Identify Industry Trends, Know Your Performance Drivers

For institutional investors, knowing your performance drivers vis-à-vis peers and understanding the flow of capital across asset classes and investment strategies is critical to making informed investment decisions. Asset Strategy View delivers three elements of market intelligence that support your analysis of performance.

Market

Intelligence

The market intelligence provided to you through Asset Strategy View can deepen the analysis you do during the investments process — helping you have more focused conversations with consultants, boards and asset managers.

Peer Group Allocation Trending

Get timely information and insights about how peers are allocating across asset classes and sub-asset classes. This valuable information supports your ongoing analysis and stakeholder engagement.

Performance Results

See how your total fund’s return compares against the return of your peer group. This capability drills down to comparisons at the asset class and sub-asset class detail.

Performance Attribution Comparisons Vis-à-Vis Peer Group

See how your total fund or plan performance compares with your peer group via three measures: Asset Allocation Effect, Manager Selection Effect and Total/Interaction Effect.

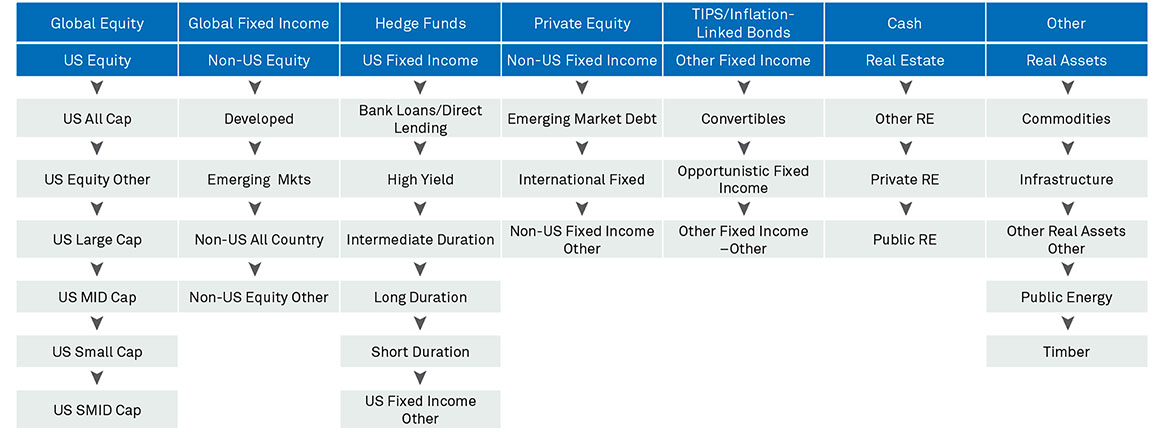

Asset and Sub-Asset Class Classifications

Asset Mandate Level

Asset categories and sub-categories

Our Solutions

Performance, Risk and Analytics

Our goal is to provide comprehensive investment risk services that monitor risk across the investment process with integrated performance solutions for comparing, evaluating and understanding the impact of investment decisions.

Hedge Fund Services

BNY provides integrated hedge fund services solutions designed to fully manage the administrative requirements of both onshore and offshore hedge funds.