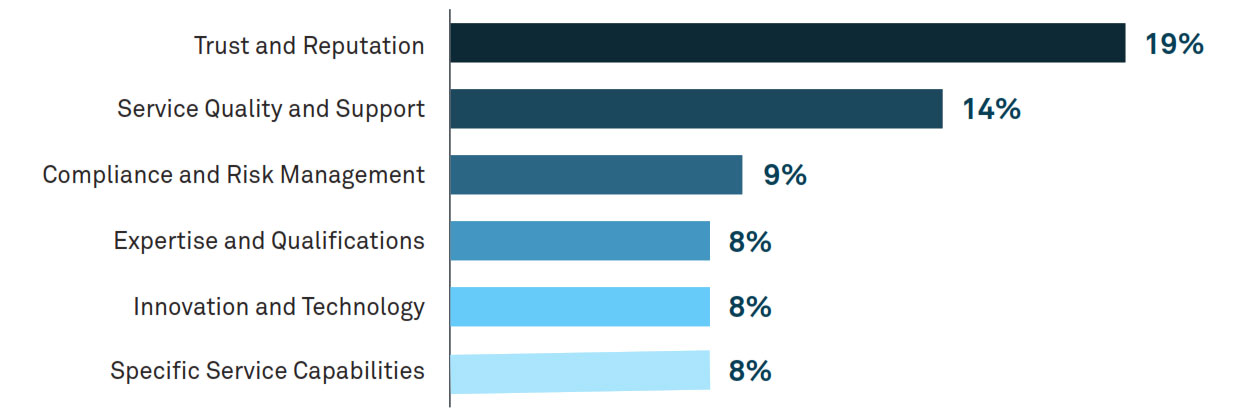

Most importantly, among the community banks surveyed that are looking to expand their capabilities, almost all showed a resounding interest in working with external partners, providing they have a strong reputation for resilience, trustworthiness and good customer service. In particular, 100% indicated interest in wealth management services and just over 95% in treasury services.

“Partnering with a provider who has a deep knowledge and understanding of corporate trust, treasury services or financial markets can ensure that I receive tailored solutions that meet our specific needs,” said one community bank representative who participated in the survey.

WHAT COMMUNITY BANKS WANT IN A PARTNER

Chapter 2: The Present and Future Challenges Community Banks Face

Our survey revealed that despite their proactiveness in staying competitive, especially when it comes to implementing cutting-edge technologies, community banks still contend with some headwinds as they look to advance and grow their businesses.

In relation to efforts to stay competitive, a core requirement for any lending institution is the ability to maintain appropriate capital and liquidity levels, and one way community banks are managing this is through programs like the Advancing Communities Together (ACT) deposit program. It aims to increase funding for community lending by making it easier for a participating community development financial institution (CDFI) or a minority depository institution (MDI) to acquire funding from depositors.4

In our survey, we asked community banks to share the services customers most often request that they’d like to better provide. Four in ten community banks surveyed referenced competitive loan rates, while over 35% would like to better offer high-yield savings or investment options to their customers. These gaps highlight opportunities to support community banks in better meeting evolving customer demands for more diverse and competitive financial products.

WHAT BANKS SEE AS THEIR TOP 3 CHALLENGES

As for the future, when asked to identify the biggest challenges their institutions face in the next five years, cybersecurity emerged as the leading long-term concern, followed by customer acquisition and retention, and data management and analytics. Cybersecurity was also highlighted as a top challenge faced by community banks in last year’s Conference of State Bank Supervisors (CSBS) Annual Survey.5 While cyber threats can happen to companies of any size, community banks tend to have smaller IT budgets and may not be equipped to keep pace with more advanced threats.

And while nine in ten of those surveyed said they are prepared to initiate digital transformations — the adoption of technologies designed to modernize the way financial services are delivered to customers — less than 20% see themselves as experts in data analytics.

Robust data analytics capabilities are essential for a successful digital transformation because they allow banks to analyze customer data effectively, optimize operations and tailor services. These findings reveal a disconnect between banks' perceived readiness and the actual expertise needed for an effective digital transformation journey.

Chapter 3: How Tech Solutions Can Help Community Banks Thrive and Grow

Community banks have been embracing digital advancements for some time, but there is still more they believe they can do to harness the power of technology to best serve their clients.

Case in point: Our study shows that about 40% of respondents plan to prioritize innovation in technology initiatives to help enhance customer satisfaction, with more than a quarter investing in services like instant payments and one in five prioritizing automated loan decision-making and account openings.

Beyond customer satisfaction opportunities, 30% of community banks polled plan to prioritize technology for risk mitigation and just under 30% want to leverage technology to handle regulatory and compliance issues. These stats dovetail with an overarching finding that nearly 35% of banks intend to employ new technologies to stay competitive.

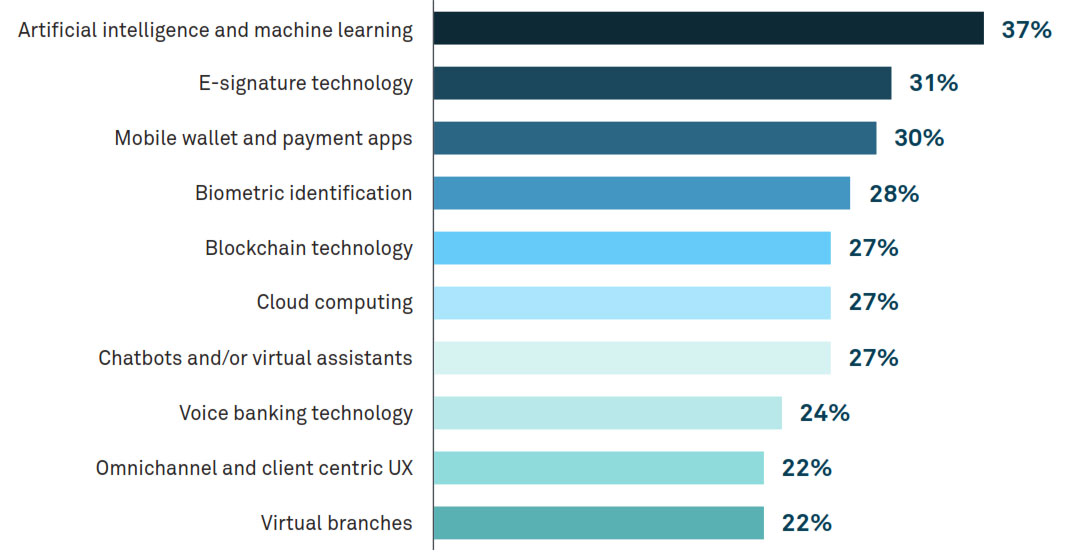

To go a layer deeper when it comes to services that would enable these banks to stay competitive, nearly one in three mentioned e-signature technology, mobile wallets and payment apps, and biometric identification.

TOP OF MIND EMERGING TECHNOLOGIES

Not surprisingly, artificial intelligence also factors into future technology spending. When asked which emerging digital technology services are “part of your bank’s strategic vision in the next five years,” nearly 40% of respondents cited artificial intelligence and machine learning.

All of these aspirations speak to a desire to meet growing customer expectations for security, convenience and speed, especially among younger consumers. In fact, two in three respondents surveyed indicated that Millennials constituted the majority of their retail consumer base.

To be able to deliver such tech-forward services effectively, though, community banks know they can’t go it alone, both from a resourcing and in-house innovation standpoint. As a potential solution, 20% of respondents in our survey are eyeing collaborations with fintech companies over the next five years for these tech capabilities.

According to one respondent, they want a partner “that leverages cutting-edge technology and innovative solutions that can provide me with competitive advantages, such as real-time reporting, automated processes, enhanced security measures and improved decision-making capabilities.”

The goal of this survey was to explore the current state of community banks in the U.S. The survey results reaffirm the crucial role community banks play in advancing our economy, and the important role BNY and other institutions have in helping community banks achieve their ambitions.

Shofiur Razzaque, Head of Community Banking & Solutions, BNY

In addition to prioritizing digital transformation to stay competitive, at least one in five community banks is also considering non-fintech partnerships to meet diverse customer needs more effectively. This can encompass collaborations across such varied industries as education and retail, among others.

Some community banks, for example, can even take advantage of a Department of Treasury initiative called the Treasury Bank Mentor-Protégé Program. It’s a unique platform that enables a protégé at a community bank to collaborate with a large commercial financial institution and receive management and technical assistance to help strengthen their balance sheet and better serve their customers.6

If there is one thing we can take away from this survey, it’s just how vital community banks are to the health of our financial system — 4,455 community banks, to be precise, stretching from state to state.

BNY, BNY Mellon and Bank of New York Mellon are corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2024 The Bank of New York Mellon. All rights reserved. Member FDIC.