MACRO & INVESTING

Macro and markets commentary, investing strategy

BNY's iFlow "Mood" Index, tracking investor flows across equities and bonds, is trending up after hitting its lowest point since the pandemic, signaling a resilient U.S. economy in 2025. Across the globe, opportunities for growth are mixed but setting the stage for incoming governments to pursue pro-growth policies via private sector funding.

Fueled by easing monetary policy and supportive fiscal policy, growth expectations for many regions signal a 50% probability for a “new cycle” in 2025. However, recession risk remains, and along with uncertainty around implementation and timing of fiscal policy, a soft landing or shallow recession scenario cannot be ruled out. The latest Vantage Point from the BNY Investment Institute charts forecasts for three possible economic scenarios in 2025.

Digital banking trends: challenges, risks and solutions in APAC

BNY Investment Institute breaks down significant secular themes and possible return expectations for the next 10 years across 50 asset classes to help investors design long-term portfolios.

BNY reflects on the key trends that affected investors throughout 2024. These takeaways influence how to identify emerging themes for 2025 and what investors need to be aware of going forward.

BNY Wealth shares economic and market-related expectations for the next 12 months, covering global and domestic factors such as inflation, growth and investment opportunities across asset classes.

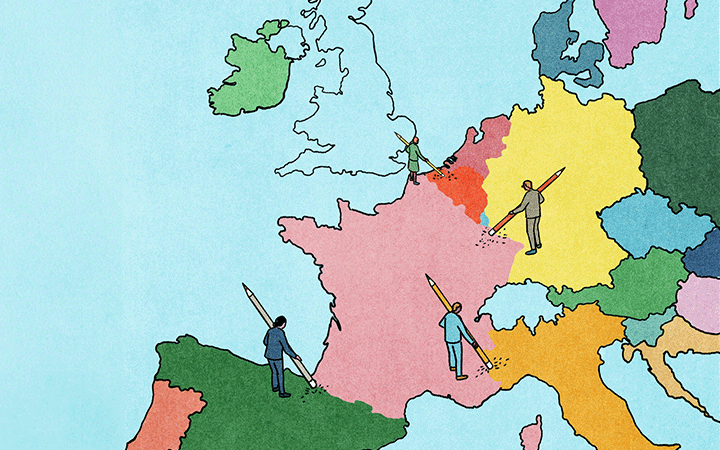

EU leaders are working to develop a continental capital markets union that can reinvigorate the European economy by guaranteeing the free movement of people, goods, services and capital across nations. Despite remarkable progress, there are still numerous barriers that stand in its way.