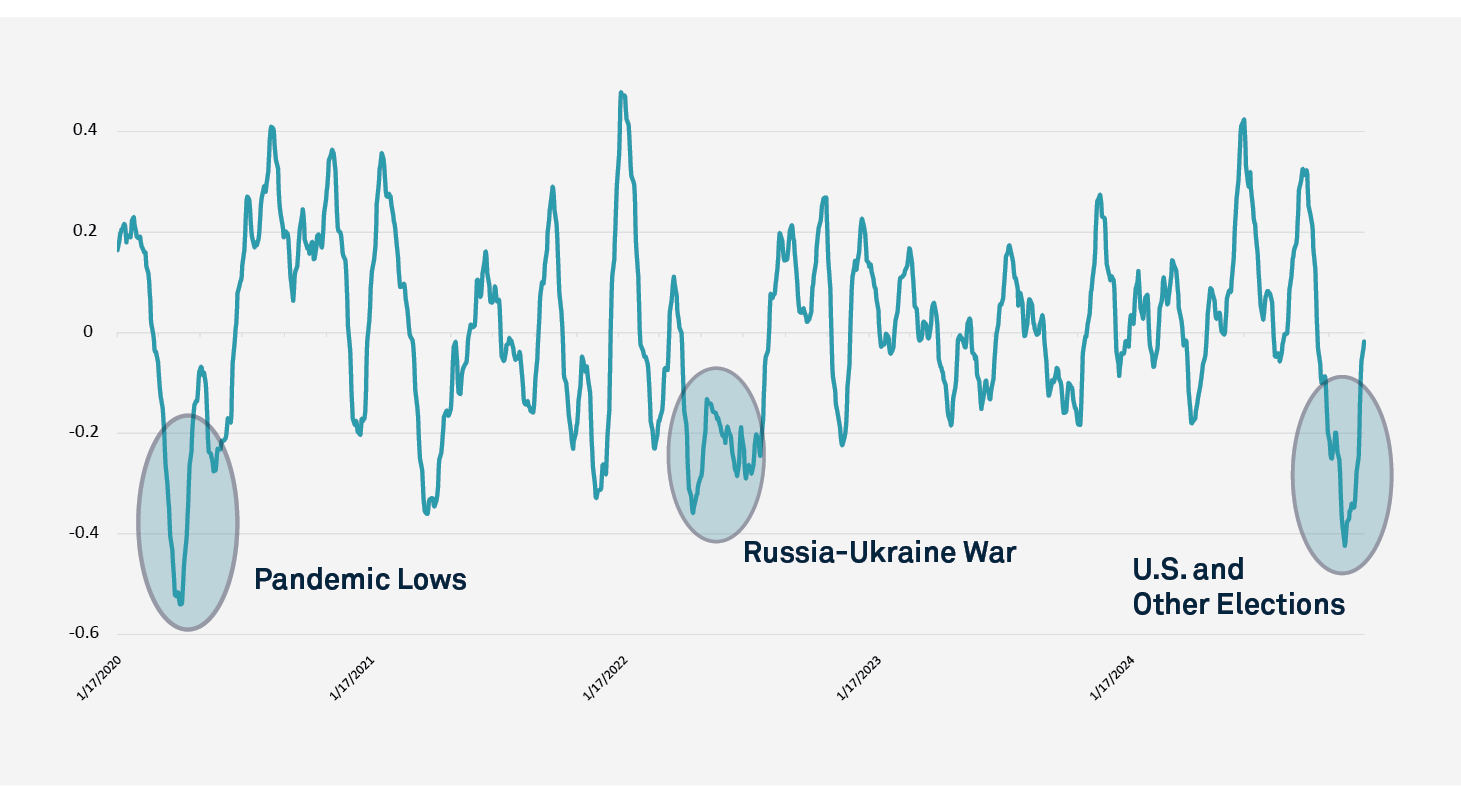

As the geopolitical environment continues to evolve, financial flows, combined with broader economic activity, are impacting growth potential across regions and fueling continued uncertainty. BNY's iFlow® Mood Index1 measures investor flows daily across equities and T-bills globally, capturing the “mood” for risk. Into the end of 2024, this indicator was at its lowest point since the worst of the pandemic. (Figure 1) However, historically, dips in flows have been temporary, and we are starting to see the index already trending up in 2025. Looking ahead, our experts expect that equities will continue to be bought and cash will be put to work as investors seek yield and thereby enable global growth.

FIGURE 1: INVESTOR "MOOD" FOR RISK TRENDING UP FOLLOWING NEAR PANDEMIC LOWS

Source: BNY iFlow

Our experts believe the U.S. economy has the fundamentals to be positioned for a healthy 2025, with the labor market in better equilibrium, inflation slowly returning towards the Federal Reserve’s 2% target and GDP hovering around its 2% trend rate of growth.

While they don’t expect a major change in the U.S. growth outlook with the incoming U.S. administration, interest rates may inch higher from here, due to a number of factors:

- Increases in tariffs would likely raise the prices of imported goods, creating both inflationary as well as growth-negative pressures.

- Border restrictions will likely be toughened and deportations intensified, putting upward pressure on labor costs, worsening the inflation outlook and leading to higher rates.

- Regulation will likely loosen, spurring capital spending.

- An extension of the 2017 tax cuts is expected to add $5 trillion to U.S. debt over the next 10 years, and additional fiscal policy expansion could be in the cards, exacerbating debt dynamics. This should cause higher bond yields at the long end of the curve and may add to already sticky inflation.

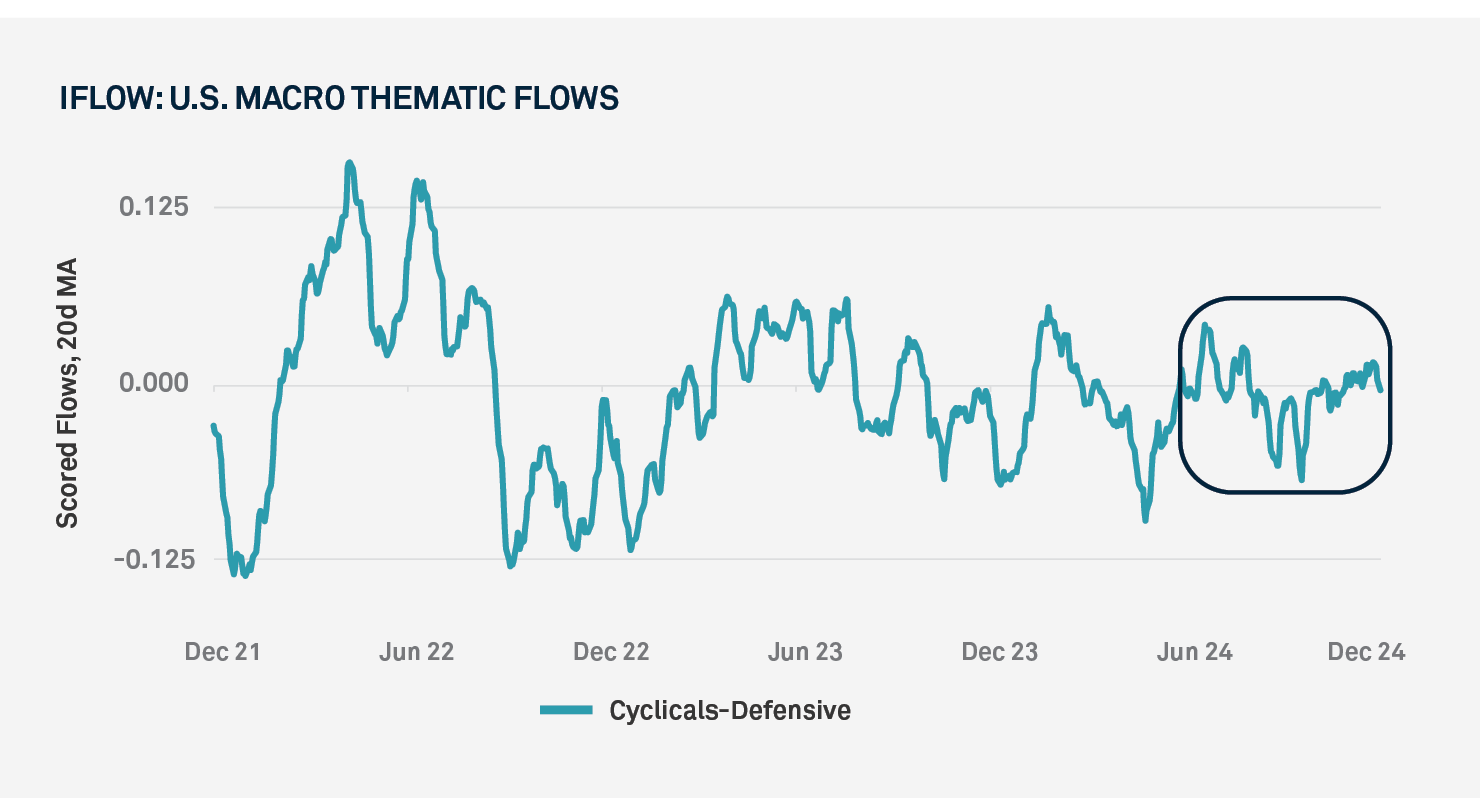

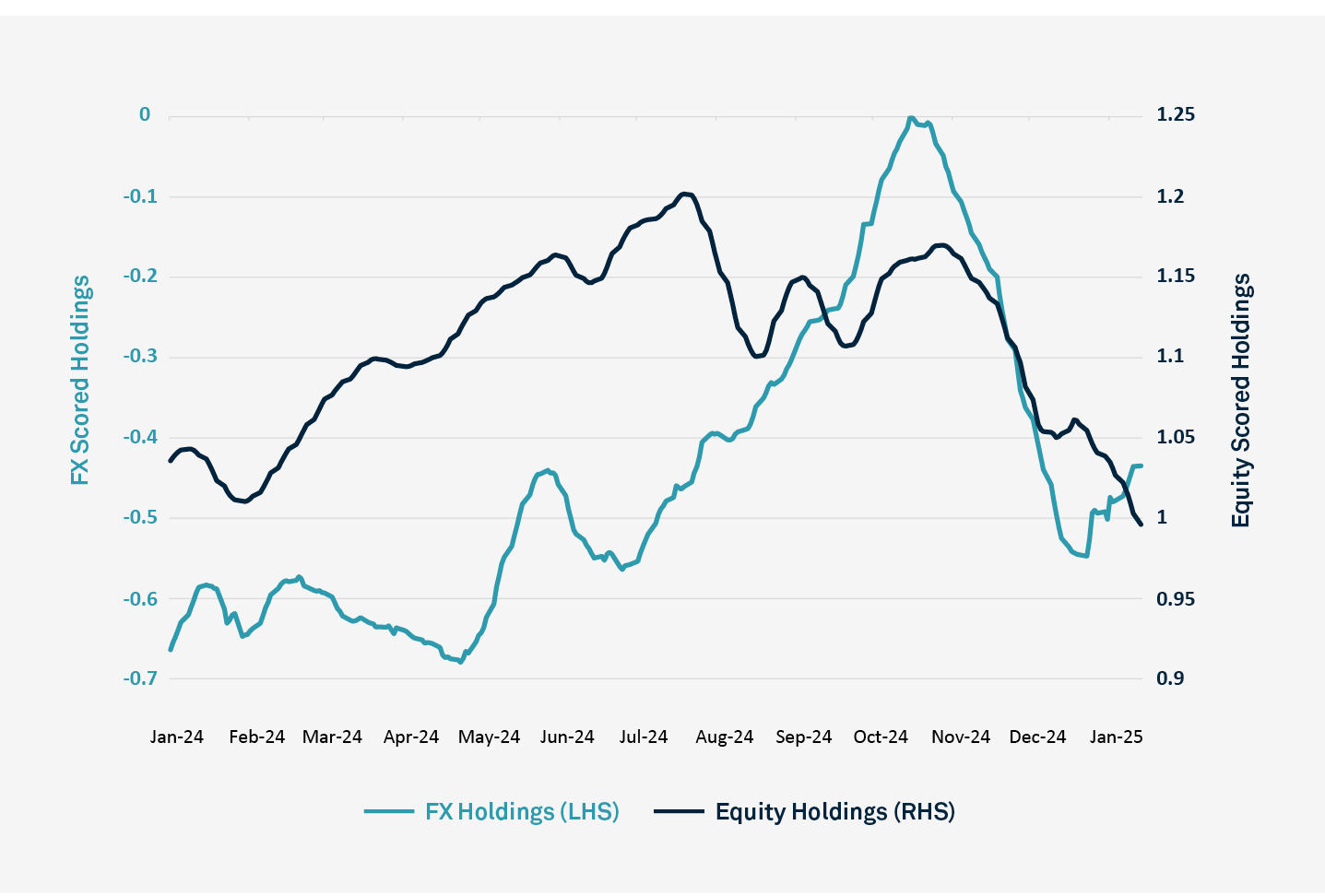

Our iFlow data demonstrates investors’ “wait-and-see” approach as the market awaits clarity around likely policy changes — investors historically tend to buy cyclicals when they expect strong growth and switch into defensives when they foresee growth tapering. Since mid-summer 2024, these macro-related U.S. equity flows have been flat (Figure 2), suggesting no measurable bias in favor of stronger or weaker growth going forward.

FIGURE 2: INVESTORS HOLDING STEADY WHILE AWAITING POLICY CLARITY

Source: BNY iFlow

Nevertheless, absent a major fiscal crisis, our experts expect U.S. growth to remain resilient and U.S. investment to continue to contribute to global growth, even if the rate environment remains restrictive.

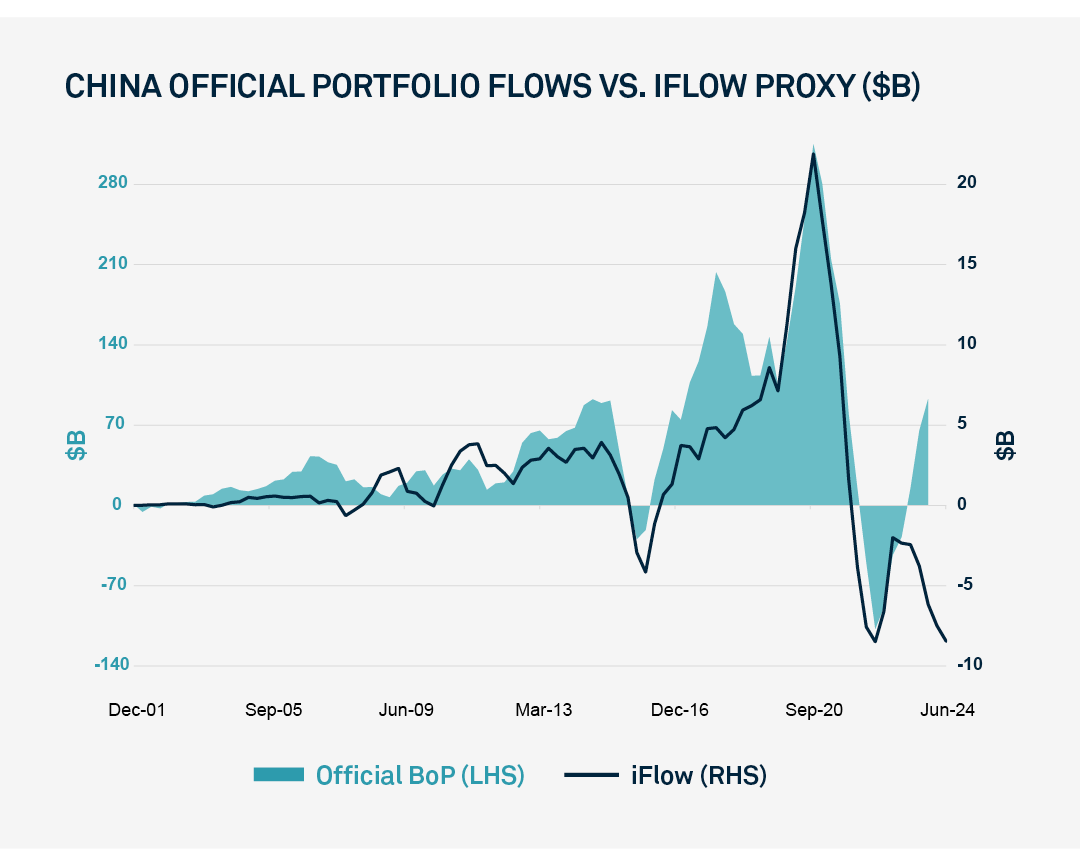

China, with its economy already under pressure, could face further headwinds from expected U.S. policy shifts. Compared to eight years ago, our iFlow data suggests that investors appear to be approaching Chinese assets with a degree of indifference. (Figure 3) Volatility in Chinese assets has remained within normal ranges, especially the Chinese renminbi, which is showing weakness mostly driven by widening rate differentials vs. the U.S. dollar (rather than active policy actions in response to potential tariffs). More recently, however, it appears Chinese authorities may be less inclined to allow further depreciation as part of efforts to stabilize public sentiment.

FIGURE 3: CHINA BALANCE OF PAYMENTS VS. IFLOW ASSET FLOWS

Source: BNY iFlow

Overall, China’s apparently deliberate focus on solidifying its growing non-U.S. trade relationships means the marginal impact of tariffs is expected to be more muted. Negotiations with China between the U.S. and EU will likely comprise a key part of the trade and geopolitical narrative in the coming years.

Independent of potential tariff impacts, China will need to focus on weak demand. Whether through infrastructure investments or by boosting domestic consumption, our experts predict that it will be less about the dollar amount and more about how the stimulus is directed that will matter to China over the next five years, as demonstrated by a disappointing market reaction to the recent stimulus announcements. Longer-term, China will likely need some help from private sector innovation as a steady bolster of its economy.

China’s economy has a broader impact on the rest of APAC and remains a critical driver of low policy rates in the region. Japan, on the other hand, appears set for ongoing recovery but there remain notable risks. The Bank of Japan has promised to normalize interest rates to the lower end by the end of 20252 — which many see as 75bps more tightening. Renminbi weakness is driving up the trade-weighted value of other currencies in the region, hurting export sentiment and likely compounding potential tariff pressures. The surprise January cut by Indonesia’s central bank can be interpreted as an early warning that the region will maintain a growth focus, even at the expense of currency weakness.

FIGURE 4: DETERIORATING APAC RISK SENTIMENT AMID UPTICK IN EM APAC CURRENCIES

Source: BNY iFlow

BNY iFlow data shows deterioration in APAC risk sentiment through accelerated selling across the emerging market (EM) APAC equities complex, following a long period of steady flows. The same data shows a sharp turnaround of EM APAC currencies scored holdings over the past few months. (Figure 4) The gradual short covering of EM APAC currencies since the beginning of 2Q24 was abruptly sold in November, leaving EM APAC the most underheld since June 2024. The all-out outflows of EM APAC equities, sovereign bonds and currencies suggest increasing hedges amidst rising global uncertainties. Thus, 2025 may be a delicate year for regional authorities as they balance stimulating domestic growth and managing capital flow volatilities.

In LatAm, the growth outlook in 2025 remains positive but volatile, and the post-pandemic rate pain lingers. Significant real rate spreads in much of the region are hampering growth.

Mexico has seen an eschew of government debt since the country’s June presidential election. The new government appears focused on reform and more investment in key industries to offset risks from changing U.S. trade policy and the persistence of high rates. Brazil’s debt burden has seemingly left clients less interested in holding its sovereign bonds. Our experts believe the key to sustainable growth is in currency normalization, with dollarization plans unlikely to work without a larger government trading or investment plan. Brazil and Mexico’s ability to fix their budgets and regain investor confidence will determine whether they return to a carry trade year, in which rate cuts promote growth rather than potential new FX risks. On the other hand, Argentina saw a notable recovery in 2H24 and it is expected to continue in 2025. Notably, LatAm plays a key role in exporting soft goods, and will continue to be crucial to the world beyond China and the U.S. Therefore, the role of the Global South and BRIC+6 in the mix of trade and FX adds to the complexity of 2025. An important risk factor for LatAm is in the FX markets as most of the currencies are overheld and either seeing selling — MXN, CLP and PEN — or losing money despite the attractive carry — BRL.

In the EU, political uncertainty in the region’s main economies continues, with France recently appointing a third PM in less than six months and Germany heading to the polls again in February. New political settlements are, however, paving the way for a new economic strategy and the region still needs to find opportunities for growth. Many believe that the Eurozone industrial engine is in crisis; manufacturing has been contracting for two years — based on national and regional purchasing manager indices3 — and the European Central Bank now acknowledges that there is strong spillover risk from weak manufacturing into the better-performing services economy. Our data from securities custody also indicates that cross-border investors are now hedging their Eurozone exposures at record levels. Meanwhile, the U.K. continues to face stagflation risk and OECD projections point to the region having the worst growth vs. inflation mix for 2025.

The new EU Commission has set its sights on making progress in harmonizing the fragmented European capital markets landscape. Formerly billed as the “Capital Markets Union” initiative, a set of reports, including ones by former Italian prime ministers Mario Draghi and Enrico Letta, are proposing more ambitious reforms with the goal of creating a European Savings and Investment Union. Early signs are that the EU Commission is willing to match the ambition of those reports with a consultation on legislation for securitization reforms. While this would be a first step, the bigger piece would be breaking down barriers for cross-border investments across and into the EU, encouraging member states to embrace a truly harmonized single capital market, allowing for greater investment and further driving growth to complement measures at national levels.

In the U.K., trapped pension savings are generally not being invested in productive financing of the real economy.4 From focusing on ensuring broader investments into unlisted equity, to supporting and even mandating consolidation, reforming the U.K.’s pension landscape appears to be at the top of the new government’s to-do list. Current government proposals are focused on minimum size thresholds for Defined Contribution (DC) schemes, the future role of master trusts and further asset pooling in Local Government Pension Schemes. Additionally, Pensions Review is looking at how DC scheme trustees, trade bodies and consultants could increase investment in less liquid assets to generate greater long-term value for members and increase U.K. productive assets infrastructure investment.

As valuations are becoming increasingly attractive and the market looks for diversification, opportunities arise. Across the globe, changes to the political and macro climate are breeding growth opportunities, including the potential for incoming governments to pursue pro-growth policies via private sector funding. The next decade will be a critical time for governments, regulators and the private sector to come together and support growth while the geopolitical environment continues to evolve.

Ben Pott, Vincent Reinhart, Bob Savage, John Velis and Geoff Yu contributed to this article.

1BNY’s iFlow Mood index is a measure of investor preference for stocks or bonds.

2 “Statement on Monetary Policy,” Bank of Japan, September 20, 2024, https://www.boj.or.jp/en/mopo/mpmdeci/mpr_2024/k240920a.pdf

3Will Beacham, “Eurozone manufacturing slump enters record-breaking 28th month, latest PMIs show,” Independent Commodity Intelligence Services (ICIS), November 4, 2024, https://www.icis.com/explore/resources/news/2024/11/04/11047050/eurozone-manufacturing-slump-enters-record-breaking-28th-month-latest-pmis-show/

4Djuna Thurley, James Mirza-Davis, “Pension scheme investments,” House of Commons Library, UK Parliament, November 18, 2024, https://commonslibrary.parliament.uk/research-briefings/cbp-10146/

Disclaimers:

iFlow® / FX MARKET COMMENTARY

The products and services described herein may contain or include certain “forecast” statements that may reflect possible future events based on current expectations. Forecast statements are neither historical facts nor assurances of future performance. Forecast statements typically include, and are not limited to, words such as “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “likely,” “may,” “plan,” “project,” “should,” “will,” or other similar terminology and should NOT be relied upon as accurate indications of future performance or events. Because forecast statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict.

iFlow® is a registered trademark of The Bank of New York Mellon Corporation under the laws of the United States of America and other countries. iFlow captures select data flows from the firm’s base of assets under custody, as well as from its trading activity with non-custody clients, on an anonymized and aggregated basis.

BNY

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.