When Alexander Hamilton, the first Secretary of the United States Treasury and founder of the Bank of New York, now BNY, created a plan for the nation’s debt, it was rooted in two core attributes: safety and liquidity.

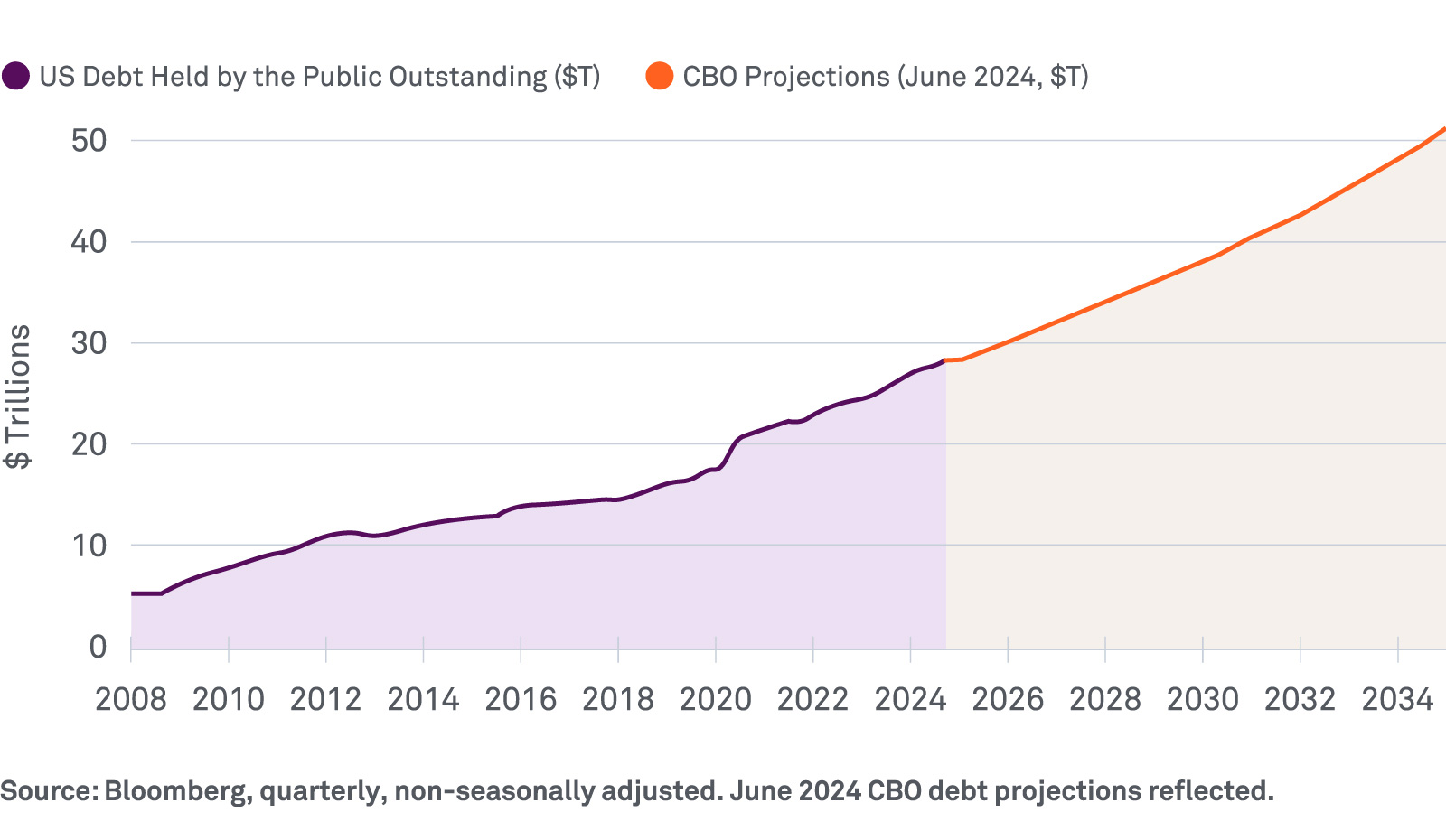

His plan was wildly successful. At $28 trillion outstanding,1 today the U.S. Treasury market is the deepest most liquid government bond market in the world (Exhibit I). The Treasury market efficiently finances the U.S. government, is used to implement monetary policy and is a safe haven for investors in times of stress.

However, the Treasury market is growing rapidly, and the market has experienced spasms of dysfunction, including in 2014, 2019 and following the COVID-19 pandemic. Now, with policy, regulatory and structural changes afoot, Treasury funding markets are seeing some of the early signs of liquidity pressures —including volatility in money market rates — that were last felt in 2019. It is more important than ever that the Treasury market remains safe and liquid, with the private and public sectors working together to find ways to improve liquidity in particular, given the seismic shifts underway.

Exhibit I: U.S. Debt Held by the Public Outstanding ($T)

Key structural forces influencing a safe and liquid Treasury market

What factors might be at play? Three structural forces at play today include:

1. Fiscal & monetary policy

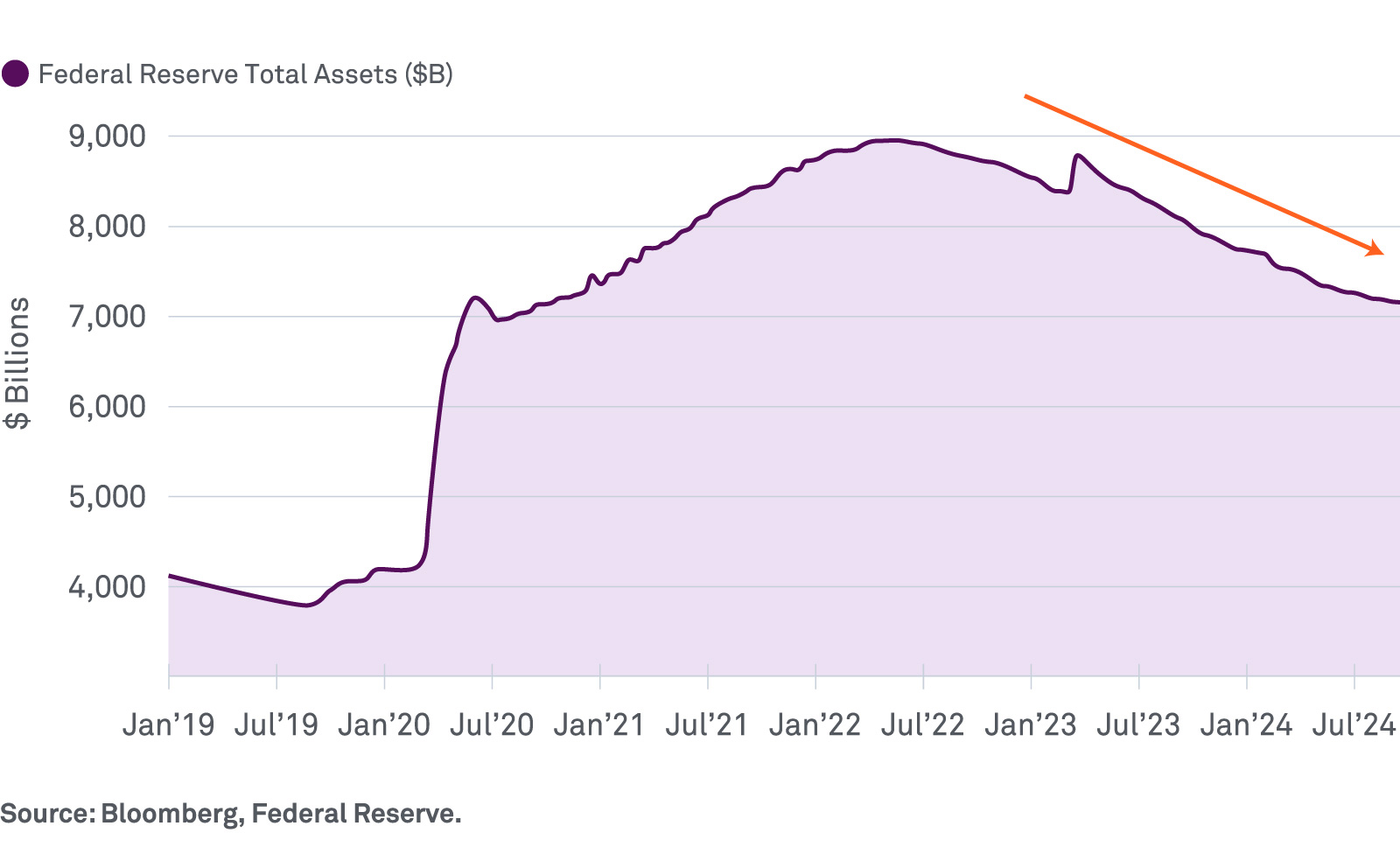

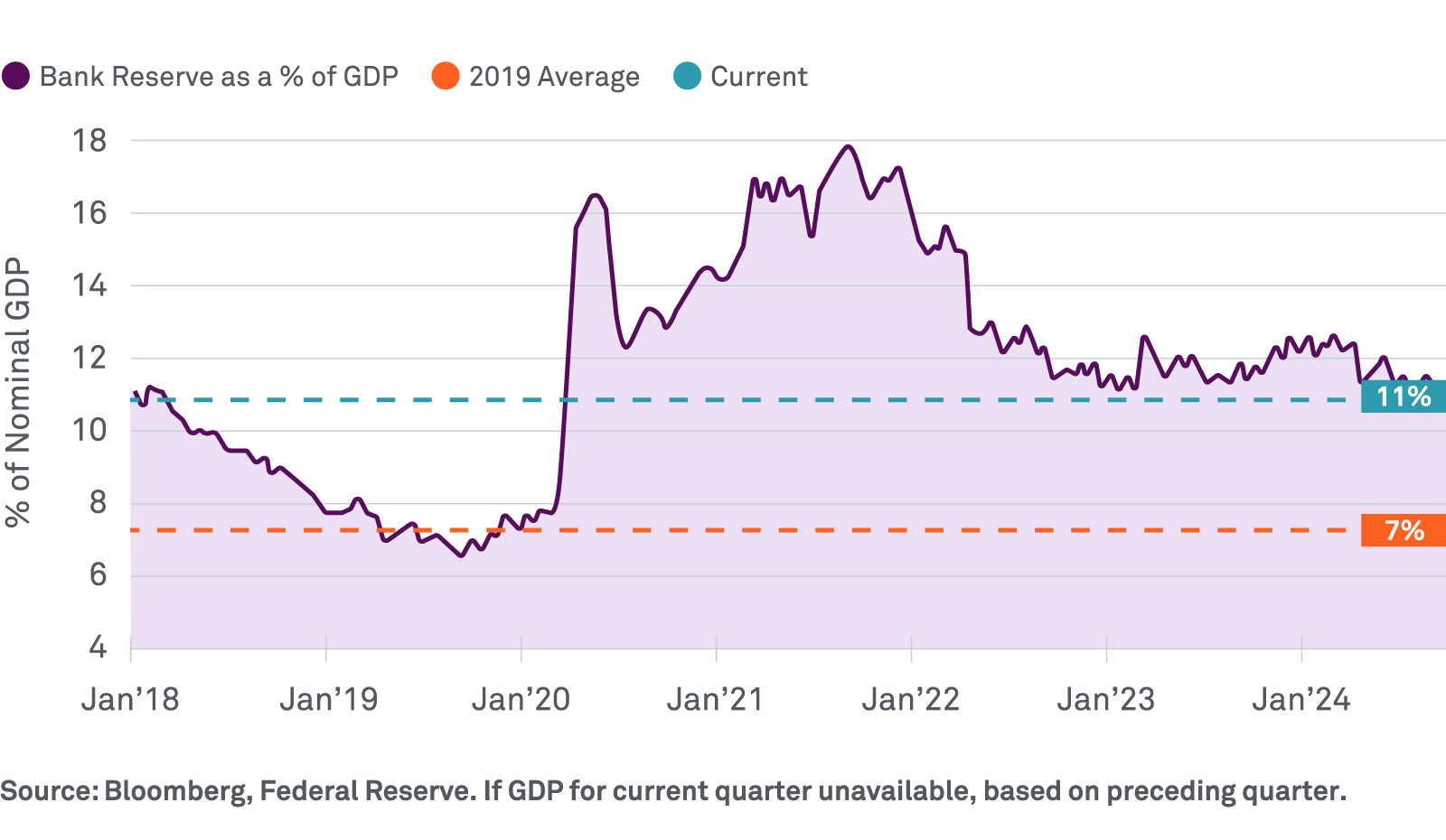

Fiscal and monetary policy are draining liquidity and increasing the amount of collateral in funding markets . For the second time following the global financial crisis, the Federal Reserve is in the process of reducing the size of its balance sheet through a process called Quantitative Tightening (QT) (Exhibit II). Each dollar in assets that runs off the Federal Reserve’s portfolio reduces private sector liquidity, and at the current pace QT is expected to pull another roughly $500 billion of liquidity out of the financial system over the next year. The last time the Fed embarked on QT in 2019, too much liquidity was withdrawn, leading to dislocations that required the Federal Reserve to intervene (Exhibit III).

Exhibit II: Federal Reserve Balance Sheet Since 2019 ($B)

Exhibit III: Bank Reserves as a % of Nominal GDP

Even as monetary policy withdraws liquidity, financing needs in the market are already growing. Barring fiscal policy changes, the Treasury market is on track to grow to over $50 trillion outstanding in the next decade (Exhibit I). This will dramatically increase the amount of collateral that needs to be financed and put upward pressure on funding rates and term premia.

2. Regulatory changes

Risk and regulatory changes are making intermediation more challenging and banks more protective of their cash reserves. Bank and dealer capacity to intermediate in Treasury markets has not kept pace with growth as regulations that have sought to make the financial system safer have in some cases come at the expense of market-making and liquidity.

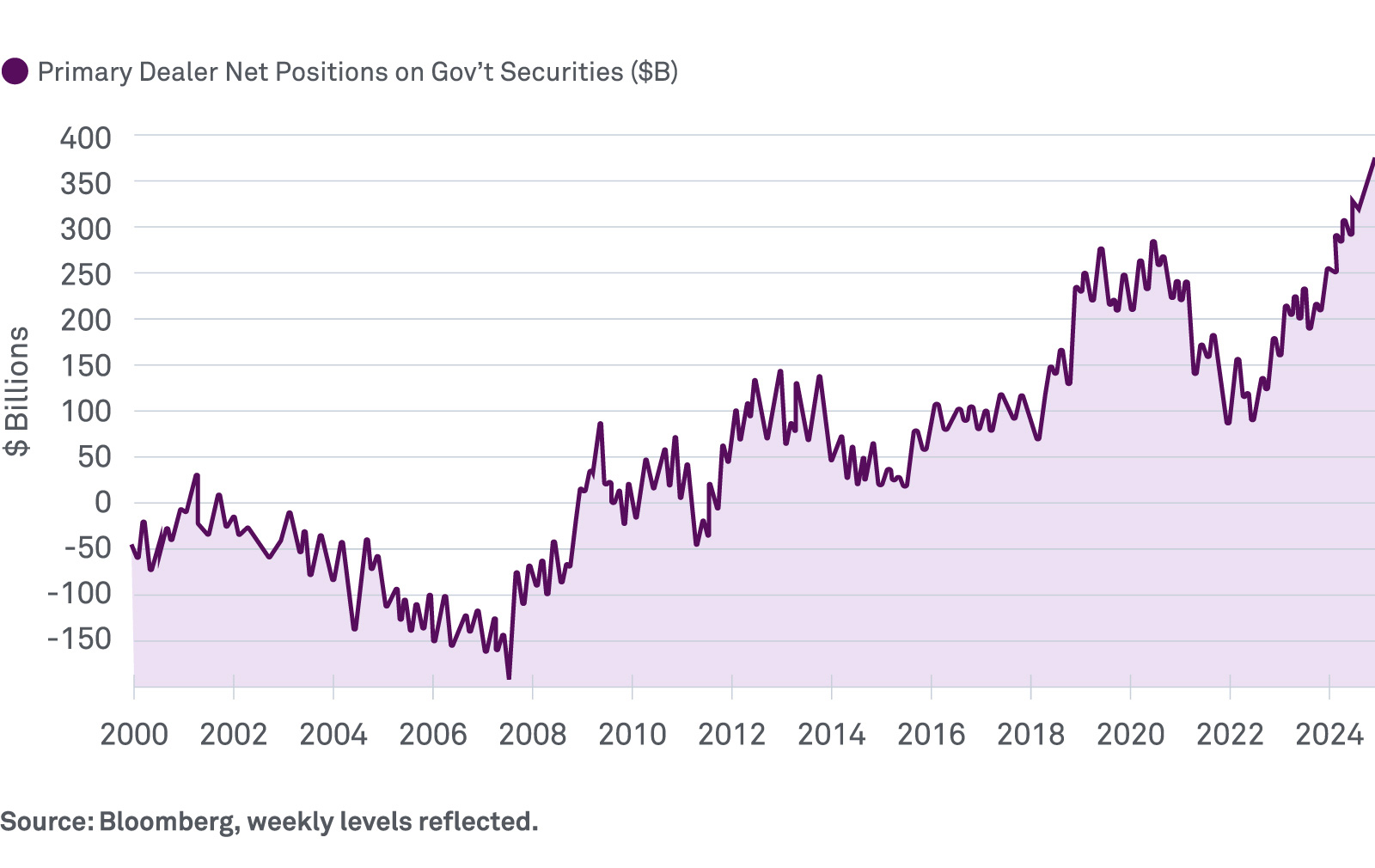

Exhibit IV: Primary Dealer Holdings of Government Securities

There are some signs that intermediaries may be facing capacity constraints: primary dealer holdings of government securities are at an all-time high (Exhibit IV). In addition, the Fed’s Overnight Reverse Repo Facility (RRP) which allows money funds to invest directly with the Fed, still has hundreds of billions in activity that could otherwise circulate in Treasury funding markets, and while it continues to drain, progress has been relatively slow over the last several months (Exhibit V). The slow drain could be indicative of dealer capacity limits for funding products such as repo, resulting in money funds carrying higher balances at the RRP .

Exhibit V: RRP Balances Outstanding ($B)

The aftermath of the March 2023 banking crisis has made banks more protective of their liquidity, and regulators are set to ramp up liquidity management expectations, which could include changes to how bank liquidity — in the form of high-quality liquid assets (“HQLA”) like Treasury securities — is measured. Some regulators are considering steps like pre-positioning collateral at the Fed’s Discount Window to guard against liquidity shocks — a move that could pull collateral and liquidity from private markets.

3. Reassembling the Treasury market

The market structure for government securities is being reassembled as regulators seek to enhance the safety of U.S. financial markets. The most significant of a raft of recent changes is the SEC’s mandate for central clearing Treasury market transactions, which could require some $4 trillion in daily transactions to be centrally cleared.2

The rule will reduce counterparty settlement risk in stress scenarios and should offer some balance sheet relief through netting of offsetting transactions but will require market participants to fundamentally change the way they interface with the Treasury market in terms of trading and operational processes. Importantly, central clearing requires participants to post margin and make contingent liquidity commitments, which increases the demand for liquidity in normal times, and can exacerbate the demand for liquidity during times of stress. As a result, the central clearing rule will convert what is counterparty credit risk today, into liquidity risk (and cost) tomorrow.

Future outlook for U.S. Treasury liquidity

The Treasury market is currently at an inflection point where the supply of liquidity is falling, and demand for it is rising. It’s a world where, in the absence of further action, higher price volatility, elevated longer-term yields and higher funding costs are all possibilities. It’s also a world where private and public solutions to support liquidity of the market are even more essential.

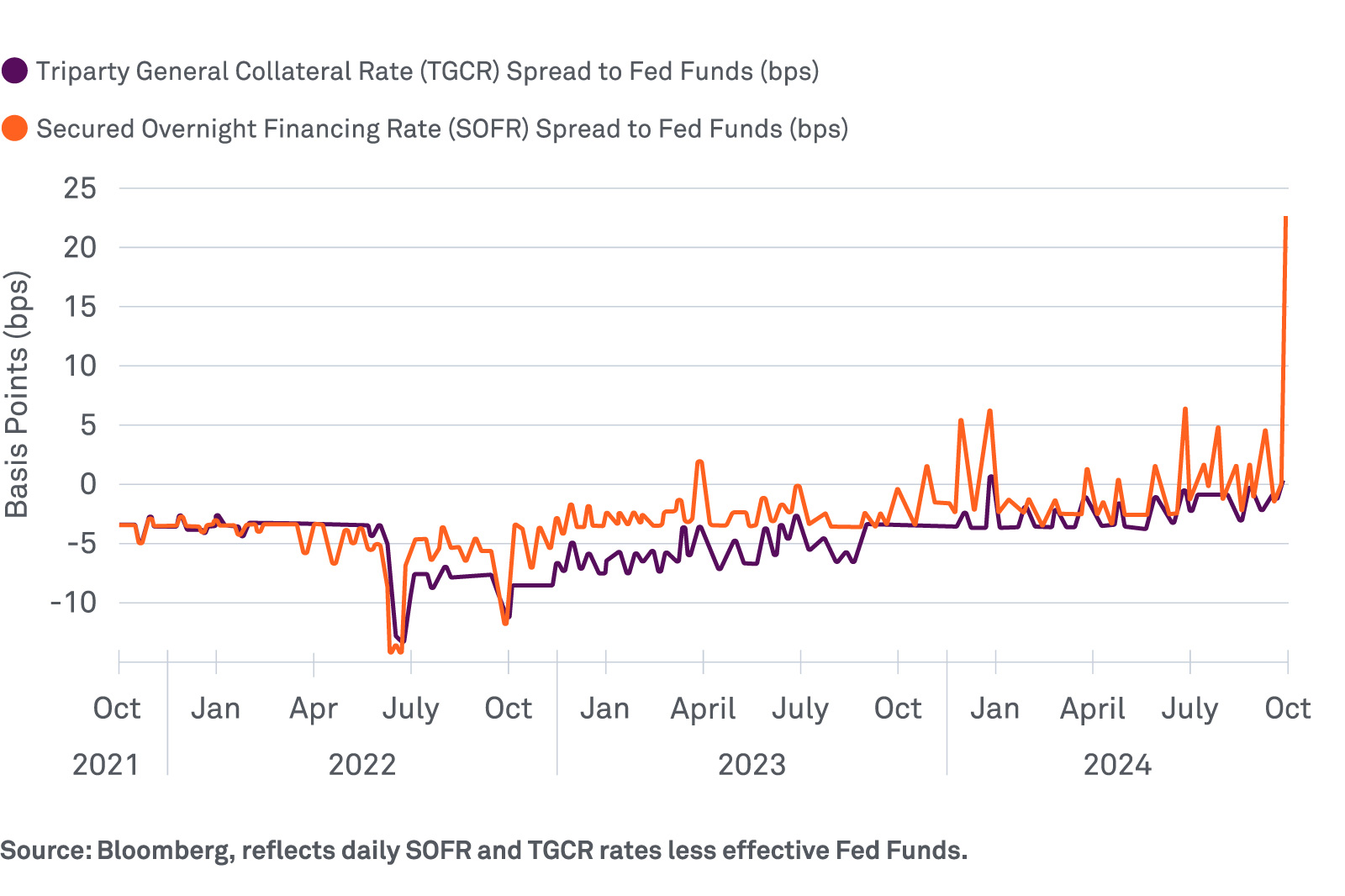

There are already nascent signals of liquidity pressures, as was on display this past September month-end. However, funding market spreads and volatility have also increased outside of month-end periods. The last episode of these liquidity pressures, in 2019, resulted in the intervention of the Fed to restore liquidity levels and shore up the Treasury financing market’s functioning.3

Exhibit VI: Repo & SOFR Spreads to Fed Funds

Both the private and public sector should continue to explore ways to strengthen market liquidity so that intervention is less likely. Tools like U.S. Treasury debt buybacks and the Fed’s Standing Repo Facility (SRF) help. Recent adjustment to the Fed’s liquidity expectations may also allow banks to consider using the Discount Window or SRF in their liquidity planning. Putting fiscal funding on a more sustainable path will become increasingly important.

Meanwhile, private sector solutions should include better sources of contingent funding, including the ability to raise liquidity throughout the day — like early morning and intraday triparty repo — better ways of mobilizing collateral when it’s most needed, more consistent margining practices and more efficient clearing capabilities.

Alex Cadmus, Strategy Lead, Global Liquidity Services and Conor Sari, Senior Associate, Global Collateral contributed to this article.