Active ETF and taxable fixed income SMA growth accelerates

U.S. Distribution Pulse Quarterly | 4Q 2024

Time to Read: 3 minutes

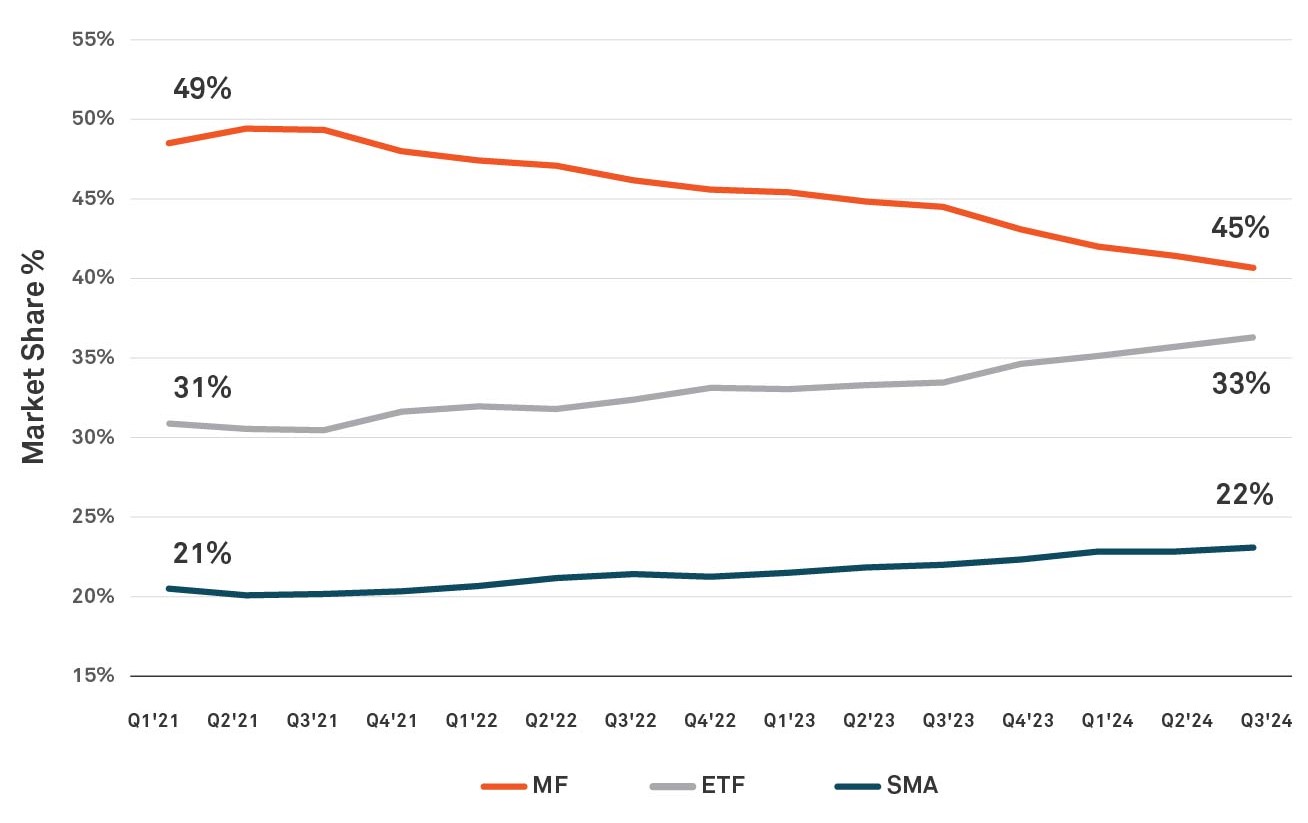

Both SMAs and ETFs continue to steal market share from mutual funds across wirehouse platforms in 2024 through Q3. Market share for mutual funds declined to 45%, as both ETFs and SMAs continue to close the gap.

Figure 1: Market Share by Product Wrapper Wirehouse Channel

Source: BNY Growth Dynamics. Trend data as of September 30, 2024.

Taxable fixed income SMAs accounted for 20% of wirehouse net sales, despite making up only 10% of SMA assets under management (AUM). The sharp uptick in demand suggests taxable fixed income SMAs are increasingly viewed as desirable at this point in the market cycle given in Fed policy1.

Both intermediate core and core plus strategies realized dramatic increases in percentage of sales, alongside corporate bond ladders. Intermediate muni and large blend (custom index2) had the biggest aggregate net flows over the last year, at $13bn and $12bn respectively.

Figure 2: Wirehouse SMA Net Sales by Investment Style

Source: BNY Growth Dynamics. Trend data as of September 30, 2024.

With strong ETF performance across all major asset classes, active ETFs collected 22% of wirehouse ETF net sales while accounting for only 5% of total ETF AUM. Taxable fixed income (30% of net sales), U.S. equity (29%) and alternatives (28%) were the leaders in active ETF flows. U.S. equity continues to grow given the strong market performance 2024 YTD, playing an increasing role as more asset managers look to chase returns in a “risk on” environment.

Industry-wide, active ETFs represented 7% of the total ETF market at the start of this year and accounted for 30% of all ETF flows in H1.3

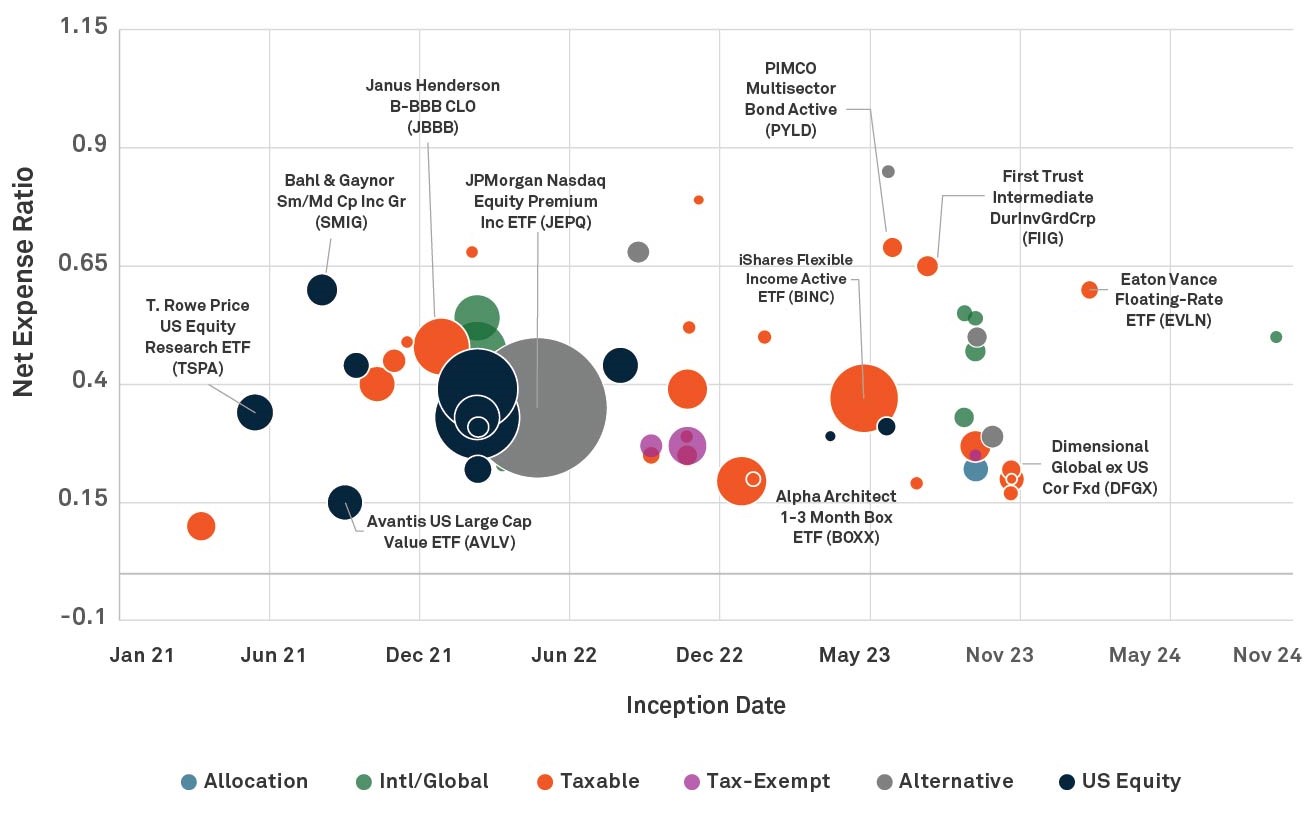

More than a third of 2024 active ETF net flows at wirehouses through Q3 (36% of $17b) came from products launched in the past three years.

The JP Morgan Nasdaq Equity Premium Income ETF (JEPQ), launched in March 2022, has been a significant source of the inflows. This is in part due to the use of option to generate higher yields, a low total cost, familiarity with the strategy backed by strong marketing and distribution.

Figure 3: Recent (>2021) Active ETF Launches that saw substantial Net Flows in 2024 - Wirehouses

Source: BNY Growth Dynamics. Trend data as of September 30, 2024.

Data from Pershing’s registered investment advisors (RIAs) also shows the strength of active ETFs that reached the market in 2022. They accounted for 30% of active ETF net sales, with Capital Group Growth ETF (CGGR) and Capital Group Growth Equity ETF (CGGO) near the top of the leaderboard.

Active ETFs are becoming a crucial part of portfolios, as investors look to actively manage risk while also valuing efficiency. Taxable fixed income SMAs, like active ETFs, are achieving remarkable net sales figures for what they represent in terms of total AUM. Going into 2025, the outlook for mutual funds remains unclear as the other product wrappers look set to further diminish their market share. However, there may still be opportunities for mutual funds to thrive in certain niches or through innovation.

Please reach out to the Growth Dynamics team who can help you use this market data to uncover opportunities and achieve deeper engagement with financial advisors.

1 Source: Federal Reserve, November 2024 https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20241107.pdf

2Custom Index: An investment approach that allows investors to create a unique index that's designed to meet specific criteria or objectives. This includes choosing securities to exclude to create a custom index, as well as a tool to help manage tax efficiency through tax loss harvesting

3Source: Morningstar, July, 2024 https://www.morningstar.com/funds/prolific-first-half-etf-flows

Disclaimer

BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material. BNY, BNY Mellon and Bank of New York Mellon are the corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2024 The Bank of New York Mellon. All rights reserved. Member FDIC.

BNY has entered into a definitive agreement to acquire Archer Holdco, LLC (“Archer”), a leading technology-enabled service provider of managed account solutions to the asset and wealth management industry.

Mutual funds, exchange-traded funds (ETFs), and separately managed accounts (SMAs) all saw net sales grow in Q1 2024.

BNY Growth Dynamics data shows flow trends to U.S. equity ETFs in the second half of 2023 began to shift, leading to the highest U.S. equity flows in Q4 2023 since the end of 2021.

BNY's Elliott Brown outlines challenges and opportunities in the private credit space including how investors are in search of new ways to achieve income/yield in a low-rate environment and the importance of strategically selecting an administrator.