The payments industry has progressed considerably in recent years. From new regulations enabling richer data to cutting-edge innovation that delivers enhanced speed, visibility and security, the transaction capabilities that are routine today were almost unthinkable just a short time ago. Yet, one area lags behind the evolution of the payments processing chain; investigations are plagued with inefficiencies and are increasingly out of sync in today’s advanced payments world.

However, two new developments on the horizon are expected to transform existing payments investigation methods, bringing them in line with the level of service clients expect when it comes to ensuring payments are secure. Financial institutions (FIs) therefore need to be alert to the changes underway and equipped with the tools to deliver these new capabilities.

Inefficient investigations: a pain point for payments

Not all payments can move seamlessly through the payments system. While straight-through processing (STP) is possible for the vast majority, about 5% of cross-border payments encounter some friction before they reach their destination, resulting in manual interventions that cost the industry upwards of $2 billion per year. When a payment exception occurs – for reasons such as incorrect payee details or missing information – this can cause frustration for the payer and payee. That frustration may also be exacerbated by how complex and cumbersome payment investigations can be, resulting in additional costs and substantial delays.

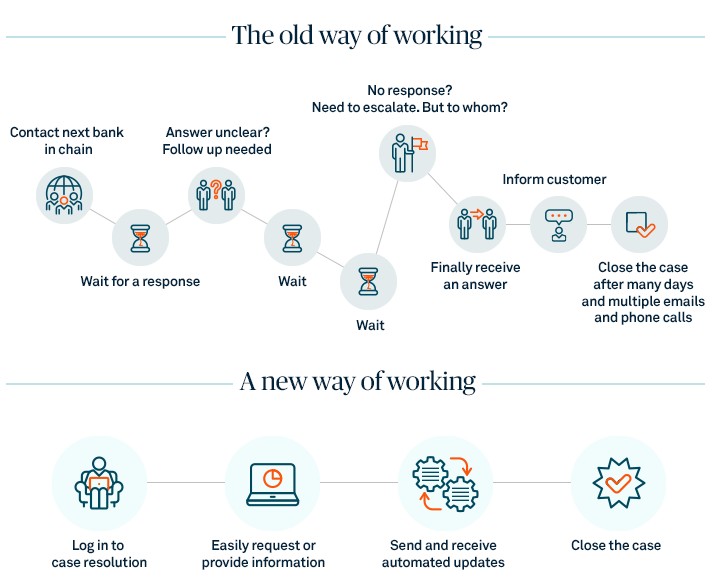

For example, due to a lack of end-to-end transparency, investigations are managed point-to-point along the payments chain. This effectively means that every bank involved must pass on the investigation message sequentially to the next bank in the chain until it reaches the relevant party with the information to action the case. As such, many banks act merely as middlemen, performing a message-forwarding task within a sequential system, creating additional work and costing valuable time.

Additionally, legacy Swift messages, which have long been the communication tool used for all payments correspondence, are largely free form. This makes them hard to automate and susceptible to human error and oversight, including typos and a lack of clarity. In the case of investigation messages (specifically, the Message Type [MT] 195, queries, and MT196, answers), there is a single, unformatted field in which the person originating the message can choose to include as much or as little information as they want, potentially resulting in a lack of detail for the recipient. This issue has shown to have the potential to affect a percentage of all investigations - with a common occurrence being a lack of clarity regarding the actual issue in question. In such instances, there can be an unnecessary ping-pong of messages between the different parties, lengthening the investigation at every stage in the communication chain.

The new, two-pronged approach through ISO 20022 and centralization

To remedy this, two investigation messages – one for a request and one for a response – are being implemented as part of the wider ISO 20022 migration, the switch from the incumbent MT messages to more structured, data-rich ISO messages for high-value and cross-border payments globally.

Investigations will then benefit from the structured data format that ISO is bringing to payments more broadly. Going forward, rather than an open text field that can be populated broadly and without structure, a drop-down menu will display approximately ten specific case types, incorporating the gamut of payment exceptions. When a type is categorized, the information required can be populated precisely, enabling the potential for automation. As the industry envisions it, in addition to the case type, users will be able to follow a structured process to resolve exceptions. This standardized message flow, with more automation, has the potential to dramatically speed up investigation resolution.

The progress underway doesn’t stop there. Payment investigations on the Swift network will also no longer be managed point-to-point. Instead, leveraging the central orchestration provided by the transaction manager, a central payments repository, as well as the tracking capabilities provided by Swift GPI, Swift will apply a “smart-routing” approach to send investigations directly to the bank best positioned to action the case. Depending on the type of investigation and what is needed, Swift may even be able to provide the required information upfront, without the case having to be passed on to a bank at all. Cutting out the middlemen in this way will enable faster and more efficient investigations and could also eliminate the inconvenience faced by intermediary FIs of having to pass on messages. Eventually, caseload volumes will shrink, allowing bank personnel to focus on the investigations they are directly involved in, ultimately saving time and expense.

Gearing up for transformational payments industry change

Swift currently plans to go live with smart routing as early as November 2024, which leaves only a narrow window of time in which FIs will need to transform their own investigation processes. As part of the transition, teams will not only have to become accustomed to the new rules governing the process, but internal payment systems may also need to be adapted to consume the greater level of information contained in these messages. Given the degree of change already coming from the wider migration to ISO messages, banks must factor this into their plans.

Swift has created collaborative global working groups involving FIs and investigation software providers – with which many banks currently partner – to help ensure the transition will be carried out effectively. However, greater levels of communication beyond this working group are needed to ensure all FIs are fully informed of the change taking place and what is required – especially given the short timelines. The good news for smaller banks is that Swift is planning to build capabilities that will enable them to handle their investigation cases in the Swift environment.

It is essential for FIs to start thinking about their processes and procedures now by mapping out what is done today and what may need to change tomorrow. If banks are to reap the benefits of faster and fewer investigations and deliver an end-to-end enhanced payments experience to clients, the path forward is clear. When it comes to value-added payments innovation, exceptions are no longer the exception.

1 “A strategic vision for instant and frictionless payments,” Financial Times (Swift partner content). https://www.ft.com/partnercontent/swift/a-strategic-vision-for-instant-and-frictionless-payments.html

BNY, BNY Mellon and Bank of New York Mellon are corporate brands of The Bank of New York Mellon Corporation and may be used to reference the corporation as a whole and/or its various subsidiaries generally and may include The Bank of New York Mellon, a banking corporation organized and existing pursuant to the laws of the State of New York operating in the United States at 240 Greenwich Street, New York, NY 10286 and operating in England through its branch at 160 Queen Victoria Street, London EC4V 4LA, England. The information contained in this material is for use by wholesale clients only and is not to be relied upon by retail clients. Not all products and services are offered at all locations.

This material, which may be considered advertising, is for general information and reference purposes only and is not intended to provide tax, legal, investment, accounting, financial or other professional advice on any matter, and should not be used or relied upon as such. This material does not constitute a recommendation by BNY of any kind. The views expressed within this material are those of the contributors and not necessarily those of BNY. BNY has not independently verified the information contained in this material and makes no representation as to the accuracy, completeness, timeliness, merchantability or fitness for a specific purpose of the information provided in this material. BNY assumes no direct or consequential liability for any errors in or reliance upon this material.

This material may not be reproduced or disseminated in any form without the express prior written permission of BNY. BNY will not be responsible for updating any information contained within this material and opinions and information contained herein are subject to change without notice. Trademarks, service marks, logos and other intellectual property marks belong to their respective owners.

©2024 The Bank of New York Mellon. All rights reserved. Member FDIC.