“Industry is increased, commodities are multiplied, agriculture and manufacturers flourish: and herein consists the true wealth and prosperity of a state.”

- Alexander Hamilton, Founding Father, first U.S. Secretary of the Treasury, and founder of the Bank of New York

Change and transformation have been ubiquitous over the course of history. Today, macroeconomic, geopolitical, demographic and sector trends, Artificial Intelligence (AI) advancements and financial market structure changes are altering economies, both advanced and emerging.

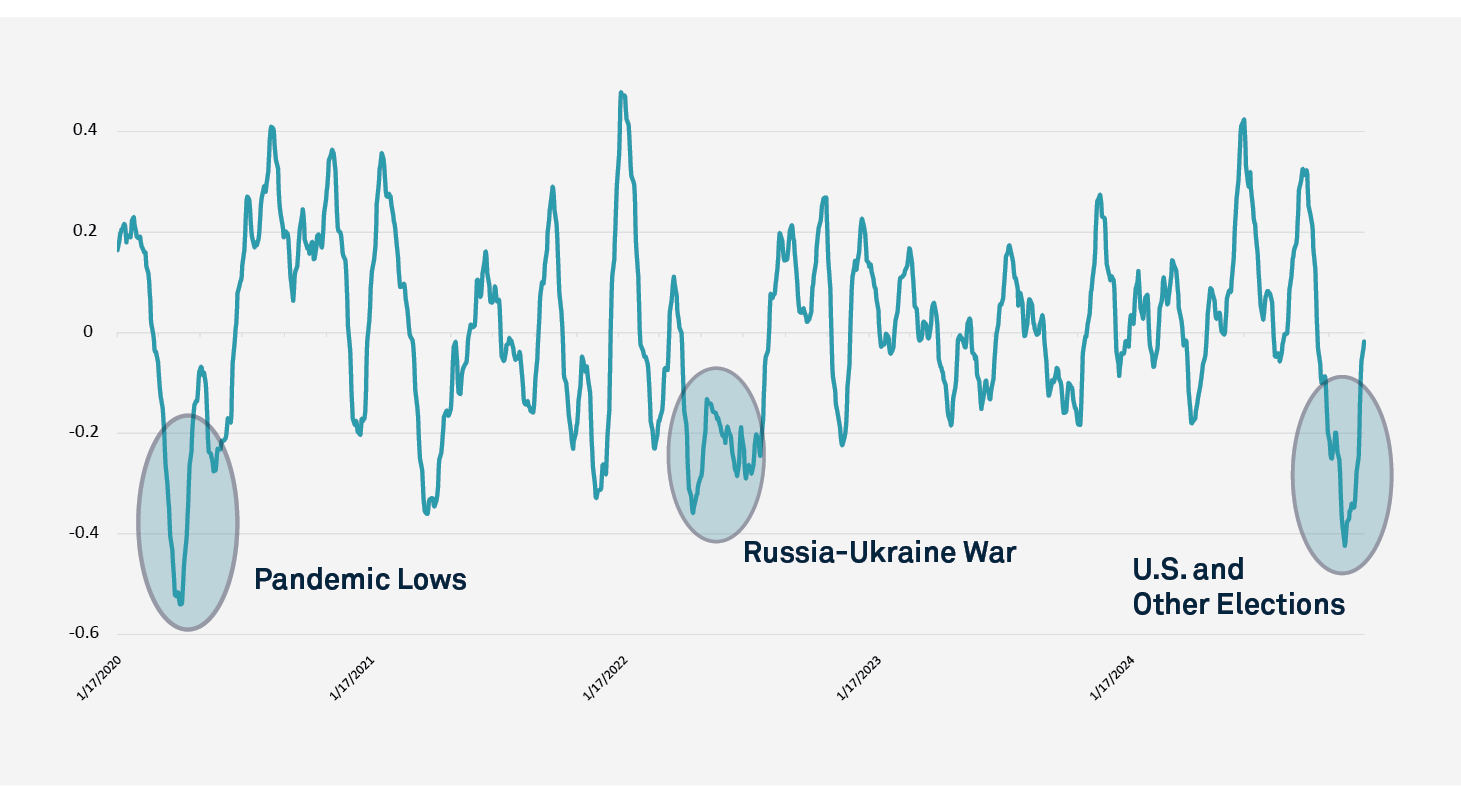

These are the trends shaping a new paradigm for growth. As we think about 2025, while there are a number of likely bright spots, including more stable inflation and stronger capital markets activity, there are also elements of uncertainty shaping macro outlooks. With a new U.S. administration, continuing inflationary pressures, political changes in Europe, military conflicts and ongoing growth challenges in China, some investors are exhibiting pause. Our proprietary iFlow® Mood Index,* (Figure 1) which measures global flows in equities and T-Bills, indicates that towards the end of 2024, investors took the most cautious approach to markets since the height of the pandemic. However, we are already seeing some of this hesitation starting to reverse, and based on iFlow data trends, we anticipate that in 2025, equity flows will rise and cash will be better put to work, propping open the door to further global growth.

FIGURE 1: INVESTOR "MOOD" FOR RISK TRENDING UP FOLLOWING NEAR PANDEMIC LOWS

On a standalone basis, our experts expect that the U.S. economy will post strong performance in 2025, with a labor market in equilibrium, inflation anticipated to slowly return to the Federal Reserve’s 2% target and GDP hovering around its 2% trend rate of growth. However, the new administration will likely come with changes to key policies — namely tariffs, taxes, immigration and regulation. While some of these changes could negatively impact growth and drive interest rates higher, our experts expect the U.S. to be resilient.

China’s economy remains under pressure, and uplifting demand remains a clear priority. Whether through infrastructure investments or boosting domestic consumption, how stimulus is directed is perhaps even more important than its size. Although any potential impact from U.S. tariff changes will be more muted, given decoupling and more regionalization, China will likely still face meaningful headwinds should tariffs be enforced.

In Europe, with manufacturing on the decline, the region is searching for new sources of growth. Private-sector funding, along with increased productivity, will be critical to progress. In fact, the European Commission is considering a set of ambitious reforms with the goal of creating a continent-wide Savings and Investments Union, which would potentially create a harmonized single capital market across member states and drive greater investment.1 Similarly, the U.K. is looking at ways to make sure a greater proportion of trapped pension savings is invested in productive financing as part of broader initiatives to reform the pension landscape.2

Across the globe, changes to political and macroeconomic climates are seeding growth prospects. On top of this, there are several megatrends that are positively influencing how economies operate. These compelling, long-term forces are set to help mold economies, businesses and societies in 2025 and beyond.

Democratization of alternative investments is cultivating opportunity and driving scale.

Market structure changes are reemphasizing the need for strategic liquidity management and collateral solutions.

Advances in AI are transforming the industry.

Alternative Investments: Sustaining and Scaling Growth

Alternative investments have historically been the realm of institutional investors, with most alternative investment managers operating with sales and service models designed specifically for institutional investors and asset owners. In recent years, a series of factors have combined to facilitate greater access to alternatives by individual investors. The democratization of this asset class is poised to fuel continued growth, but in order to take advantage of these opportunities, asset managers will need to work through the new challenges they present and find ways to scale their operations.

Improving Accessibility: A key step towards sustaining the growth of this asset class is to market investment funds through a wider set of distribution channels, including individual investors. In the U.S. alone, over 15,000 investment advisors are providing asset management services to more than 60 million individuals.3 Alternative investment adoption by new intermediaries and end-investors has led managers to develop new business models favoring partnerships between traditional and alternative investment managers and multi-manager products, allowing clients to access multiple strategies through a single fund. Collaborations with wealth distribution platforms can help fund managers broaden their reach to access more of these advisors and their clients. They can also help facilitate education programs for advisors and end-investors. Education is critical to explain the general nuances of alternative investments, including clearly communicating the risks, fees, liquidity terms and expected performance, as well as a key component of building brand recognition, helping investors differentiate between alternatives investment managers.

Shifting to External Administration to Improve Margins and Risk Management: Shifting from an internal to an external fund administration model can drive operational leverage by providing access to more advanced systems and processes that help streamline operations, reduce errors and improve compliance. External administrators can also help with other essential client-relations activities, including KYC/AML requirements and accreditation checks, as well as reducing costs and improving experience for key lifecycle events like capital calls and distributions.

Enhancing Data Management: Given the complexity of alternative assets and the increased protections sought by regulators, the need to deliver timely, accurate performance data and robust data management systems is paramount. Managers are looking to invest in systems and processes that are designed to handle the unique complexities of alternative assets — from governance frameworks and analytics to data aggregation and reporting that can be tailored to the needs of individual investors.

On top of this, other demographic shifts — including The Great Wealth Transfer — are compounding the impact of this megatrend and driving a need for holistic financial advice, including comprehensive guidance on how to manage the complexities of retirement planning, estate planning, tax preparation, insurance, annuities, investments and more. To enable growth, it is therefore vital that asset and wealth managers, as well as life insurers, partner with key financial services institutions across the investment ecosystem to meet the increasingly complex needs of their clients.

Market Structure Changes: Adaptation and Growth

The global market landscape has changed significantly over the last decade, notably due to rapidly evolving technology and regulatory frameworks. As a result, technology, market structure and the regulatory environment have never been more interconnected. Moreover, as structural factors such as quantitative tightening (QT), the potential for new banking regulations and U.S. Treasury central clearing advance global markets, market participants can leverage opportunities created by these changes to better position themselves for growth. They are seeking flexible and efficient liquidity solutions in order to manage through these market structure changes to elevate their strategy.

• QT: The Federal Reserve is in the process of reducing the size of its balance sheet through QT, with close to $2 trillion coming off since 2022,4 with each dollar in assets that runs off the Fed’s portfolio reducing private-sector liquidity. At the same time, financing needs in the market continue to grow.

• Potential New Banking Regulation: Regulatory changes have made intermediation more complex, with bank and dealer capacity lagging the overall growth of the U.S. Treasury market.

• Mandatory Central Clearing: As regulators seek to enhance the safety of U.S. financial markets, they are altering the market structure for government securities, and market participants will be required to submit a substantial portion of their cash and repo trades to clear at a U.S. Treasury central counterparty (CCP).

Overall, the more market participants plan for these changes and realign their businesses accordingly, the better they will be positioned for growth. Our experts are already seeing a shift in market players approaching collateral management as a value-add component of funding and liquidity strategy, rather than a secondary function. The March 2023 U.S. regional banking crisis also resulted in banks generally becoming more protective of cash reserves, with further regulation on the sector a possibility.

The traditional overnight funding model is being complemented by more granular sources and uses of funding via triparty intraday repo and early morning maturity triparty repo. While these products have existed in bilateral repo and unsecured markets, the introduction to the triparty repo space is an important step toward increasing the flexibility of vital money markets and improving liquidity management.

Unlocking the AI Growth Multiplier

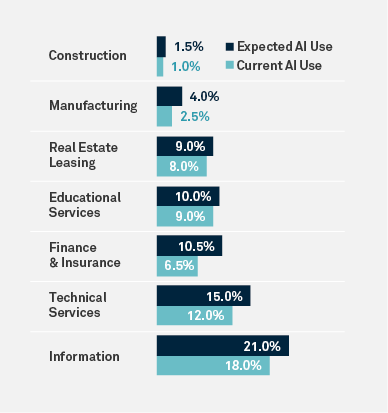

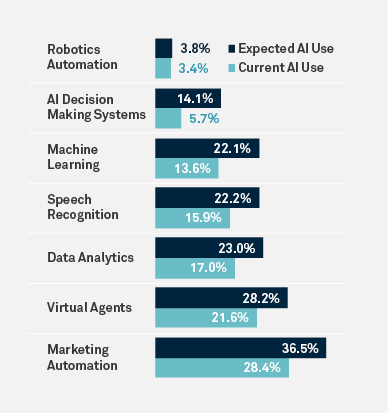

The increasing adoption of AI is changing how the world operates, contributing to increased efficiency and productivity with an expectation of adding $19.9 trillion to the global economy by 2030, or 3.5% of global GDP.5 The practical use of AI is already becoming an essential part of industries like financial services, transforming the way products and services are offered. (Figure 2) This opens the door to more innovation and new operating models, which can motivate organizations to reimagine growth across an enterprise.

We see AI driving growth for financial institutions and their clients in three key ways.

Process Excellence: Driving operational leverage from basic automation to increasingly autonomous operations

Product Innovation: Transforming products into smart, integrated and customized client solutions

Business Model Evolution: Creating new value streams by informing the evolution of business models

As the financial services industry continues to innovate with AI, its potential depends on the human ability to interact with and harness these capabilities in a safe and responsible way. The more companies can make AI usable and accessible, with appropriate embedded governance, the more we can tap into and extend AI’s benefits. At BNY, we believe that every employee should be able to leverage AI. Throughout 2024, we focused on empowering our workforce with the knowledge and tools to thrive in an AI-driven world. We now have tens of thousands of employees leveraging our AI platform, Eliza, including many who have never written a line of code. Now, with the right training, they are developing their own AI initiatives. We are embracing the power of AI to make it easier for our employees to do their jobs and channel their energy towards supporting our clients in new and innovative ways.

Where do we go from here?

As this combination of macro drivers and megatrends continues to unfold, growth will take on a different trajectory. The strongest pockets of growth will emerge from the industries, regions and businesses that successfully adopt new operating models to scale offerings tailored to existing and emerging client demands, plan for and realign business strategies in line with market structure enhancements and keep pace with human-centric advancements for AI applications. Collaboration between the public and private sectors will be essential to unlocking pro-growth policies and funding pathways to enable global growth.

BNY AT A GLANCE

$52.1T

Assets under custody and/or administration (6)

$2.0T

Assets under management (7)

100+

Markets where BNY serves clients

*BNY's iFlow Mood index is a measure of investor preference for stocks or bonds.

1 Enrico Letta, “Much More Than a Market – Speed Security, Solidarity” European Council, Council of the European Union, April 2024, https://www.consilium.europa.eu/media/ny3j24sm/much-more-than-a-market-report-by-enrico-letta.pdf

2 Djuna Thurley, James Mirza-Davis, “Pension scheme investments,” House of Commons Library, UK Parliament, November 18, 2024, https://commonslibrary.parliament.uk/research-briefings/cbp-10146/

3 “SEC Staff Publishes New Investment Adviser Statistics Report,” U.S. Securities and Exchange Commission, May 15, 2024, https://www.sec.gov/newsroom/press-releases/2024-57

4 “Credit and Liquidity Programs and the Balance Sheet,” Board of Governors of the Federal Reserve System, January 2025, https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

5 Lapo Fioretti, Carla La Croce, Andrea Siviero, Elisabeth Clemmons, “The Global Impact of Artificial Intelligence on the Economy and Jobs: AI will Steer 3.5% of GDP in 2030,” IDC, August 2024. https://www.idc.com/getdoc.jsp?containerId=prUS52600524

6 Consists of AUC/A primarily from the Asset Servicing line of business and, to a lesser extent, the Issuer Services line of business. Includes the AUC/A of CIBC Mellon Global Securities Services Company (“CIBC Mellon”), a joint venture with the Canadian Imperial Bank of Commerce, of $1.8 trillion at 2.December 31, 2024, $1.9 trillion at September 30, 2024 and $1.7 trillion at December 31, 2023. Information is preliminary.

7 Represents assets managed by BNY Investments and BNY Wealth as of December 31, 2024.

iFlow®/FX MARKET COMMENATRY

The products and services described herein may contain or include certain “forecast” statements that may reflect possible future events based on current expectations. Forecast statements are neither historical facts nor assurances of future performance. Forecast statements typically include, and are not limited to, words such as “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “likely,” “may,” “plan,” “project,” “should,” “will,” or other similar terminology and should NOT be relied upon as accurate indications of future performance or events. Because forecast statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict.

iFlow® is a registered trademark of The Bank of New York Mellon Corporation under the laws of the United States of America and other countries. iFlow captures select data flows from the firm’s base of assets under custody, as well as from its trading activity with non-custody clients, on an anonymized and aggregated basis.

BNY General Disclaimer

BNY is the corporate brand of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally. This material does not constitute a recommendation by BNY of any kind. The information herein is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

© 2025 The Bank of New York Mellon. All rights reserved. Member FDIC.