MARGIN SERVICES

Collateral and financing solutions for a changing market.

Collateral and financing solutions for a changing market.

BNY Margin Services helps clients efficiently manage collateral using innovative solutions for both collateral providers and receivers. As a global provider, we help buy-side and sell-side clients optimize their collateral portfolios with sophisticated analytics and tools to evaluate eligibility, as well as flexible bilateral and triparty solutions, while meeting increasingly complex financing and liquidity requirements.

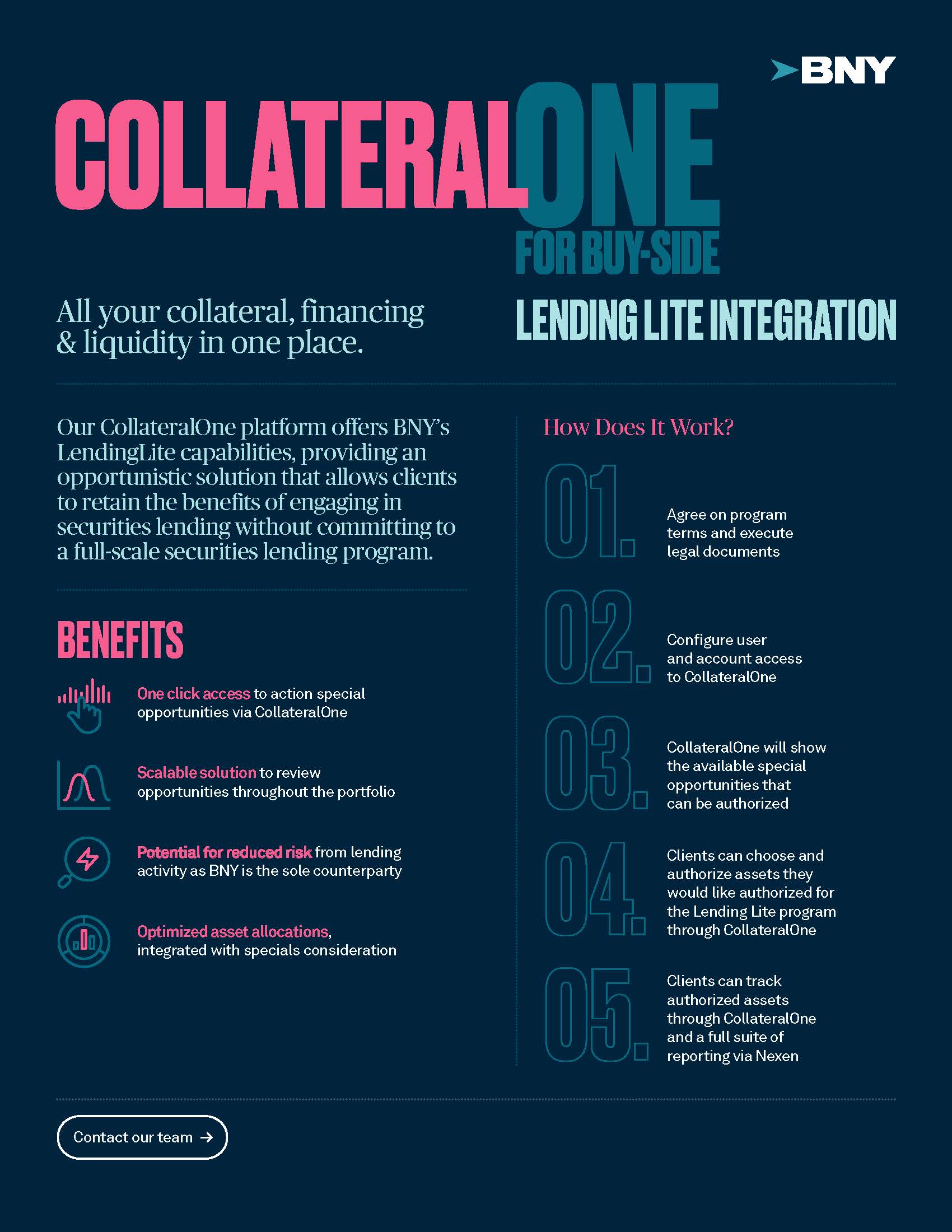

This new platform expands the triparty for buy-side offering across the BNY eco-system, helping clients to efficiently centralize how collateral and financing activities are managed while having access to optional specials-only lending – opening up a world of new possibilities for utilizing assets.

CollateralOne for buy-side is a new platform integrated with BNY’s triparty capabilities, which provides clients with a holistic view of their BNY assets, liabilities and financing opportunities in one place. Connecting BNY’s LendingLite service with the CollateralOne for buy-side platform can help clients to identify specials and receive incremental revenue from lending, without committing to a full-scale securities lending program.

Access the CollateralOne Fact Sheet

Access GLMX Integration Fact Sheet

Asset owners holding fully paid securities can earn extra passive income by giving permission to their broker dealer to loan securities through Fully Paid Security Lending* (aka FPL). BNY offers segregation services for pledgors to facilitate their underlying FPL deals.

Access the FPL Fact Sheet

Margin DirectSM provides custody services for posted margin balances for collateralized transactions. This allows BNY to hold margin balances while you transact with counterparties, providing a strong element of risk mitigation in your counterparty relationships.

Access the Margin Direct Fact Sheet

MarginConnect is our electronic messaging options, which links two of the largest and most recognized collateral industry leaders: BNY collateral segregation service and AcadiaSoft’s collateral call messaging product.

Access the MarginConnect Fact Sheet

MARGIN SERVICES

Compliance with the margin requirements is a journey. We’ve helped hundreds of clients meet their compliance requirements. See below to learn how we can help guide you through these regulations.

UNCLEARED MARGIN RULES

The Uncleared Margin Rules require counterparties in non-cleared over-the-counter (OTC) derivative trades to exchange initial margin (IM) and variation margin (VM) with each other. These rules began life in 2009, when the G20 countries committed to reforming the OTC derivatives market in the wake of the financial crisis. The G20 agreed to two major reforms: The first was that standardized derivatives would be cleared at central counterparties. The second was that non-standardized derivatives unsuitable for central clearing would be subject to IM and VM requirements. In the years since, the rules have been codified as legally binding regulation in Australia, Canada, the European Union, Hong Kong, Japan, Korea, Singapore, Switzerland and the United States.

THE JOURNEY

If you are captured, the rules will impact the entire lifecycle of your trade from inception through to post trade settlement. Here, you can learn about the individual steps toward compliance, explained simply across Pre-Trade, Exchange and Settlement.

AM I CAPTURED?

Determining whether you are captured under the rules is based on whether your average aggregated national amount (AANA) of non-cleared OTC derivatives exceeds a certain threshold over a certain period of time.

Meeting the Uncleared Margin Rules need not be complicated. Here, you can learn about the different options BNY offers to help guide you through this journey.

Triparty is a low-touch option. It maximizes the efficiency and flexibility for collateral pledgors by outsourcing many of your day-to-day margin segregation responsibilities. This makes the account structure particularly suitable for portfolio managers running multiple funds with complex allocation requirements.

Review the key steps that Collateral Receivers/Providers or collateral administration agents, will need to complete to onboard with our MarginDirect service.

Review the key steps that Clients will have to complete to onboard as a Collateral Provider in our Segregated IM Triparty Service.

Triparty is a low-touch option. It maximizes the efficiency and flexibility for collateral pledgors by outsourcing many of your day-to-day margin segregation responsibilities. This makes the account structure particularly suitable for portfolio managers running multiple funds with complex allocation requirements.

Review the key steps that Collateral Receivers, or Agents that Collateral Receivers have outsourced to, to onboard with our Segretated IM Triparty service.

Our Third-Party margin segregation model allows you to take a more direct role in the management of your collateral and has traditionally proved a more popular choice for institutions that have fewer securities and trading relationships. The construct fully supports the segregation (pledge) of your collateral when you are posting in favor of your counterparty.

In Collateral Administration accounts where IM is essentially a reserve for potential future exposure (PFE) during a margin period of risk (MPR), capturing funding costs, we offer Standard Initial Margin Model (SIMM).

Learn more about BNY’s Markets solutions.

Findaium: Buy-side firms, triParty and a new look at generating alpha

This article investigates why buy-side firms are making the change to triparty and what benefits can be gained.

ISDA Standardized IM Methodology (SIMM)

Looking for information about the Standardized IM Methodology? Find it here.

EU Regulation on Uncleared Derivatives

Read the EU regulation that brought the Uncleared Margin Rules into force in Europe.

CFTC Final Rules on Margin Requirements for Uncleared Swaps

You can find the CFTC rule enforcing the margin requirements in the U.S. here.

Markets products are offered through BNY or Capital Markets, LLC in the US and select countries in NA, EMEA and APAC where permitted by local law. Not all products and services are offered in all countries. Please confirm with a BNY representative.