THE ALTERNATIVES RENAISSANCE

Institutional investing into the alternative investments (alts) market is mature, with institutional capital deployed to alts asset classes for more than two decades. While alternative managers traditionally have raised capital from institutions, an influx of new capital is coming from the private wealth space. Alts are becoming increasingly democratized as logistical investing challenges are addressed by alts managers, allowing them to access a largely untapped pool of investors, in what has the potential to be the next frontier of exponential growth for the alts industry.

The potential of the private wealth market is huge. Alts account for less than 3% of the portfolios of high-net-worth individuals, for example.1 But over the next decade, it is estimated that alts assets under management for private wealth investors will increase three-fold from $4 trillion to $12 trillion.2

To help capture this valuable source of fresh capital, alts managers increasingly are working with wealth managers to better understand their needs in the alts space and how to match product offerings with the suitability of private clients. While individual private wealth investments may not be as large as institutional allocations, private wealth individuals invest for the long-term and provide an opportunity for alts managers to diversify their capital base.

For wealth managers that are newer to alts, these investment strategies present both opportunities and challenges. As wealth managers become more experienced with the different risk-return profiles and how to incorporate them in portfolio construction, demand for these products will continue to grow. The benefits of alts include returns uncorrelated to traditional equity and fixed income markets, potential for higher yields, downside protection and greater diversification. An increased focus on alts within wealth management firms is palpable, with hundreds of new hires taking place and specialist teams devoted to this segment becoming larger. Figures show that hiring rates are likely to increase by nearly 50% year over year in 2024.3

BNY has established alts expertise across investment management, advisory, distribution, securities services, wealth technology and custody and clearing. In addition, BNY Pershing offers support for alts and wealth managers across the alts ecosystem through targeted introductions and investment access via BNY Alts BridgeSM. Having these relationships with both sides of the market offers a unique vantage point to observe trends and be actively involved in the evolving alts space — including the rise in wealth managers actively looking to invest in alternatives and hedge fund clients proactively marketing to the private wealth segment.

With private clients seeking to leverage new investment opportunities, BNY Pershing has undertaken a deep dive into the alts landscape, collecting primary data through a wealth industry survey to understand key considerations and deciding factors for wealth managers when making investments into alts. The survey findings uncover insights into the state of play in the market, shedding light on the experiences of wealth managers and how alts solutions can be shaped to help overcome barriers to entry and support evolving client needs.

ANALYZING THE NEW ERA OF PRIVATE WEALTH AS THE SOURCE OF CAPITAL FOR ALTS

Alts gaining traction

The buzz around alts is loud and getting louder.

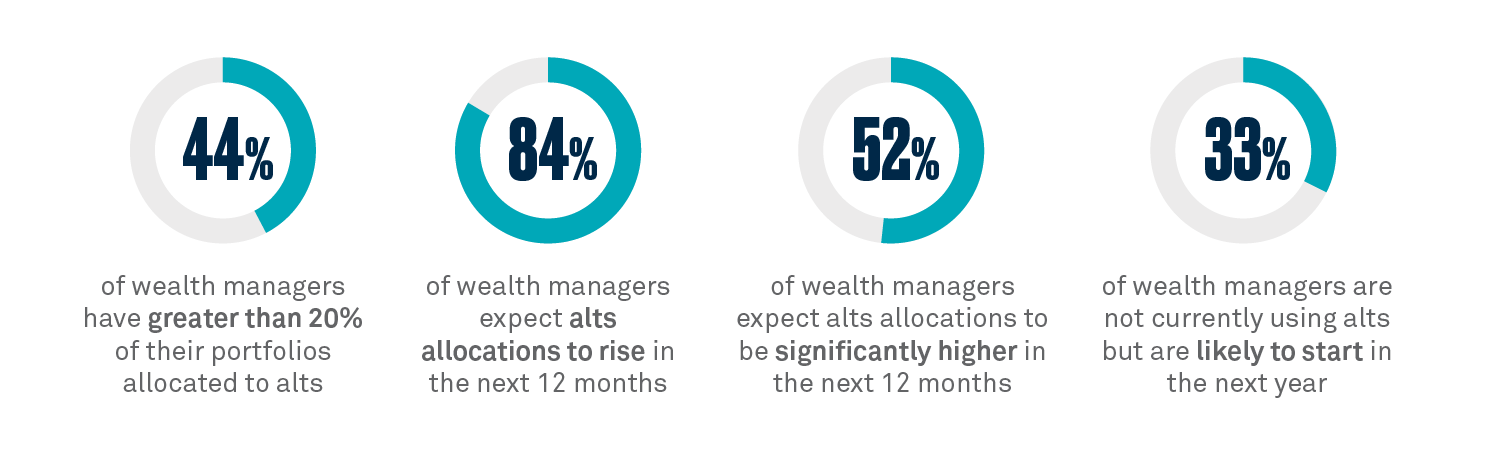

Among the wealth managers surveyed:

With a majority of respondents expecting to increase their allocations to alts over the next year, it’s clear there is a growing interest in the impact alts can make for private client portfolios. In fact, 84% of wealth managers surveyed are looking to alts to diversify returns or increase return potential as two of the top factors driving their investment decisions.

REITs and private equity riding high

Nearly 90% of respondents shared that they are using alts to generate longer-term returns and the most popular asset class is REITs, used by 89% with their private clients. Depending on private client liquidity needs, REITs can be accessed via public markets and private markets. Since both options are available to private clients of different liquidity profiles, REITs may have the broadest appeal.

Private equity also is one of the top three alts asset classes ranked in the survey, used by 67% of wealth managers.

Hedge Funds a top choice for alts allocation

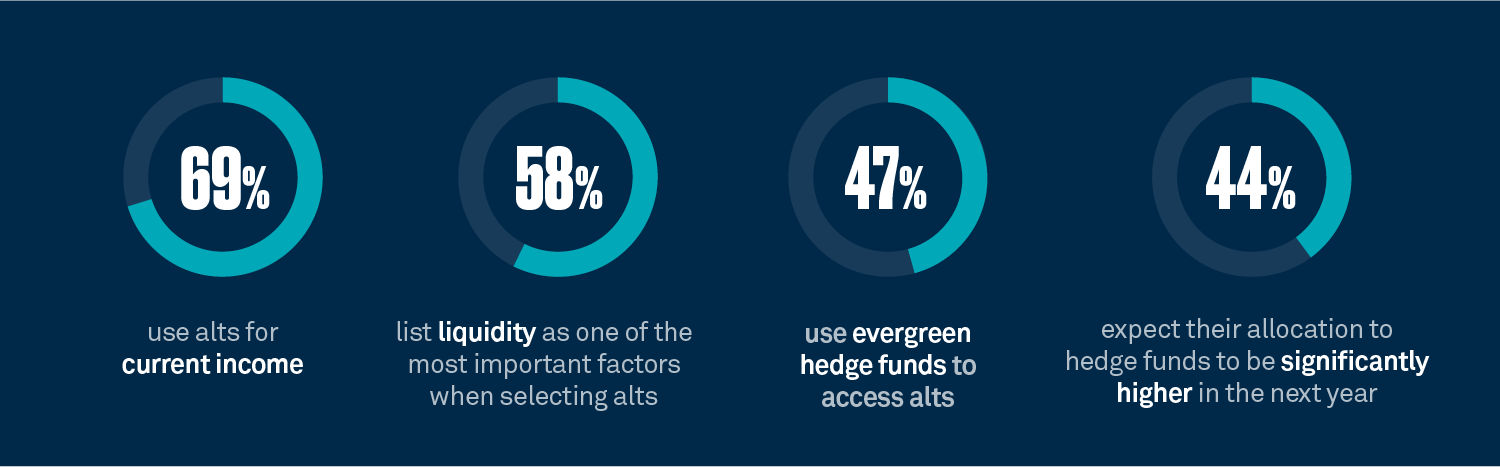

An overarching finding from our survey is that liquidity is one of three most important factors in portfolio construction and how alternatives strategies are used.

Among the wealth managers surveyed:

When selecting alts funds, key considerations highlighted by survey respondents include liquidity, diversification of returns and increased return potential. As such, the ability of hedge funds, in particular, to provide these investment attributes is emphasized by survey respondents. This is in contrast to the general perception that private markets and illiquid alts are the most sought-after strategies currently and that hedge funds may be experiencing stagnant interest. Instead, with the use of hedge funds anticipated to rise, according to the survey, this could indicate that liquid alternatives have even more room to grow, driven by the wealth management space. Ultimately, the survey results highlight that there is no “one size fits all” approach when it comes to alts; it comes down to the suitability of each private client, and depending on their needs, it may be suitable for private clients to invest in liquid alts, illiquid alts or a mix of both.

Big brands

With many wealth managers relatively new to the alts space, it may be easier for them to invest in products offered by market-leading brand name investment firms. The majority of participants favor using large traditional managers that offer alternative products and large alternative/private market managers for selecting alts.

84%

of wealth managers turn to large traditional managers that offer alternative products

80%

of wealth managers turn to large alternative or private market managers

56%

of wealth managers turn to asset managers with a historical focus on retail investors

Straightforward strategies are the order of the day

Survey respondents revealed that wealth managers’ capacity to undertake complex, time-consuming research is limited -- particularly when it comes to alts research and manager selection.

Having a robust selection of alts managers to choose from is the biggest challenge for wealth managers

44%

of wealth managers agree that it is harder to research alts products than traditional investments

>75%

of wealth managers spend 6 hours or less screening for, researching, or learning about alts products

This is an indication that simple and straightforward strategies may have the most success with private clients. The wealth manager must first understand the investment benefits of the strategy in order to explain those benefits to their private clients. Therefore, the easier the strategy is to understand, the more efficient it can be to inspire private clients to invest.

Documentation and compliance inefficiencies

Respondents shared that their greatest operational challenges when investing in alts on behalf of their private clients are complying with legal and regulatory requirements and managing manual documentation.

- Confirming a legal, risk or compliance matter was viewed by 51% of respondents as being harder than in the traditional investments space.

- The most time-consuming part of the subscription document/order entry form process, according to 78%, is completing a legal, risk or compliance matter.

- This was followed by verifying investor data and completing numerous manual fields at 66% and 51%, respectively.

1Elisa Battaglia Trovato, “Alternative assets becoming key battleground for wealth managers,” Professional Wealth Management, FT Wealth Management, February 26th 2024; https://www.pwmnet.com/alternative-assets-becoming-key-battleground-for-wealth-managers

2Hugh MacArthur, Rebecca Burack, Graham Rose, Christophe De Vusser, Kiki Yang, and Sebastien Lamy; “Global Private Equity Report 2024;” Bain; Bain & Company, Inc.; 2024; https://www.bain.com/globalassets/noindex/2024/bain_report_global-private-equity-report-2024.pdf

3Sasha Jensen, “The Push for Private Wealth: Diversifying Through Alternatives,” Jensen Partners Executive Search, Jensen Partners Executive Search, October 9,2024, https://www.jensen-partners.com/insights/the-push-for-private-wealth-diversifying-through-alternatives/#:~:text=Private%20wealth%20clients%E2%80%94%20high%2Dnet,while%20also%20offering%20greater%20diversification