The U.S. Treasury market, the most liquid government securities market in the world, plays a pivotal role in the global economy. U.S. Treasuries serve as a benchmark for global interest rates and play a key role in monetary policy and global financial stability.

There are two important changes to the U.S. Treasury market underway. One is the interplay of Quantitative Tightening (QT) with continued U.S. fiscal expansion, the other is regulatory changes, including mandated central clearing for U.S. Treasuries. Market participants can leverage these changes to create opportunities and better position themselves for growth.

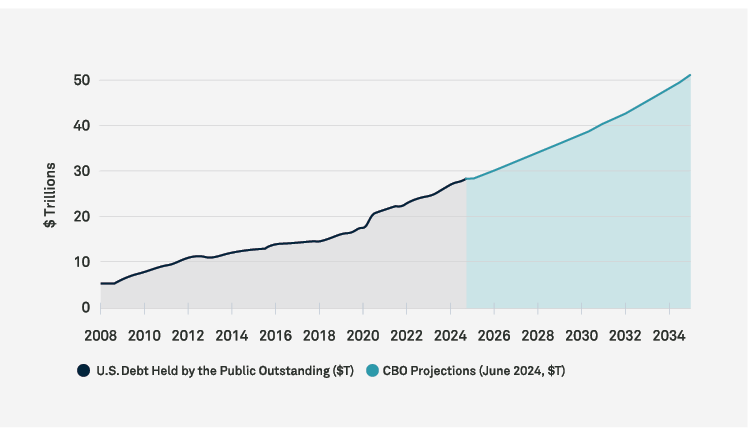

Fiscal Growth and Quantitative Tightening: Monetary and fiscal policy are currently draining liquidity and materially increasing the amount of collateral in funding markets. For the second time following the Global Financial Crisis, the Federal Reserve is reducing the size of its balance sheet through QT.1 With each dollar in assets that runs off the Federal Reserve’s portfolio, private sector liquidity is also reduced. While current monetary policy withdraws liquidity, financing needs in the market continue to grow. Barring fiscal policy changes, the Treasury market is on track to grow from today’s $28 trillion to over $50 trillion outstanding in the next decade.2 (Figure 1) This would dramatically increase the amount of collateral that needs to be financed and put upward pressure on funding rates and term premia.

FIGURE 1: OUTSTANDING U.S. DEBT HELD BY THE PUBLIC POISED FOR CONTINUED GROWTH

Source: Bloomberg, quarterly, non-seasonally adjusted. June 2024 CBO debt projections reflected

Bank Regulatory Changes: Risk and regulatory changes have also made intermediation more complex, with bank and dealer intermediation capacity lagging the overall growth of the U.S. Treasury market. The March 2023 U.S. regional banking crisis also resulted in banks generally becoming more protective of cash reserves, with further regulation on the sector a possibility. One potential change includes pre-positioning collateral at the Federal Reserve’s Discount Window to guard against liquidity shocks – which would pull collateral and liquidity from private markets. For the resilience of global financial markets, it is important that any future changes support intermediation and strengthen liquidity within the U.S. Treasury market.

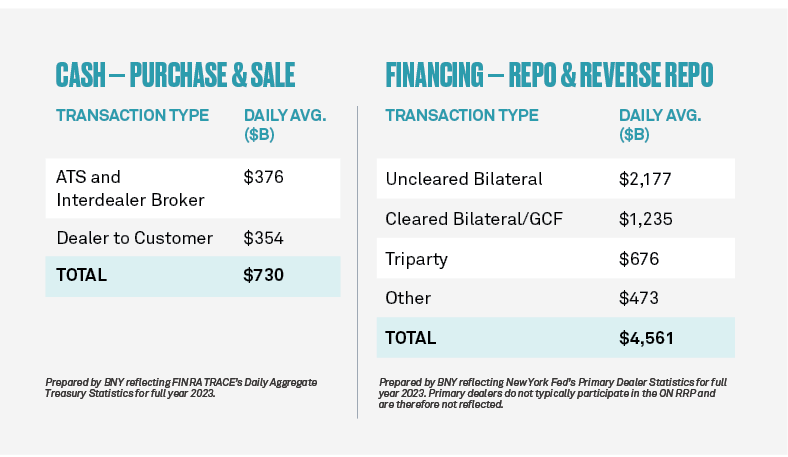

Mandated U.S. Treasury Central Clearing: The Treasury market is currently at an inflection point: liquidity is falling while demand for it is rising. In the absence of further action, higher price volatility, elevated longer-term yields and higher funding costs are possible. The market structure for government securities is being "reassembled" as regulators seek to enhance the safety of U.S. financial markets, most significantly through the SEC’s mandate for central clearing of Treasury market transactions, which could require $4 trillion to be centrally cleared daily. (Figure 2)

FIGURE 2

The SEC rule will require market participants to submit a substantial portion of their cash and repo trades to clear at a U.S. Treasury central counterparty (CCP). The SEC rule aims to reduce counterparty settlement risk in stress scenarios and seeks to offer some balance sheet relief through netting of offsetting transactions. The rule will also require market participants to change the way they interface with the Treasury market. Importantly, this central clearing framework requires participants to post margin and make contingent liquidity commitments, which would increase the demand for liquidity in normal times and potentially during times of stress.

The implementation dates for the rule are approaching, with central clearing of eligible cash transactions required by December 31, 2025, and central clearing of eligible repo transactions required by June 30, 2026. Market participants can prepare by assessing whether their U.S. Treasury transactions are in scope for central clearing, determining the clearing access model that best fits their activity and implementing a robust change management program that considers the implications across risk, collateral management, technology, operations and legal.

Improved Liquidity and Collateral Solutions Driving Resilient Global Markets: The above structural changes underscore the importance of flexibility in sources and uses of funding. Market participants are seeking flexible and efficient liquidity solutions, including the ability to manage their liquidity in smaller time increments. The traditional overnight funding model is being complemented with more granular sources and uses of funding. Enter triparty intraday repo and early morning maturity triparty repo. Intraday triparty repo allows lenders to put their cash to work for a few hours during the day and for borrowers to receive secured funding for the needed period only. Early morning maturity triparty repo allows lenders to access their overnight triparty repo cash earlier in the day. While these products have existed in the bilateral repo and unsecured markets, the introduction of these products into the triparty repo space is an important step toward increasing the flexibility of vital money markets. Together, these options can help improve liquidity management.

While collateral can provide a much-needed source of liquidity for market participants, type, location and timing are critical factors that can help increase collateral mobility and utility. There have been significant industry advancements on all three of these fronts to allow for increased mobility, optimization and flexibility. As market participants seek more advanced collateral solutions, they need comprehensive answers that better enable them to meet their unique financing needs.

Due to the need to manage liquidity in varying time zones and jurisdictions, global collateral networks have continued to grow, connecting more markets. As a result, interoperable solutions have emerged, allowing market participants to mobilize collateral more efficiently to meet global funding requirements. These solutions are becoming increasingly advanced as they integrate new technologies, including distributed ledger technology, that allow them to mobilize assets across borders more efficiently.

Optimization, the process of managing and allocating collateral efficiently to meet liquidity needs, reducing costs and enhancing returns, is another key focus for market participants. As market participants seek to reduce their funding costs and needs, more sophisticated collateral optimization solutions provide a mechanism to manage regulatory requirements more efficiently across liquidity, funding and capital (e.g., Net Stable Funding Ratio, Liquidity Coverage Ratio). These solutions and algorithms have improved significantly, including by leveraging artificial intelligence.

With the potential for higher price volatility, elevated longer-term yields and higher funding costs on the horizon, market participants must stay nimble to navigate changes. Taking it one step further, these changes can be approached as strategic opportunities for growth. Increased partnership between the public and private sectors can not only help drive resilient and less fragmented global markets but can also establish key pathways to enable this growth.

Alex Cadmus, Laide Majiyagbe, Conor Sari and Nate Wuerffel contributed to this article.

1 David Wessel, “How will the Federal Reserve decide when to end ‘quantitative tightening’?” Brookings, October 17, 2024, https://www.brookings.edu/articles/how-will-the-federal-reserve-decide-when-to-end-quantitative-tightening/

2 “Budget and Economic Data,” Congressional Budget Office, https://www.cbo.gov/data/budget-economic-data#3

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material and any products and services may be issued or provided under various brand names of BNY in various countries by duly authorized and regulated subsidiaries, affiliates, and joint ventures of BNY, which may include any of those listed below:

This material may not be distributed or used for the purpose of providing any referenced products or services or making any offers or solicitations in any jurisdiction or in any circumstances in which such products, services, offers or solicitations are unlawful or not authorized, or where there would be, by virtue of such distribution, new or additional registration requirements.

The Bank of New York Mellon, a banking corporation organized pursuant to the laws of the State of New York, whose registered office is at 240 Greenwich St, NY, NY 10286, USA. The Bank of New York Mellon is supervised and regulated by the New York State Department of Financial Services and the US Federal Reserve and is authorized by the Prudential Regulation Authority (PRA) (Firm Reference Number: 122467).

The Bank of New York Mellon also operates in the UK through its London branch (UK companies house numbers FC005522 and BR000818) at 160 Queen Victoria Street, London EC4V 4LA, and is subject to regulation by the Financial Conduct Authority (FCA) and limited regulation by the PRA. Details about the extent of our regulation by the PRA are available from us on request.

The Bank of New York Mellon operates in Germany as The Bank of New York Mellon Filiale Frankfurt am Main and has its registered office at Friedrich-Ebert-Anlage 49, 60327 Frankfurt am Main, Germany (Zweigniederlassung registered in Germany with Registration No. HRB 12731). It is under the supervision of the German Central Bank and the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), Marie-Curie-Str. 24-28, 60439 Frankfurt, Germany) under BaFin-ID 10100253.

The Bank of New York Mellon SA/NV, a Belgian public limited liability company, with company number 0806.743.159, whose registered office is at Boulevard Anspachlaan 1, B-1000 Brussels, Belgium, authorised and regulated as a significant credit institution by the European Central Bank (ECB), under the prudential supervision of the National Bank of Belgium (NBB) and under the supervision of the Belgian Financial Services and Markets Authority (FSMA) for conduct of business rules, a subsidiary of The Bank of New York Mellon.

The Bank of New York Mellon SA/NV operates in Ireland through its Dublin branch at Riverside II, Sir John Rogerson's Quay Grand Canal Dock, Dublin 2, D02KV60, Ireland and is registered with the Companies Registration Office in Ireland No. 907126 & with VAT No. IE 9578054E. The Bank of New York Mellon SA/NV, Dublin Branch is subject to additional regulation by the Central Bank of Ireland for Depository Services and for conduct of business rules.

The Bank of New York Mellon SA/NV operates in Germany as The Bank of New York Mellon SA/NV, Asset Servicing, Niederlassung Frankfurt am Main, and has its registered office at MesseTurm, Friedrich-Ebert-Anlage 49, 60327 Frankfurt am Main, Germany (Zweigniederlassung registered in Germany with registration No. HRB 87912). It is subject to limited additional regulation by the Federal Financial Supervisory Authority (Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin), Marie-Curie-Str. 24-28, 60439 Frankfurt, Germany) under BaFin ID 10122721.

The Bank of New York Mellon SA/NV operates in the Netherlands through its Amsterdam branch at Tribes SOM2 Building, Claude Debussylaan 7, 1082 MC Amsterdam, the Netherlands, registered with the Dutch Chamber of Commerce under registration number 34363596. The Bank of New York Mellon SA/NV, Amsterdam Branch is subject to limited additional supervision by the Dutch Central Bank (De Nederlandsche Bank or DNB) on integrity issues only. DNB holds office at Spaklerweg 4, 1096 BA Amsterdam, the Netherlands.

The Bank of New York Mellon SA/NV operates in Luxembourg through its Luxembourg branch at 2-4 rue Eugene Ruppert, Vertigo Building – Polaris, L- 2453, Luxembourg. The Bank of New York Mellon SA/NV, Luxembourg Branch (registered with the Luxembourg Registre de Commerce et des Sociétés under number B105087) is subject to limited additional regulation by the Commission de Surveillance du Secteur Financier at 283, route d’Arlon, L-1150 Luxembourg for conduct of business rules, and in its role as depositary and administration agent for undertakings for collective investments (UCIs).

The Bank of New York Mellon SA/NV operates in France through its Paris branch at 7 Rue Scribe, Paris, Paris 75009, France. The Bank of New York Mellon SA/NV, Paris Branch is subject to limited additional regulation by Secrétariat Général de l’Autorité de Contrôle Prudentiel at Première Direction du Contrôle de Banques (DCB 1), Service 2, 61, Rue Taitbout, 75436 Paris Cedex 09, France (registration number (SIREN) Nr. 538 228 420 RCS Paris - CIB 13733).

The Bank of New York Mellon SA/NV operates in Italy through its Milan branch at Via Mike Bongiorno no. 13, Diamantino building, 5th floor, Milan, 20124, Italy. The Bank of New York Mellon SA/NV, Milan Branch is subject to limited additional regulation by Banca d’Italia - Sede di Milano at Divisione Supervisione Banche, Via Cordusio no. 5, 20123 Milano, Italy (registration number 03351).

The Bank of New York Mellon SA/NV operates in Denmark as The Bank of New York Mellon SA/NV, Copenhagen Branch, filial af The Bank of New York Mellon SA/NV, Belgien, CVR no. 41820063, and has its registered office at Strandvejen 125,1. DK-2900 Hellerup, Denmark. It is subject to limited additional regulation by the Danish Financial Supervisory Authority (Finanstilsynet, Strandgade 29, DK-1401 Copenhagen K, Denmark).

The Bank of New York Mellon SA/NV operates in Spain through its Madrid branch with registered office at Calle José Abascal 45, Planta 4ª, 28003, Madrid, and enrolled on the Reg. Mercantil de Madrid, Tomo 41019, folio 185 (M-727448). The Bank of New York Mellon, Sucursal en España is registered with Banco de España (registration number 1573).

The Bank of New York Mellon (International) Limited is registered in England & Wales with Company No. 03236121 with its Registered Office at 160 Queen Victoria Street, London EC4V 4LA. The Bank of New York Mellon (International) Limited is authorised by the PRA and regulated by the FCA and the PRA.

BNY Mellon, National Association, is the primary operating subsidiary of The Bank of New York Mellon Corporation, through which BNY Wealth conducts its trust and fiduciary business under the supervision of the US Office of the Comptroller of the Currency.

In the UK, a number of services associated with BNY Mellon Wealth Management’s Family Office Services – International are provided through The Bank of New York Mellon, London Branch.

Investment management services are offered through BNY Mellon Investment Management EMEA Limited 160 Queen Victoria Street, London EC4V 4LA, which is registered in England No. 1118580 and is authorised and regulated by the Financial Conduct Authority. Offshore trust and administration services are through BNY Mellon Trust Company (Cayman) Ltd.

BNY Mellon Fund Services (Ireland) Designated Activity Company is registered with Company No 218007, having its registered office at One Dockland Central, Guild Street, IFSC, Dublin 1, Ireland. It is regulated by the Central Bank of Ireland.

Regulatory information in relation to the above BNY entities operating out of Europe can be accessed at the following website: https://www.bny.com/corporate/emea/en/regulatory-information.html

For clients located in Switzerland: The information provided herein does not constitute an offer of financial instrument or an offer to provide financial service in Switzerland pursuant to or within the meaning of the Swiss Financial Services Act ("FinSA") and its implementing ordinance. This is solely an advertisement pursuant to or within the meaning of FinSA and its implementing ordinance. Please be informed that The Bank of New York Mellon and The Bank of New York Mellon SA/NV are entering into the OTC derivative transactions as a counterparty, i.e. acting for its own account or for the account of one of its affiliates. As a result, where you enter into any OTC derivative transactions with us, you will not be considered a "client" (within the meaning of the FinSA) and you will not benefit from the protections otherwise afforded to clients under FinSA.

The Bank of New York Mellon, Singapore Branch, is subject to regulation by the Monetary Authority of Singapore. For recipients of this information located in Singapore: This material has not been reviewed by the Monetary Authority of Singapore.

The Bank of New York Mellon, Hong Kong Branch (a branch of a banking corporation organized and existing under the laws of the State of New York with limited liability), is subject to regulation by the Hong Kong Monetary Authority and the Securities & Futures Commission of Hong Kong.

The Bank of New York Mellon, Seoul Branch, is a licensed foreign bank branch in Korea and regulated by the Financial Services Commission and the Financial Supervisory Service. The Bank of New York Mellon, Seoul Branch, is subject to local regulation (e.g. the Banking Act, the Financial Investment Services and Capital Market Act, and the Foreign Exchange Transactions Act etc.)

The Bank of New York Mellon, Shanghai Branch (Financial Licence No. B0078B231000001) and the Bank of New York Mellon, Beijing Branch (Financial Licence No. B0078B211000001) are licensed foreign bank branches registered in the People’s Republic of China and are supervised and regulated by the National Financial Regulatory Administration.

The Bank of New York Mellon is regulated by the Australian Prudential Regulation Authority and also holds an Australian Financial Services Licence No. 527917 issued by the Australian Securities and Investments Commission to provide financial services to wholesale clients in Australia. Where a document is issued or distributed in Australia by The Bank of New York Mellon on behalf of BNY Mellon Australia Pty Ltd (ACN 113 947 309) located at Level 2, 1 Bligh Street, Sydney NSW 2000, and relates to products and services of BNY Mellon Australia Pty Ltd or one of its subsidiaries, note that The Bank of New York Mellon does not provide these products or services. None of BNY Mellon Australia Pty Ltd or its subsidiaries is an authorized deposit-taking institution and the obligations of BNY Mellon Australia Pty Ltd or its subsidiaries do not represent investments, deposits or other liabilities of The Bank of New York Mellon. Neither The Bank of New York Mellon nor any of its related entities stands behind or guarantees obligations of BNY Mellon Australia Pty Ltd. The Bank of New York Mellon has various other branches in the Asia-Pacific Region which are subject to regulation by the relevant local regulator in that jurisdiction.

The Bank of New York Mellon, Tokyo Branch, is a licensed foreign bank branch in Japan and regulated by the Financial Services Agency of Japan. The Bank of New York Mellon Trust (Japan), Ltd., is a licensed trust bank in Japan and regulated by the Financial Services Agency of Japan. The Bank of New York Mellon Securities Company Japan Ltd., is a registered type 1 financial instruments business operator in Japan and regulated by the Financial Services Agency of Japan.

The Bank of New York Mellon, DIFC Branch, regulated by the Dubai Financial Services Authority (DFSA) and located at DIFC, The Exchange Building 5 North, Level 6, Room 601, P.O. Box 506723, Dubai, UAE, on behalf of The Bank of New York Mellon, which is a wholly owned subsidiary of The Bank of New York Mellon Corporation.

The Bank of New York Mellon has various subsidiaries and representative offices in the Latin America Region which are subject to specific regulation by the relevant local regulator in each jurisdiction.

BNY Mellon Saudi Financial Company is licensed and regulated by the Capital Market Authority, License number 20211-04, located in Alfaisaliah Tower, 18th Floor, King Fahad Road, P.O. Box 99936 Riyadh 11625, Kingdom of Saudi Arabia.

BNY Wealth conducts business through various operating subsidiaries of The Bank of New York Mellon Corporation.

Pershing is the umbrella name for Pershing LLC (member FINRA, SIPC and NYSE), Pershing Advisor Solutions (member FINRA and SIPC), Pershing Holdings (UK) Limited, Pershing Limited (UK), Pershing Securities Limited (UK), Pershing Securities International Limited (Ireland), Pershing (Channel Islands) Limited, Pershing Securities Singapore Private Limited, and Pershing India Operational Services Pvt Ltd. Pershing businesses also include Pershing X, Inc. a technology provider. Pershing LLC is a member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at sipc.org. SIPC does not protect against loss due to market fluctuation. SIPC protection is not the same as, and should not be confused with, FDIC insurance.

Past performance is not a guide to future performance of any instrument, transaction or financial structure and a loss of original capital may occur. Calls and communications with BNY may be recorded, for regulatory and other reasons.

Disclosures in relation to certain other BNY group entities can be accessed at the following website: https://www.bny.com/corporate/emea/en/disclaimers/eu-disclosures.html

This material is intended for wholesale/professional clients (or the equivalent only), and is not intended for use by retail clients and no other person should act upon it. Persons who do not have professional experience in matters relating to investments should not rely on this material. BNY will only provide the relevant investment services, and this material is only being distributed, to investment professionals.

Not all products and services are offered in all countries.

If distributed in the UK, this material is a financial promotion. If distributed in the EU, this material is a marketing communication.

This material, which may be considered advertising, (but shall not be considered advertising under the laws and regulations of Singapore), is for general information purposes only and is not intended to provide legal, tax, accounting, investment, financial or other professional counsel or advice on any matter. This material does not constitute a recommendation or advice by BNY of any kind. Use of our products and services is subject to various regulations and regulatory oversight. You should discuss this material with appropriate advisors in the context of your circumstances before acting in any manner on this material or agreeing to use any of the referenced products or services and make your own independent assessment (based on such advice) as to whether the referenced products or services are appropriate or suitable for you. This material may not be comprehensive or up to date and there is no undertaking as to the accuracy, timeliness, completeness or fitness for a particular purpose of information given. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

Any references to dollars are to US dollars unless specified otherwise.

This material may not be reproduced or disseminated in any form without the prior written permission of BNY. Trademarks, logos and other intellectual property marks belong to their respective owners.

The Bank of New York Mellon, member of the Federal Deposit Insurance Corporation (FDIC). Please note that many products and affiliates of The Bank of New York Mellon are NOT covered by FDIC insurance.

Trademarks and logos belong to their respective owners.

Please click here for additional information regarding disclaimers and disclosures.

© 2025 The Bank of New York Mellon. All rights reserved.