Diversification of investment strategies has a notable impact on whether public asset owners choose to conduct portfolio management internally or externally. Approaches vary depending on the asset class and instrument, with some institutions internalizing some asset classes while concurrently externalizing others. For example, one central bank will increase in-house fixed-income management but externalize the management of corporate bonds specifically. Likewise, a public pension fund will further in-house alternative investments and specific equities while externalizing others.

Our extensive research reveals public asset owners' ambitions, challenges and outlooks, in order to help them adapt to increasing demands, learn from others’ experiences and ultimately accelerate their ambitions and impact.

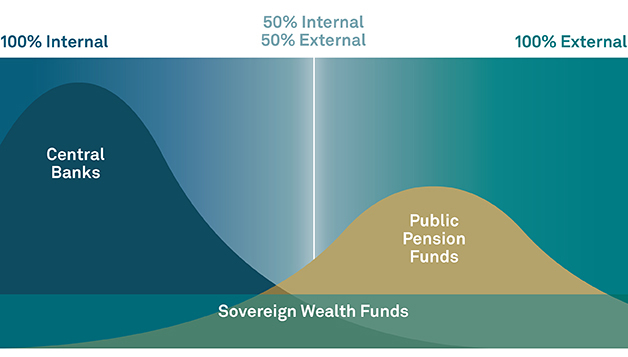

In general, central banks show a clear preference for internal management, with most wanting 80%-100% of assets managed in-house. Meanwhile, public pension funds slightly favor externalization, with 40% of assets managed internally and 60% allocated to third-party managers (see Figure 1, “Public Asset Owners Vary in Their Preferences for Internal/External Ratios”).

Figure 1: Public Asset Owners Vary in Their Preferences for Internal/External Ratios

What ideal ratio of internal to external management are public asset owners targeting in the next 5 years? (Select one)

Source: BNY Mellon/OMFIF operating model survey

Cost and the ability to build up national capabilities rank as the top rationales for internalizing portfolio management. Improved performance and better control and oversight are a close second. Examples include several institutions currently establishing internal trading teams and a pooled pension fund, which in the past had moved asset management toward external managers, rebuilding its internal desk.

Interview Perspectives

We are the single most important asset manager in the country. The more we internalize, the more we can help the local financial sector as a hub for activity and a destination for talent.

Sovereign Wealth Fund

If our investments are with an external manager, usually in another country, we don’t have proximity and visibility over what’s going on, no matter how many reports or data we get. But it’s our duty to oversee investment closely.

Central Bank

We have a general push to internalize, but when it comes to exotic stuff, we go external.

Sovereign Wealth Fund

Public asset owners typically externalize strategically for specific geographies or asset classes where they can learn from external managers’ expertise. Some more sophisticated institutions go as far as running a concurrent external and internal strategy to explore new asset classes. One sovereign wealth fund professional said that it employs both internal and external desks and “plays them off each other.”

In alternatives, public asset owners’ first forays are often through direct investments and acquisitions of real estate. As they gain sophistication and confidence, many co-invest with external third-party institutions, while others add private equity, hedge funds and hedge funds of funds to their portfolios. At their most sophisticated, public asset owners can act as quasi-private equity shops themselves, leading sourcing, due diligence and strategic investments.

Public asset owners also seek out external managers to achieve improved performance and benefit from additional services, such as market insights or reporting. Only a small minority say cost benefits are a primary driver when hiring external managers.

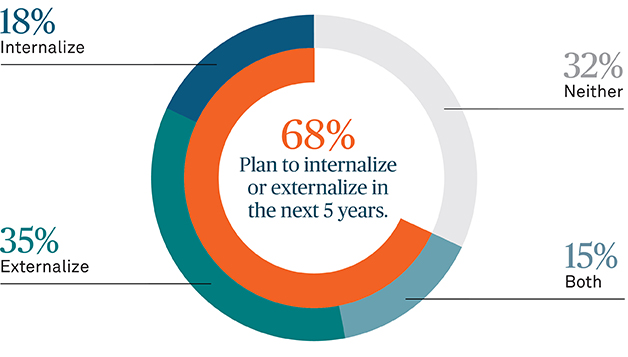

Not only are there a variety of approaches taken to internalization and externalization, but the balance between the two approaches changes over time. Unlike operating models, which are much more static, the ratio of internal and external management is highly dynamic, with two-thirds of institutions planning to change their strategy over the next five years (see Figure 2, “The Majority of Public Asset Owners Will Change Their Mix of Internal and External Portfolio Management”).

Figure 2: The Majority of Public Asset Owners Will Change Their Mix of Internal and External Portfolio Management

Do public asset owners plan to move part of their portfolio management to external managers in the next 5 years? (Select all that apply)

Source: BNY/OMFIF operating model survey

New Assets and Investment Strategies Set the Tone

Asset Servicing Global Disclosure

© 2022 The Bank of New York Mellon Corporation. All rights reserved.