Surging models propelled active ETFs to record highs

U.S. Distribution Pulse Quarterly | 3Q 2024

Scott Anderson

Time to Read: 4 minutes

The wirehouse channel recorded more than $10bn in active ETF net inflows in the first half of 2024 alone, putting them on course to surpass the record sales performance levels for 2022 and 2023 this year. A range of models and rep-as-portfolio manager programs (Rep-as-PM) have been driving active ETF flows at wirehouses over the past 12 months. The diversity in products across the top ten range from AVUV, a small value quant-based ticker, to CGGR, an actively-managed large growth strategy.

For registered investment advisors (RIAs), U.S. equity accounted for 44% of active ETF sales over the past year, compared to a 21% share of sales at wirehouses. Wirehouses, by contrast, have a greater proportion of active ETF sales concentrated in options income (29% of sales over the past twelve months) and taxable fixed income (41%).

Figure 1: Wirehouse - Active ETF Net Flows

.jpg)

Source: BNY Growth Dynamics. Trend data as of June 30, 2024.

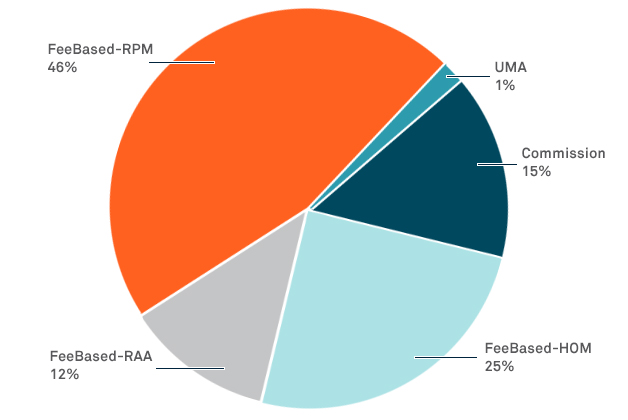

Home office and third-party models are accelerating demand for actively managed ETFs. Fee-based rep-as-portfolio manager programs (Rep-as-PM) were the early adopters in the active ETF space and accounted for 46% of ETF net sales YTD ending in Q2 2024. But home office models surged to account for 25%. This reflects a 10% increase in net sales compared with 2021, which was a record year for ETF sales. With more models now able to offer three-year live performance track records, manager willingness to consider active strategies in models will support further growth..

By contrast, Rep-as-PM saw a 1% decline in the same period. Commission-based active ETFs saw net sales plunge by 12% and Rep-as-advisor saw no significant change.

Figure 2: Active ETF Net Sales Q3'21-Q2'24

Source: BNY Growth Dynamics. Trend data as of June 30, 2024.

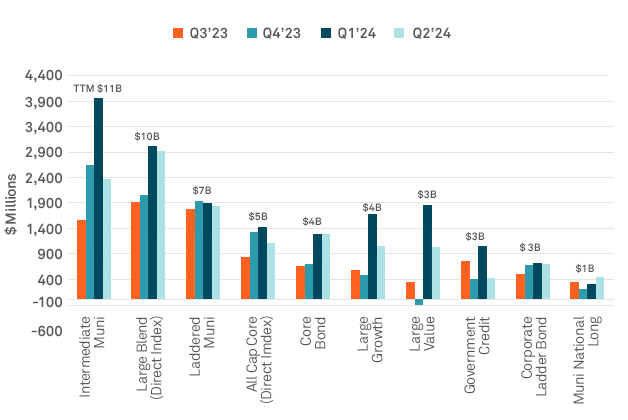

SMAs continue to steal market share from mutual funds, accounting for $18bn of net inflows in Q2 2024 for a 2% quarter-on-quarter rise in AUM. That contrasts with mutual funds, which experienced a seventh quarterly outflow over the last two years.

SMAs are growing across all asset classes, with intermediate municipal bonds continuing to lead SMA flows over the past 12 months. Taxable fixed income strategies are also growing, as core, government credit, corporate ladder and core plus strategies have experienced more sales in the last four quarters than in the prior two years.

Equity large-cap blend was the leader in the most recent quarter Flows were driven by direct indexing platforms gathering assets tied to major equity benchmarks. Direct indexing is a form of passive investing that allows investors to directly own the individual securities that make up a custom benchmark index. Some examples of direct index strategies include Parametric Custom Core, Natixis AIA and PGIM Custom Harvest.

Figure 3: Wirehouse SMA Net Sales by Investment Styles

Source: BNY Growth Dynamics. Trend data as of June 30, 2024.

Wirehouses have reason for optimism as we head into the final part of 2024. Unprecedented growth in active ETF sales is helping to mitigate some of the disruption caused by persistent outflows from mutual funds. With actively managed ETFs still accounting for only 5% of portfolios, there is considerable potential for prolonged future growth in sales of these vehicles. The market for active ETFs is dynamic, with scalable home office models accounting for a growing share of a market that was previously dominated by Rep-as-PM offerings.

Like ETFs, SMAs are also seizing market share from mutual funds. Indeed, amid robust demand for everything from equities to fixed income and aided by growing interest in direct indexing, SMAs are sitting in a favorable position.

All flow data is sourced from BNY Growth Dynamics as of June 30, 2024. The aggregate data used in this analysis is based on Mutual Fund, ETF and SMA asset and sales data reported to BNY Growth Dynamics under a data sponsor agreement. Data currently represents approximately $3.1 trillion in assets under management (AUM) with national broker-dealers. The data set includes sales through a financial advisor and excludes institutional and retirement plan sales.

Scott Anderson

Director of Research, BNY Growth DynamicsSM

Disclaimer

BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2024 The Bank of New York Mellon. All rights reserved. Member FDIC.

BNY has entered into a definitive agreement to acquire Archer Holdco, LLC (“Archer”), a leading technology-enabled service provider of managed account solutions to the asset and wealth management industry.

Mutual funds, exchange-traded funds (ETFs), and separately managed accounts (SMAs) all saw net sales grow in Q1 2024.

BNY Growth Dynamics data shows flow trends to U.S. equity ETFs in the second half of 2023 began to shift, leading to the highest U.S. equity flows in Q4 2023 since the end of 2021.

BNY's Elliott Brown outlines challenges and opportunities in the private credit space including how investors are in search of new ways to achieve income/yield in a low-rate environment and the importance of strategically selecting an administrator.