As growth in alternative investments continues, alternative investment managers face a new paradigm of opportunities and challenges. BNY believes many managers are evaluating the most effective way to adapt their operating models in order to best engage, service and scale in their next phase of growth.

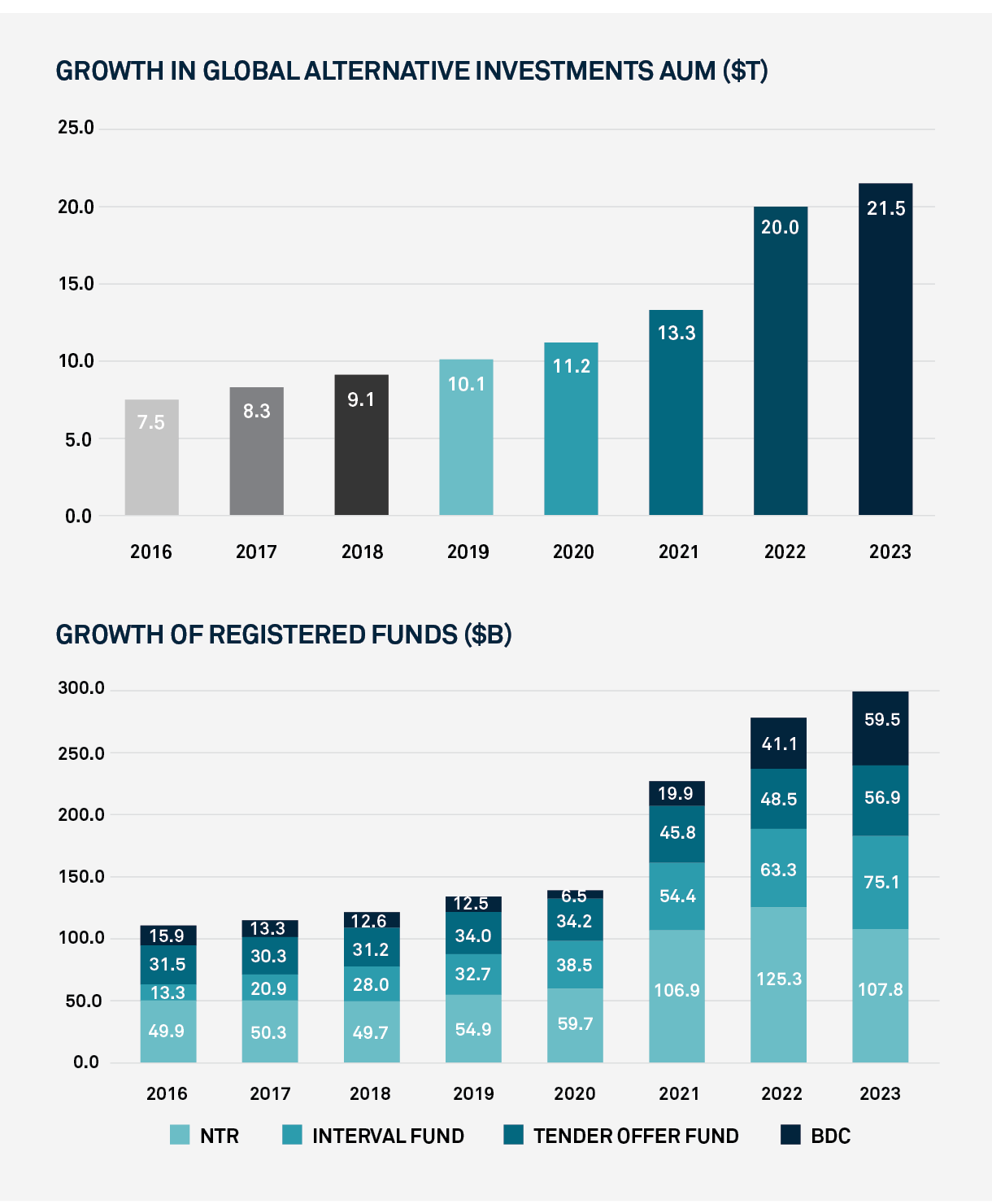

FIGURE 1: CONTINUED GROWTH IN GLOBLAL ALTERNATIVE ASSETS AND REGISTERED FUNDS

Source: S&P Global, Preqin Investor Outlook - “Alternative Assets, H2 2023 Report Extract,” 2023 iCapital Financial Advisor Survey

Since 2016, alternative investment AUM has tripled and alternative registered funds have seen a substantial increase. Asset allocators predict that alternative assets will continue to be an increasingly important component of a total portfolio, as alternatives have historically demonstrated the trifecta of lower volatility, diversification benefits and return enhancement.1 Notably, private markets are experiencing a surge in dollars allocated. Private market AUM is projected to grow at more than double the rate of public assets, reaching $65 trillion by 2032,2 which is being driven by a few catalysts: the trend for companies to stay private for longer and public companies opting to privatize, as well as regulatory trends seeming to support more inclusion for individual investors.

In addition to a desire for higher returns, investors around the world are facing a growing retirement savings gap, where the traditional portfolio may no longer be sufficient to meet long-term cash needs. Alternative investments, on the other hand, not only offer potential returns to help close the gap but also have the long-term duration and return enhancement to match most investors’ retirement timelines. Alternative investment managers are actively working to capitalize on these trends to continue to grow AUM sustainably. But these shifts in investor base are also requiring asset managers to consider the next chapter of their operating models and evaluate what structural changes are required to keep pace with client expectations and expected growth. Based on BNY’s conversations with our touchpoints across the alternatives ecosystem, including clients, industry stakeholders and our experts, there are a few key areas where alternatives investment managers seem focused going into 2025.

Managers are tapping into new growth opportunities

Cerulli Associates reports that alternative investment managers expect 23% of their assets to come from [individual] clients by 2028 compared to ~13% in 2024. Additionally, 43% of managers expect Defined Contribution plans to have >5% allocation to alternative assets in the next five years.3 The ongoing demand from individual investors for alternative investment products is encouraging managers to be creative with how they access investors and structure investment opportunities, which has led managers to develop:

- New business models favoring partnerships between traditional and alternative investment managers to tap into new investment opportunities and leverage existing distribution channels

- Multi-manager products allowing clients to access multiple strategies through a single fund and, conceptually, allowing them to reduce their concentration risk — the result, however, is an increased need for transparency and common reporting structures

In the U.K. and Europe, regulators are easing access for individual investors to invest in alternative funds. The U.K.’s Long Term Asset Fund (LTAF), the EU’s revised European Long Term Investment Fund (ELTIF), Luxembourg’s Undertakings for Collective Investment (UCI) Part II funds, and Switzerland’s Limited Qualified Investor Fund (L-QIF) are new fund structures designed to facilitate individual investments in less liquid assets. These were implemented, in part, to encourage constituents to build retirement savings.

Managers want to make their products more accessible to more investors

With the new fund types and product mix increasing investor interest, the next step towards sustaining growth is to increase fund marketing through more scalable distribution channels and increasing investor and advisor education.

In the U.S. alone, there are over 15,000 investment advisors providing asset management services to more than 60 million individuals.4 Most alternative investment managers, however, have sales and service models that were designed for the significantly more concentrated institutional investor and asset owner client base. In order to effectively reach the breadth of advisors and end-investors globally, fund managers require significant scale and key distribution partners. In fact, 87% of asset managers report that the HNW advisor-sold channel is the top priority for alternative investment distribution and 53% view mass-affluent, advisor-sold as a top priority. Conversely, only 13% of managers view direct distribution to HNW investors as a top priority.5

Enter the potential for collaborations with wealth distribution platforms that can help facilitate target connectivity and education programs for advisors and investors. Given that this is a newer asset class for some investors, education is critical for building awareness, familiarity and trust with individual investors. Demystifying risks, fees, liquidity terms and expected performance — as well as the multitude of vehicle structures and wrappers — will help individual investors and their advisors make informed decisions.

While financial advisors and institutions can play a crucial role in educating individuals by offering personalized advice and guidance, building brand awareness across fund managers is also critical. Managers that can differentiate themselves from peers and establish relationships with well-known financial services institutions can improve their brand presence and ease the pathway for new individual investment.

Managers are exploring ways to gain operating leverage

As managers explore ways to sustainably scale their administrative and infrastructure capabilities, many are shifting from an internal to external model. External fund administrators, given their investments over time on scaled systems and processes, can potentially provide managers with streamlined operations, error reductions and other ways of improving investor experience and risk management.

One example of reducing operational risk by moving to external fund administration is the ability to simplify investor subscription processes through digitization of investor onboarding, accreditation and compliance checks such as KYC/AML requirements, as well as potentially reducing costs and improving the investor experience for key life-cycle events like capital calls and distributions. By addressing these key operational challenges, managers can focus their attention on the core tenets of their business such as fundraising and deployment. Firms that have begun utilizing external fund administrators have already seen growth potential. According to Cerulli data, in 2024, 63% of asset managers were leveraging an external distribution platform, up from 44% in 2023, with another 17% considering use of one.6

ALTS BRI DGE

Making Alternative Investing Easier, as only BNY can.

*AltsBridge is currently for U.S. investors only. The U.S. may or may not follow suit on regulatory access easing; retirement systems and use of products for non institutional investors will have different structures for U.S. investors.

Managers are looking for ways to improve data management

Institutional investors allocating capital to alternative investment managers are seeking higher-quality, end-to-end reporting. Additionally, with the increase in individual investors, the growth in underlying sub-asset classes presents a need for more robust and more flexible data management for internal and external reporting. Regulators around the world are also increasing their expectations regarding data quality and reporting.

To achieve better data management, managers will need to invest in data management systems (DMS) and processes that are specifically designed to handle the unique requirements of alternative investments as part of larger multi-asset-class portfolios, including implementing data governance frameworks, establishing quality controls, and investing in data analytics tools that can help institutions analyze and interpret large volumes of data. Therefore, DMSs will need to be flexible to accommodate financial, non-financial and unstructured data sets. In addition, tailoring reporting for individual investors to include accurate data aggregation, transparent and consistent investor communication and personalized, real-time reporting through intuitive digital dashboards will be key to alternative investment managers achieving scale.

We believe the outlook for alternatives investing remains bright. With inflation continuing and life expectancies increasing, the search for yield is top of mind for investors and presents opportunity for more investment diversity for those investors that can take on additional risks. We see an opportunity for players across the investment ecosystem to come together to address these challenges, implement standards and increase ease and transparency, to help enable growth for all.

Joanna Berg, Paul Fleming and David Moss contributed to this article.

For use with Financial Professionals only. Not for use with the general public.

1 Russ Koesterich, “Private Markets Investing for Wealth Clients,” Blackrock, September 12, 2024, https://www.blackrock.com/us/financial-professionals/insights/private-markets-investing

2“Private market assets to grow at more than twice the rate of public assets, reaching up to $65 trillion by 2032, Bain & Company finds,” Bain, August 21, 2024, https://www.bain.com/about/media-center/press-releases/2024/private-market-assets-to-grow-at-more-than-twice-the-rate-of-public-assets-reaching-up-to-$65-trillion-by-2032-bain--company-finds/

3 “Alternatives providers increasingly strike partnerships to gather retail assets,” Cerulli, August 21, 2024, https://www.cerulli.com/press-releases/alternatives-providers-increasingly-strike-partnerships-to-gather-retail-assets

4 “SEC Staff Publishes New Investment Adviser Statistics Report,” U.S. Securities and Exchange Commission, May 15, 2024, https://www.sec.gov/newsroom/press-releases/2024-57

5 Krissy Davis, Julia Cloud, Karl Ehrsam, Snehal Waghulde, Doug Dannemiller, “2025 Investment Management Outlook,” Deloitte, October 7, 2024, https://www2.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/investment-management-industry-outlook.html

6 “Alternatives providers increasingly strike partnerships to gather retail assets,” Cerulli, August 21, 2024, https://www.cerulli.com/press-releases/alternatives-providers-increasingly-strike-partnerships-to-gather-retail-assets

Altsbridge Disclaimer

Alternative strategies (including hedge funds and private equity) may involve a high degree of risk and prospective investors are advised that these strategies are appropriate only for persons of adequate financial means who have no need for liquidity with respect to their investment and who can bear the economic risk, including the possible complete loss, of their investment. The strategies will not be subject to the same regulatory requirements as registered investment vehicles. The strategies may be leveraged and may engage in speculative investment practices that may increase the risk of investment loss. Investors should consult their investment professional prior to making an investment decision.

Alts Bridge Feeder Funds were established to invest all of the capital contributed to the fund (net of fund fees and expenses) in a single underlying private investment vehicle (Underlying Fund). The manager of the Alts Bridge Feeder Fund operates the fund as a means for investors to access the performance of the Underlying Fund. However, investors will have no direct interest in the Underlying Fund, will have no voting rights in the Underlying Fund and will have no standing or recourse against the Underlying Fund, its underlying manager (“Underlying Fund Manager”) or their respective Affiliates. The interests in the Alts Bridge Feeder Funds have not been approved or disapproved by the U.S. Securities and Exchange Commission (the "SEC") or by the securities regulatory authority of any state or of any other jurisdiction. The Interests have not been registered under the Securities Act of 1933, as amended (the "Securities Act"), the securities laws of any other state or the securities laws of any other jurisdiction, nor is such registration contemplated. The funds will not be registered as an investment company under the Investment Company Act of 1940, as amended (the "1940 Act"). Consequently, limited partners of the funds are not afforded the protections of the 1940 Act. The funds are offered only to qualified investors who do not require immediate liquidity of the investment. An investment in the fund does not constitute a complete investment program. Investors must fully understand and be willing to assume the risks involved in the fund's investment program.

1784 Alternatives Management, LLC, a subsidiary of BNY, will act as manager of the Alts Bridge Feeder Fund. The Manager will administer the day-to-day operations of the Alts Bridge Feeder Fund and its investment in the Underlying Fund. However, no BNY Entity will act as the investment adviser to the Alts Bridge Feeder Fund. Various other subsidiaries of BNY will provide services to the Alts Bridge Feeder Fund. Pershing is the platform provider and provides custody services for the Alts Bridge Feeder Funds. BNY Mellon Advisors, Inc. will perform diligence on the Underlying Funds and Underlying Fund Managers. The Bank of New York Mellon will act as the administrator of the Alts Bridge Feeder Fund. BNY Mellon Securities Corporation, a registered broker-dealer, will act as distributor for the Alts Bridge Feeder Fund. Investors and their Financial Professional should closely review in their entirety the “Offering Materials” for an Alts Bridge Feeder Fund, which include (i) the Alts Bridge Platform Disclosure Document; (ii) the Alts Bridge Feeder Fund Supplement for the Alts Bridge Feeder Fund (including the Underlying PPM attached thereto); (iii) the limited liability company agreement of the Alts Bridge Feeder Fund; and (iv) the Alts Bridge Subscription Agreement. Information provided is for informational and educational purposes only and is not a recommendation to take any particular action, or any action at all, nor an offer or solicitation to buy or sell any securities or services presented. It is not investment advice. Investing involves risk, including the possible loss of principal invested. Technology Services Provided by Pershing X Inc.

BNY makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material. The information contained is for informational purposes only and is not a commitment to deliver any product or service. BNY makes no representations or warranties regarding the product, its features, or its availability, which are subject to change at any time. The platform is expected to be available to U.S. Registered Investment Advisors (RIAs) and Independent Broker-Dealers (IBDs) who are clients of BNY Pershing. For professional use only. Not intended for use by the general public. BNY will not be responsible for updating any information contained within this material and information contained herein is subject to change without notice. BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally.

Investment Products: Not FDIC Insured / No Bank Guarantee / May Lose Value

BNY General Disclaimer

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.